| This section of the overview will describe the data contained in

NxCore Messages. It will simply serve as an outline of the data included in

NxCore tape files. The overview will begin with the coreHeader

and coreData.

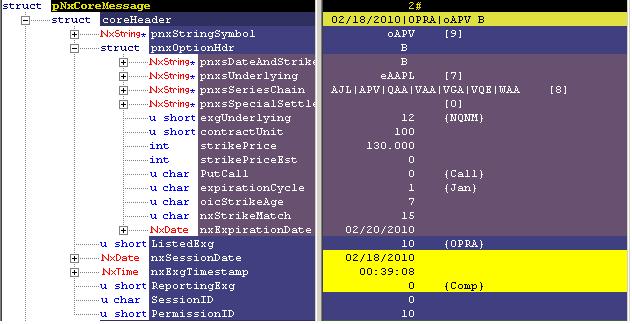

Data contained in coreHeader's option header for ALL option messages:

> >

All symbol strings for all messages are located in the string symbol field.

In this picture the root option symbol can be found in the string symbol field.

As you can see from the image the option header has all the

information regarding the option. It has the date code, the underlying, series

chain, a special settle (if it is one), the underlying's exchange, contract

units, decimal strike price, call or put, expiration cycle, and the exact

expiration date. It should be noted that as of Feburary 12th, 2010 the strike

code no longer exists. Detailed information regarding the option

header can be found

here.

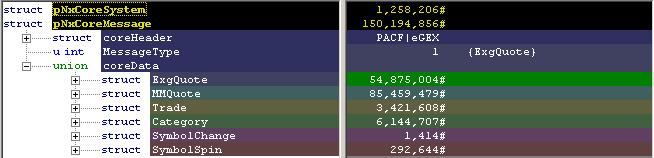

As previously mentioned NxCore tape files have seven different message

types. Each one corresponds to a number and this number is assigned to

MessageType. This is detailed in the pictures below. The

status message is 0 and is not detailed in this overview.

> >

The first message type is ExgQuote, exchange quotes.

> >

Sent for every exchange quote (regular quote) and BBO (Exchange-determined

Best Bid/Offer). Each quote update includes the bid and ask prices, sizes and

condition codes, plus price/size changes. Also for symbols trading on multiple

exchanges, each ExgQuote also contains fields with the current values of the

best bid/best ask prices, sizes and condition codes. This message type is by

far the most active of all messages your callback will receive (depending of

course on the exchanges you request). A typical trading day will have 700+

million option quotes! Detailed information regarding each field can be found

here.

The second message type is MMQuote, market maker quotes.

> >

Sent for every Market Maker Quote ("level 2") from either Nasdaq

SuperMontage, Intermarket quotes on Nasdaq issues (e.g. Cincinnati -- ISLD,

pacific -- ARCA), or Nasdaq Intermarket quotes on listed (NYSE/AMEX)

securities. A typical trading day will have 40+ million or so of these

messages. MMQuotes contain Market Maker identifiers and quote types in addition

to bid and ask prices, sizes, condition codes and price/size changes. For depth

messages, the market makers will be D1/D2/D3/D4/D5/D6/D7/D8/D9/D10 to signify

the 5 or 10 levels of depth. Detailed information regarding each field can be

found here.

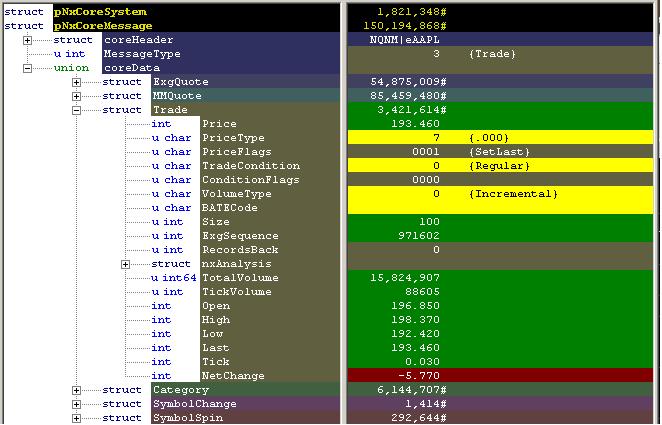

The third message type is Trade, trades.

> >

NxTrade messages are the most heavily processed and analyzed within the

Nanex Financial Servers. Many members in NxTrade are the result of this

processing and are therefore unique to NxCore. Other members are updated from

exchanges but rarely found in other financial feeds.

>

>Trade messages are sent for last sale reports and corrections to last sale

reports. Less than 10% of the Nanex Financial Feed contains Trade messages,

mostly due to the heavy volume of quotes. When processing a tape, you can set a

filter to exclude ExgQuote and MMQuotes, which will dramatically speed up the

processing of trades. The relationship between the last sale and the most

recent quote has been added to the Trade message members to make it easier to

exclude quotes in certain analysis situations.

>

>There is an abundance of information included with each trade message you

won't find, or rarely find in other feeds, such as original Exchange Sequence

numbers, trade condition processing flags (is the trade eligible to update

last, high, low, open?), NxCore QuoteMatch (matches each trade to the recent

regional and BBO quotes), NxCore Realtime Trade Filter analysis results, and

NxCore Significant High/Low data on each trade message. A typical trading day

will have 10+ million of these message types. Detailed information regarding

each field can be found

here.

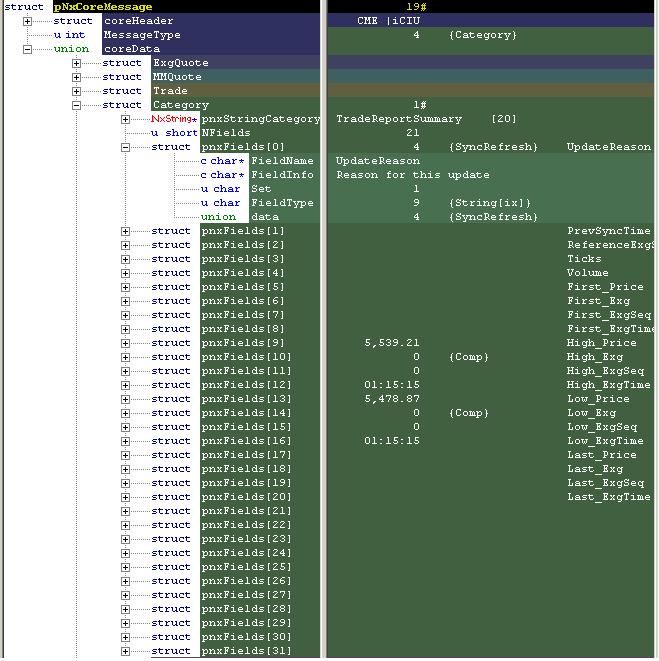

The fourth message type is Category, categories.

> >

Sent for all other data types, such as fundamental information, 52

week/contract/YTD high/low data, additional trade correction information,

exchange code translations trade/quote condition code translation, trading

halts, trading imbalances, open trade indications, etc. A typical trading day

will have 1-2 million or so of these message types, with the bulk of them

occurring at the start of each tape summarizing the previous trading session. A

list of all the categories and the information stored in them can be found

here.

The fifth message type is SymbolChange. symbol changes.

> >

Sent when an issue changes symbols or trading venues (switches exchanges).

The most frequent user of this message type are Nasdaq equities changing

between Pink Sheets, Bulletin Board, Over-The-Counter, or when the

adding/removing the fifth letter 'E' because of a change in delinquency filing

status. Also, when option symbols change, each option contract in the series

generates one of these messages.

The sixth message type is SymbolSpin, symbol spins.

> >

NxCoreSymbolSpin Messages are automatically sent once for each Symbol in

the System near the beginning of each NxCore Tape. Symbol Spin messages

provides a convenient and efficient method for iterating Symbol Sets without

having to create and maintain a container to hold them. The system symbol spin

is useful for preallocating storage before market open to minimize allocations

and reallocations during active trading.

The data contained in NxCore tape files goes above and beyond what normal

feeds provide. This is evident from this short overview. All the messages

contain the data required to complete analysis or to trade.

If NxCore's data is a good fit for your real time applications or if you

are interested in our historical tape

files, please contact Jerry Chandler at

sales@nanex.net.

|