Back to Main Page

Analysis of the "Flash Crash"

Date of Event: 20100506

Part 5, Crash Myths

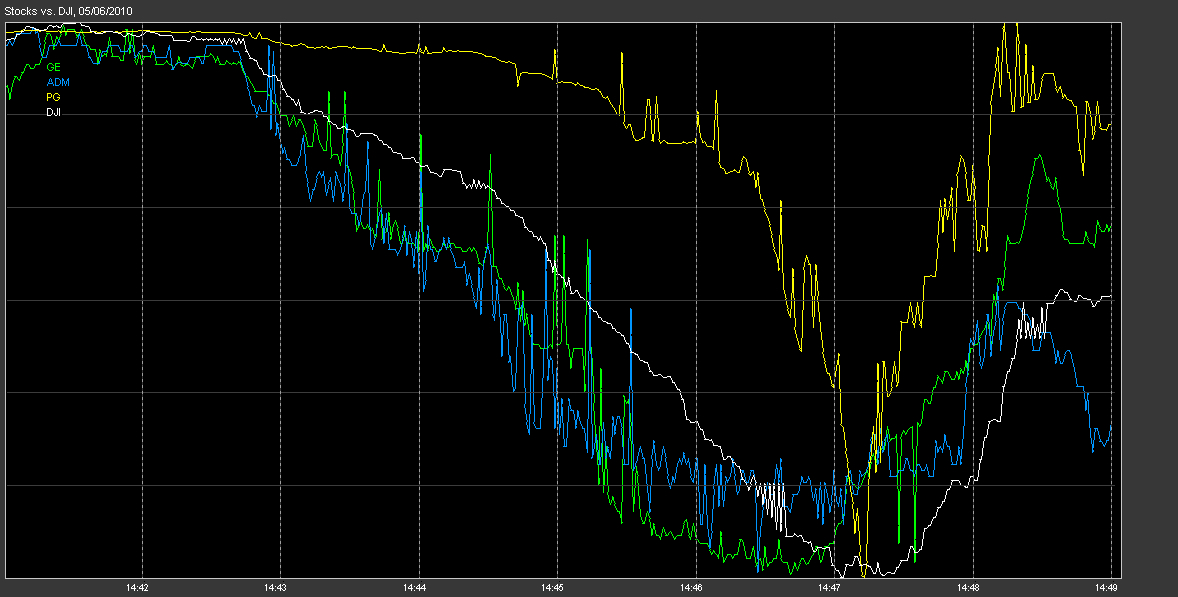

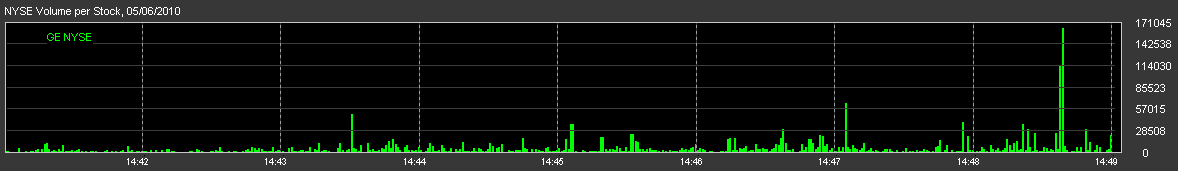

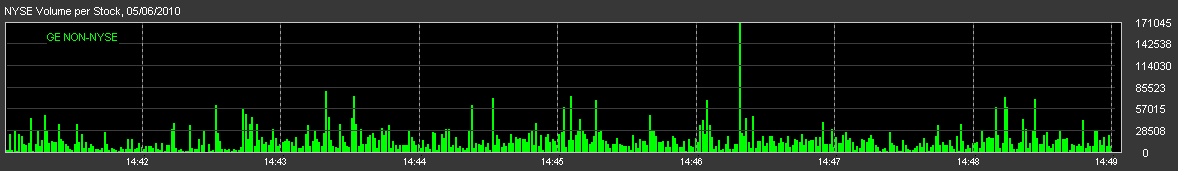

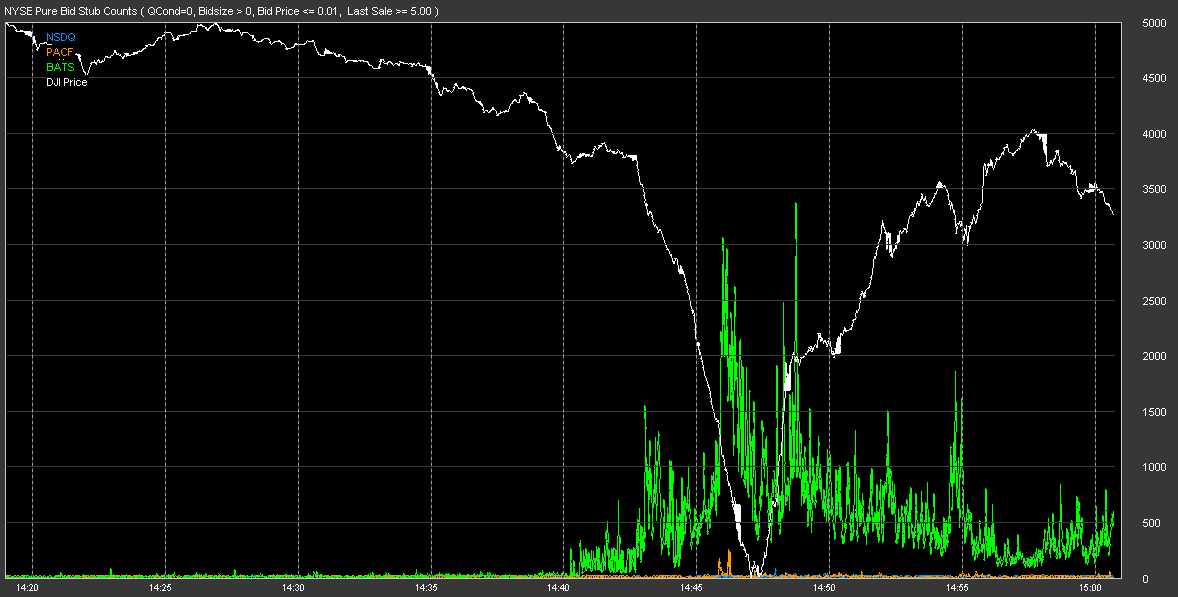

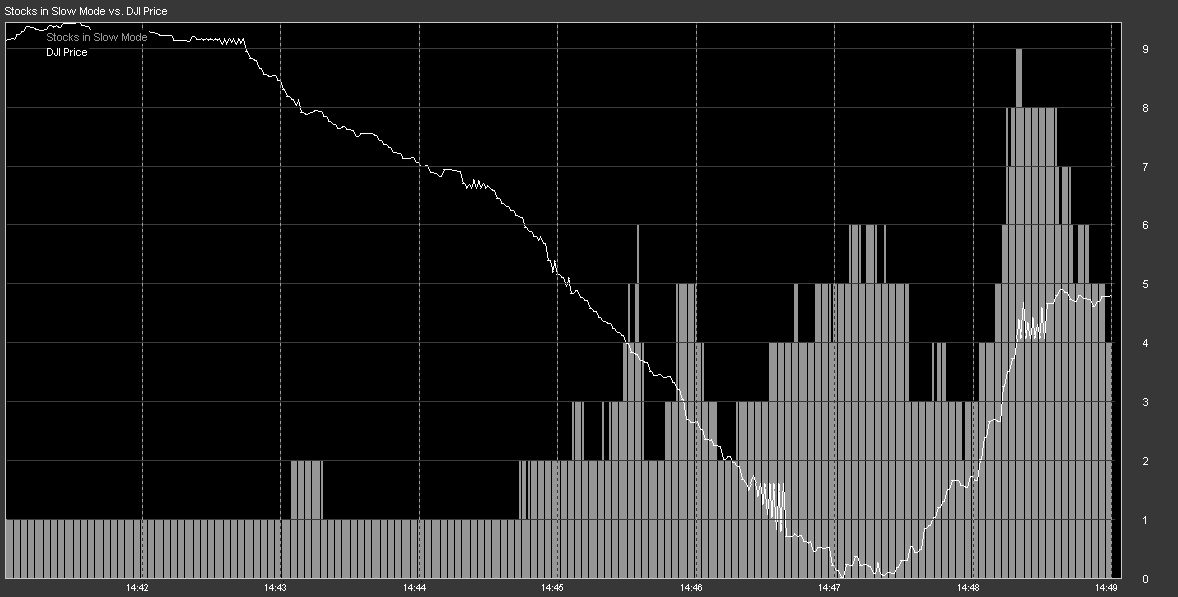

| There are many who believe that the NYSE "Slow Quote" mode or LRP's (Liquidity Replenishment Point) caused the market to drop. However, only 1 stock was in slow quote mode when the final decline began, and only 3 were by the time it was half way done. From the chart below it is clear that the NYSE was not entering slow mode until WELL into the collapse: |

Chart 1:

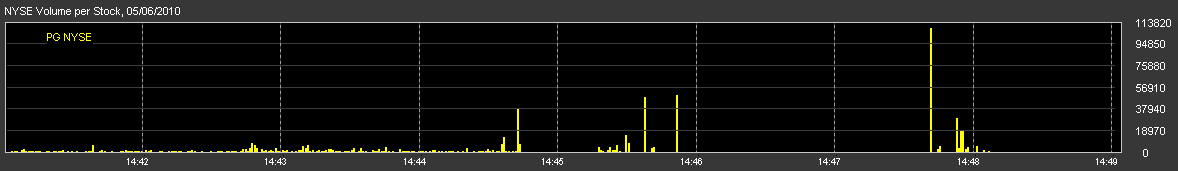

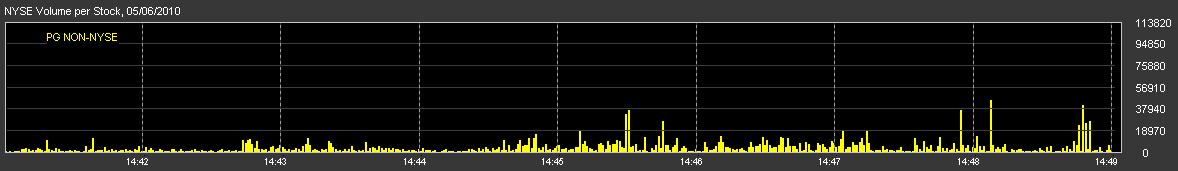

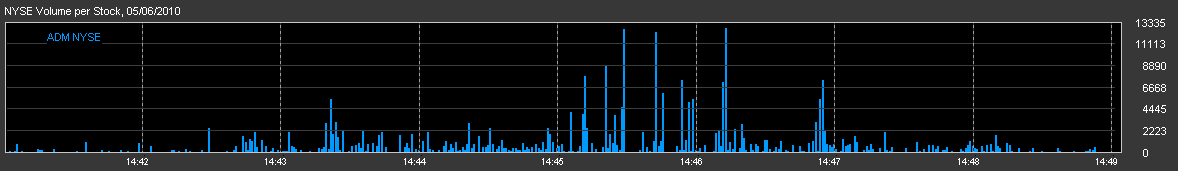

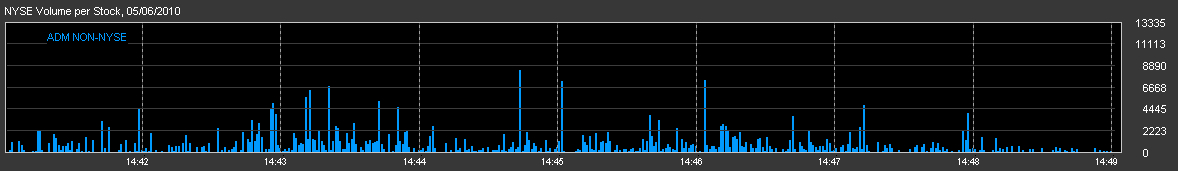

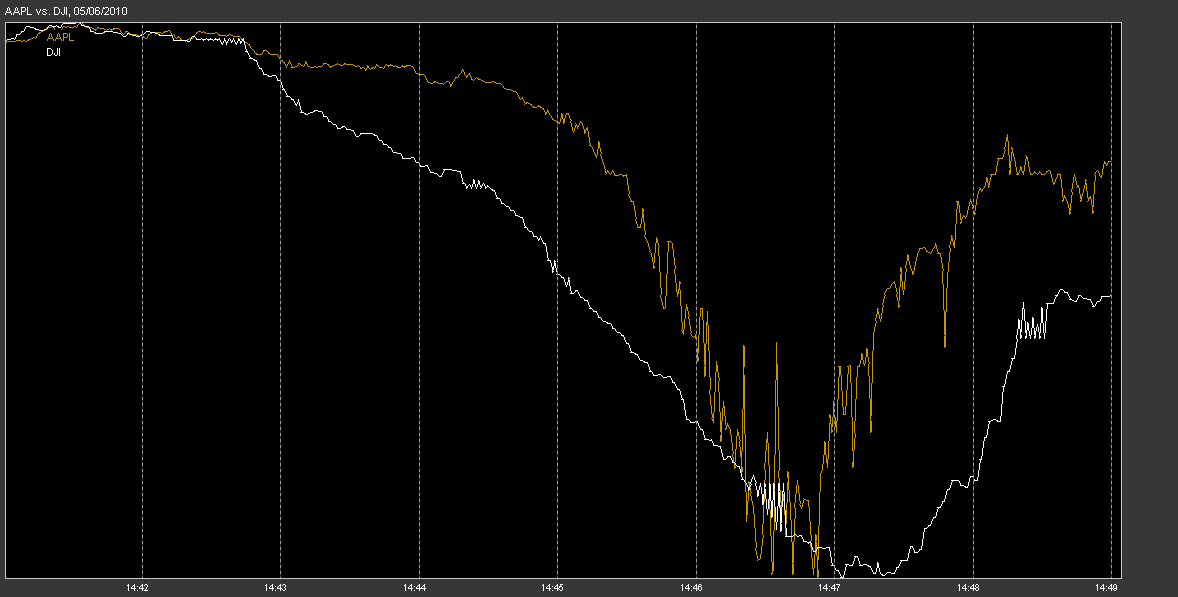

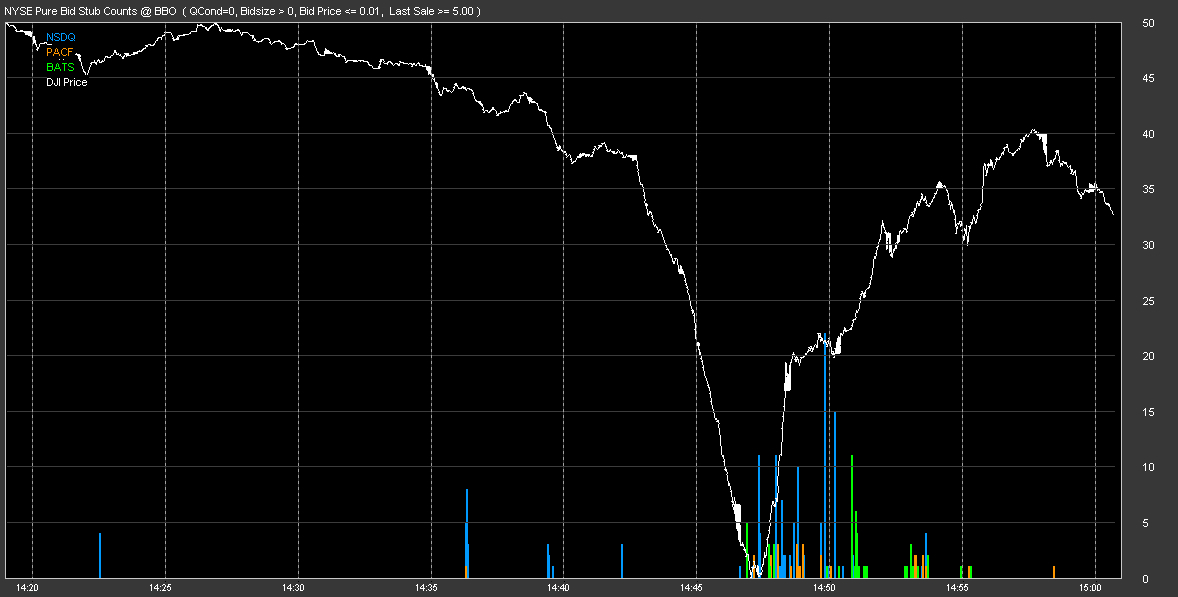

| Furthermore, the stocks entering "slow mode" were trailing the market, not leading the market. The stocks that led the market are the same stocks we analyzed in Part 3, The Evidence. PG was such a stock that trailed the market. From the following chart you can see that PG had NO trades on the NYSE when it entered "slow mode" from approx. 14.45.30 to 14.47.15 and that at this time, the market had already collapsed. |

Chart 2: