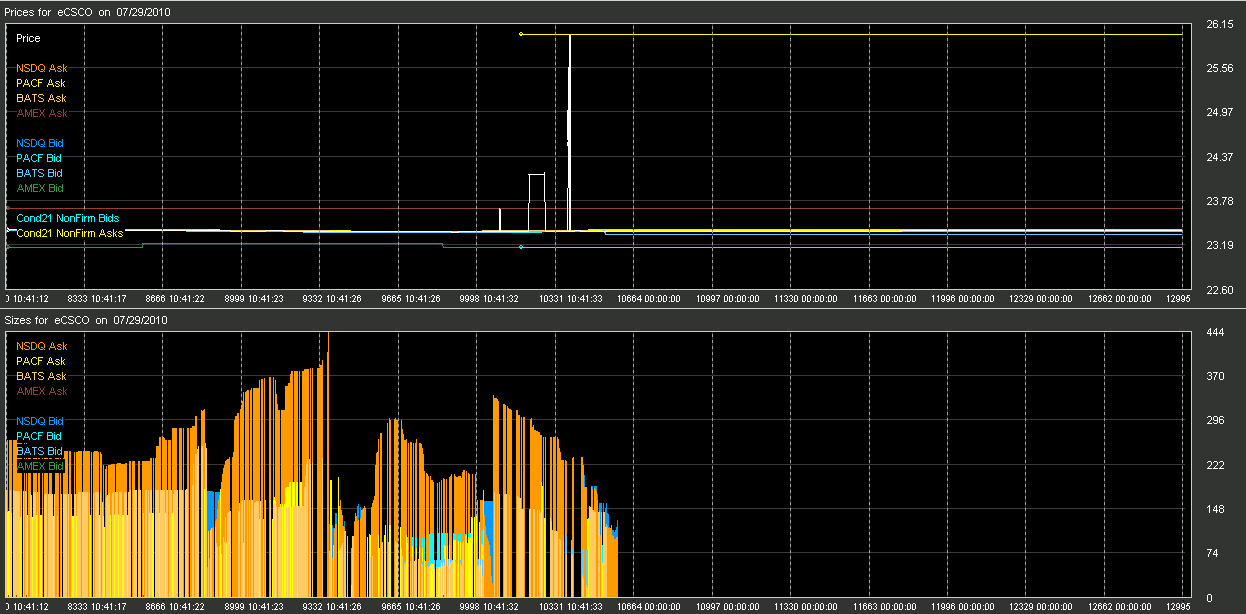

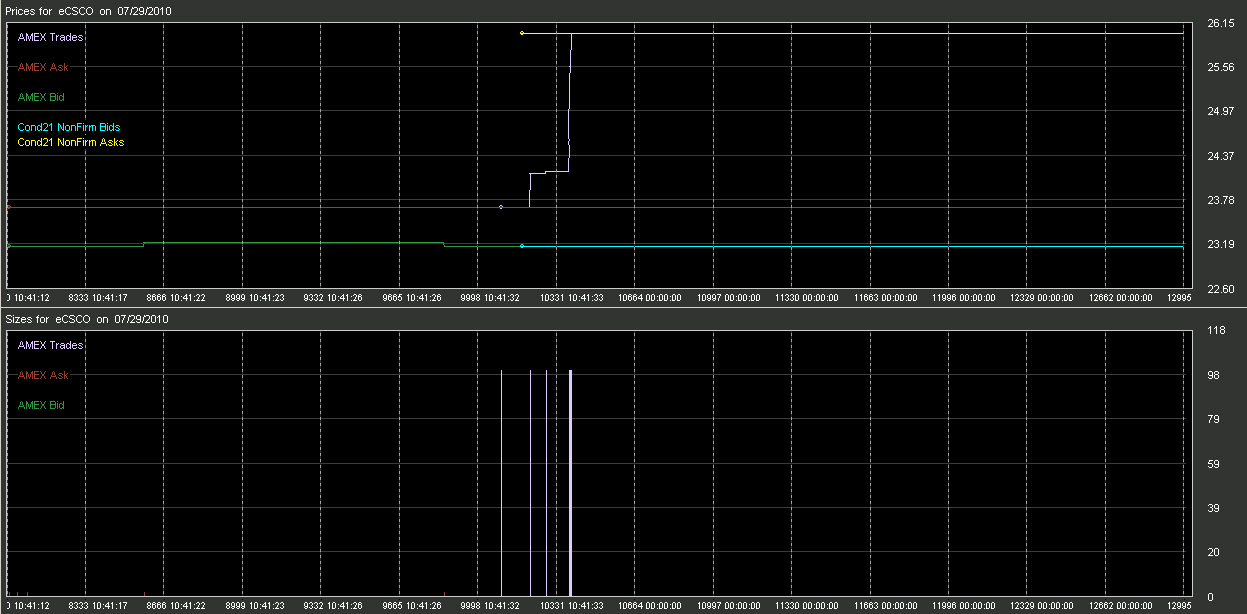

After the Flash Crash of May 6'th 2010, new rules were set by the SEC in order to help prevent another repeat of the event. One of these rules is a test trial of about 50 stocks with a new circuit breaker rule (see SEC Approves New Stock-by-Stock Circuit Breaker Rules). At 10:43 on 07/29/2010 Cisco Systems became the fifth stock to trigger the new circuit breaker rule and cause a halt in trading. We've analyzed this event and below are our findings. At 10:41:33 a Quote was sent from AMEX with an ask price of $26.00 and a quote condition Non-firm. The quote condition Non-firm, a rarity, does not update the NBBO. However within a millisecond trade executions began printing from AMEX that were tagged as ISO (Intermarket Sweep Order) which occurs when an order is sent to an exchange with specific instructions to NOT route the order to another exchange regardless of price. Whoever sent in the order wanted to execute on AMEX and AMEX only. That's exactly what AMEX did and the entity sending the order got exactly what they wanted. This is why we believe the exchange did not later cancel these trades. This illustrates how trivial it would be for someone to purposely trip a circuit breaker on demand. Chart 1 - 07/29/2010. This chart show the bids/asks for four of the quoting exchanges from 10:41:12 through 10:41:33 when trading was halted. Clearly there was plenty of liquidity before and after the 10% rise in price.  Chart 2 - 07/29/2010. This chart shows the AMEX bid/ask/trades and the Cond21 NonFirm quote that comes in with a 26.00 ask price.  Chart 3 - 07/29/2010. This chart shows a zoomed in view of the AMEX trades stepping up in price until the $26 ask was hit.  20100729.1041.CSCO.txt (Raw data).

|