Strange Days - 20100716

Back to Table Of Contents

On July 16'th 2010 we observed a very large spike in our bandwidth and HFT

monitoring systems. While this burst of unusual traffic happened

pre-market when there is normally little to no traffic, it exemplifies

the ability of machine algorithms to stuff the system rapidly.

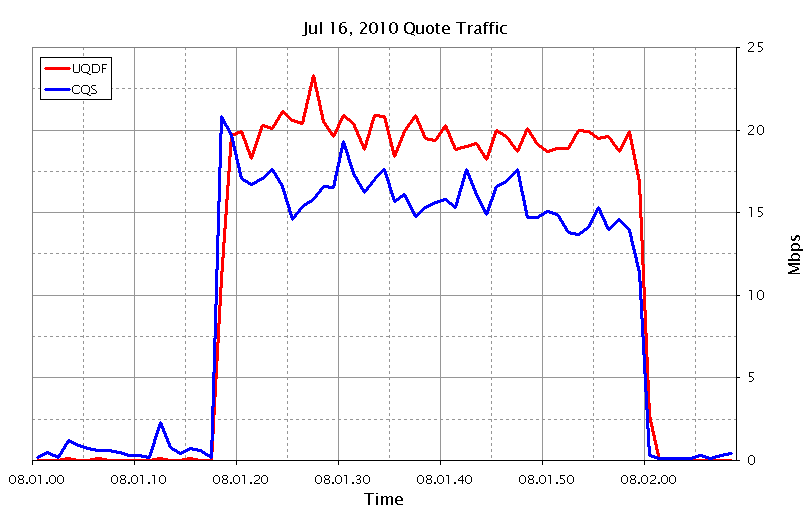

As an example of the bandwidth used, we will take a 1 second slice from this

period, at 8:01:32.

At 08:01:32 there were 46,976 quotes for NASDAQ stocks and 34,907 quotes for

NYSE/AMEX/PACF stocks.

CQS traffic was a minimum 16.2 mbps for that second.

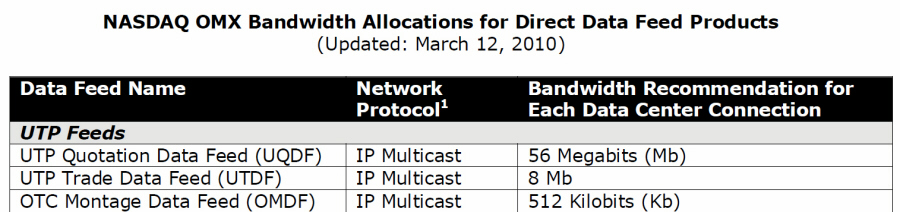

UQDF Bandwidth recommendation is 56mbps (Nasdaq quotes) .

UQDF quote size is 50 bytes / short quote (not including any protocol overhead)

.

UQDF hit a minimum of 18.8 mbps bytes for that second.

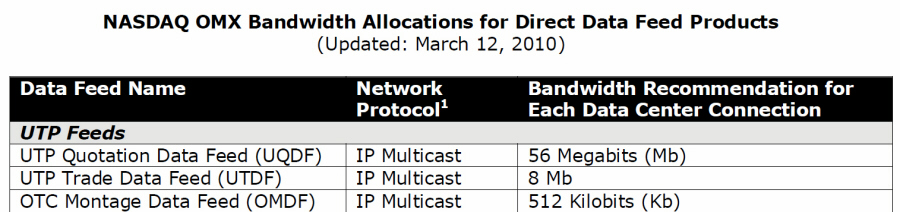

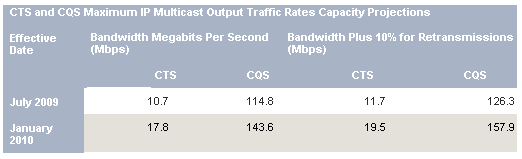

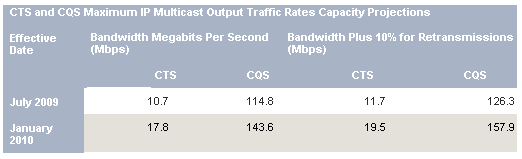

Next note the official bandwidth recommendations and capacity figures:

Tables 1 and 2:

|

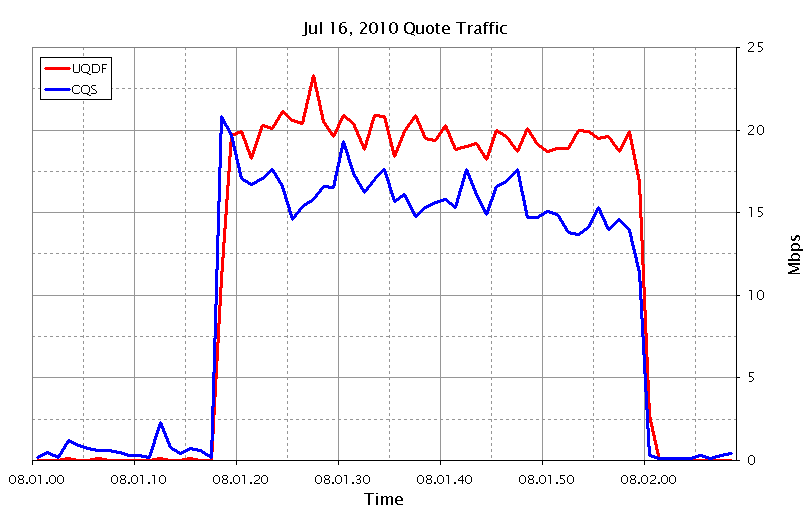

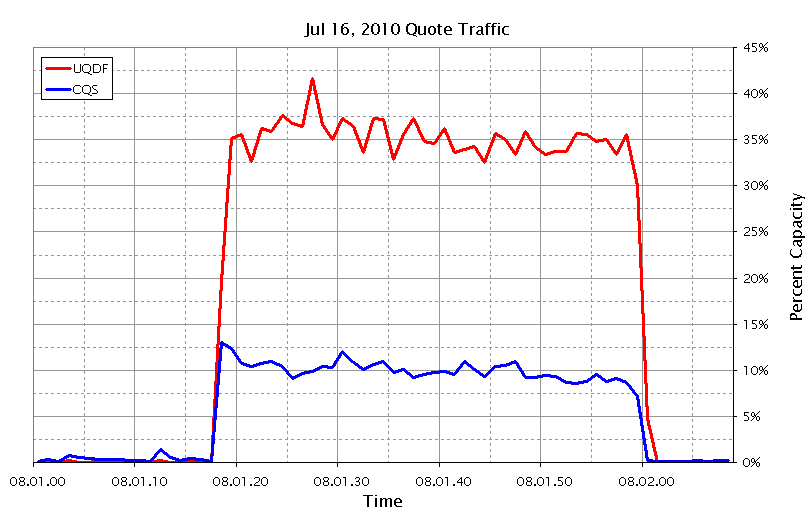

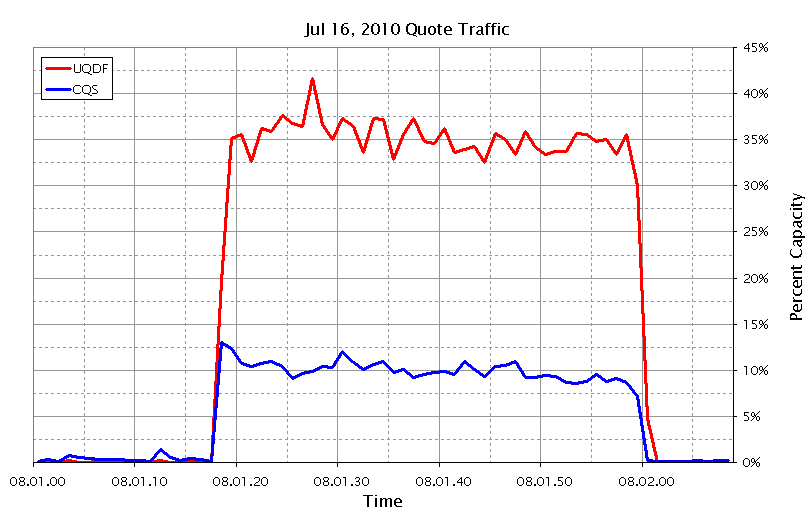

Charting the actual Mbps and %Capacity numbers:

Chart 1 - Quote Traffic, Mbps:

Chart 2 - Quote Traffic, Percent Capacity:

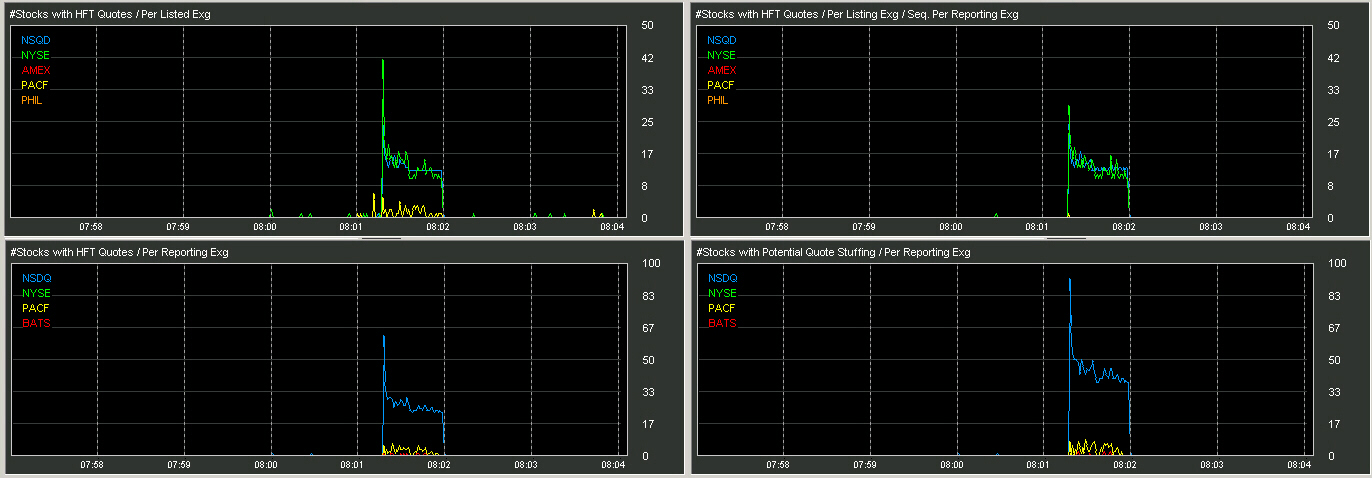

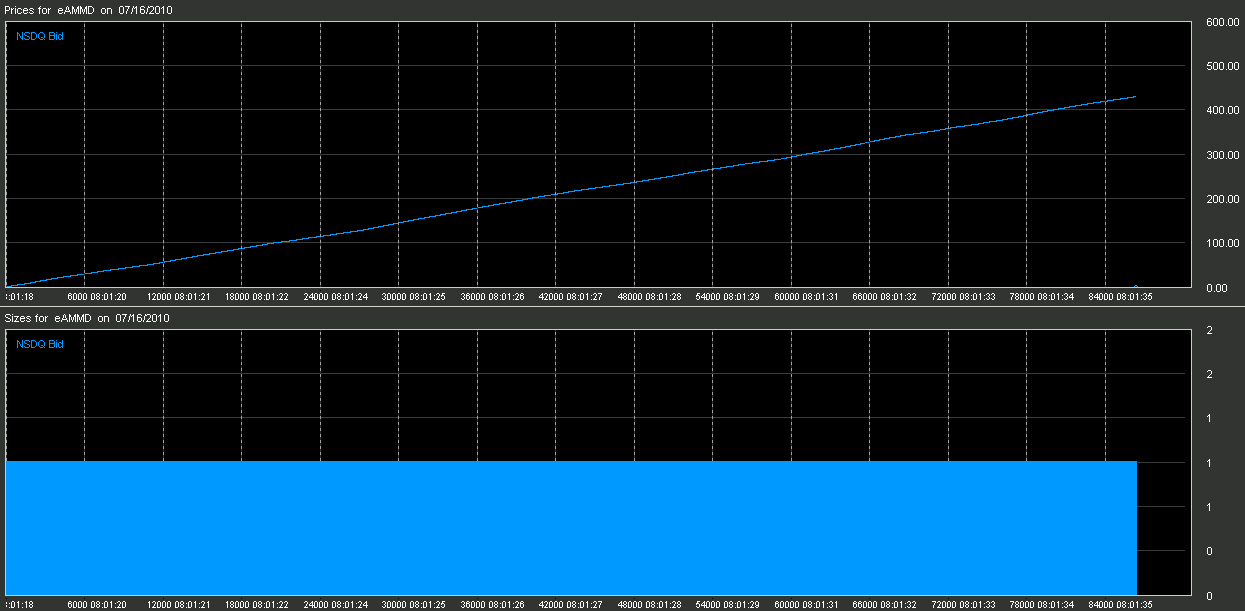

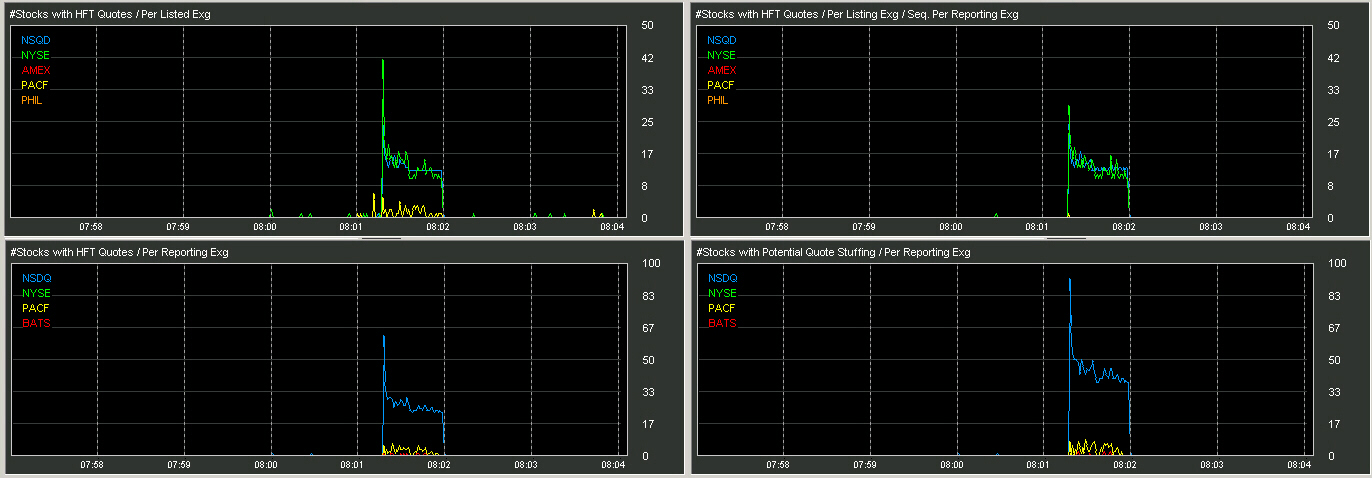

Finally we present charts of the HFT monitor spikes as well as charts of some

of the quotes in individual issues.

Chart 3 - Spike in HFT Monitoring System.

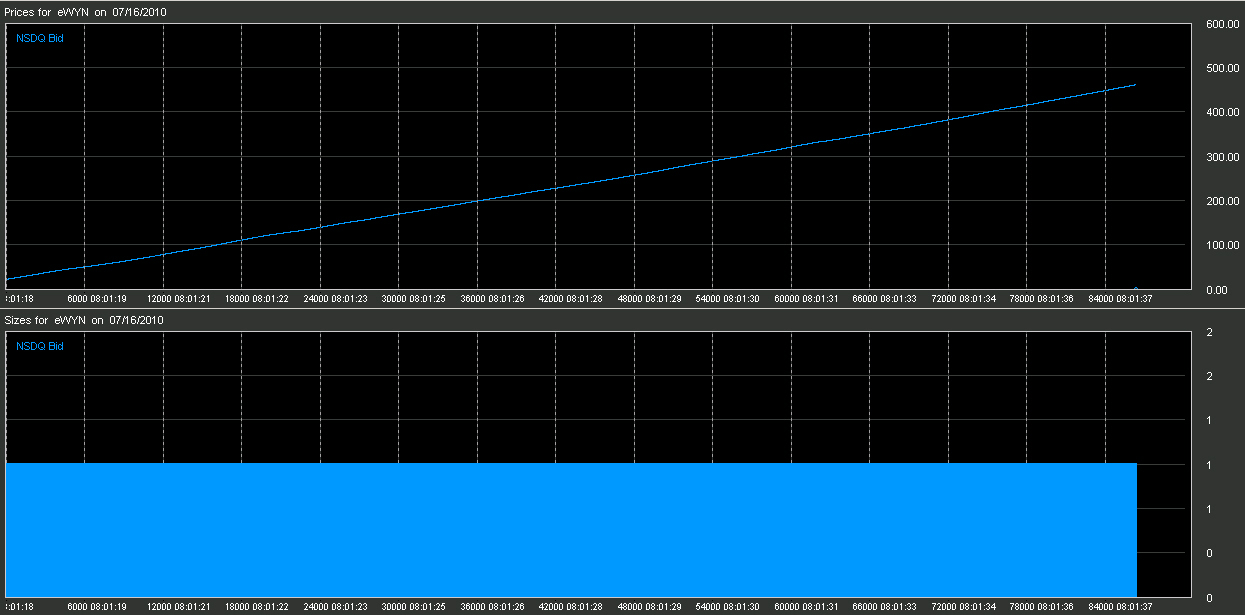

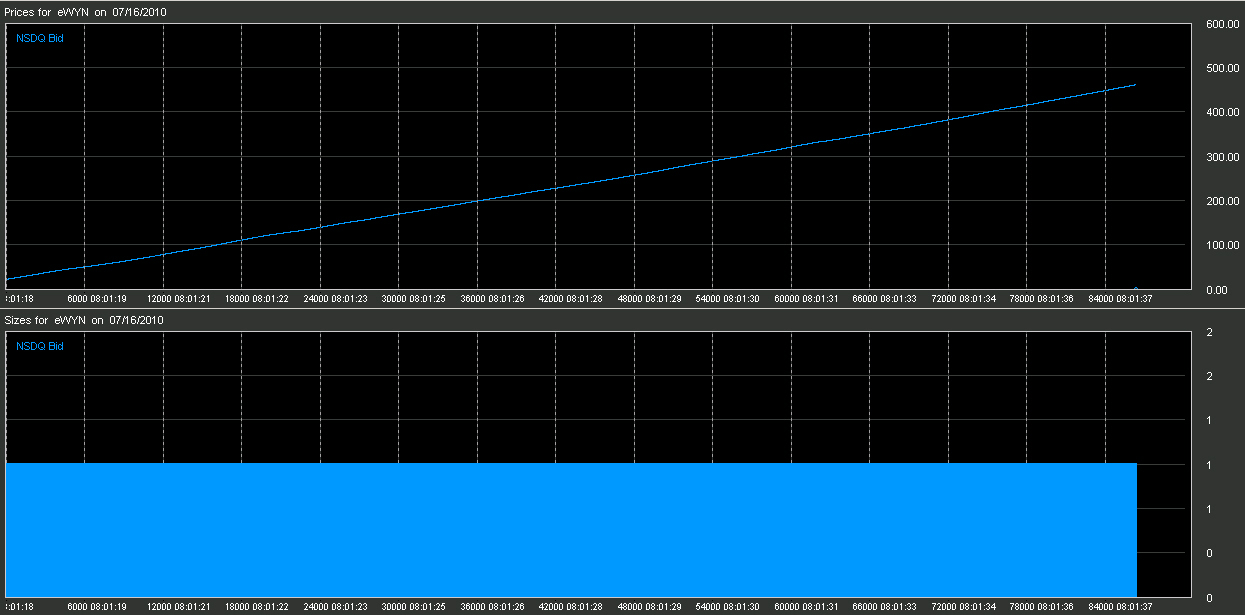

Chart 4 - Stock Symbol WYN. Over 84,000 quotes in just under 20 seconds.

Note the BBO bid followed the NSDQ bid tick for tick.

This same pattern was seen in the majority of stocks burst during this

time.

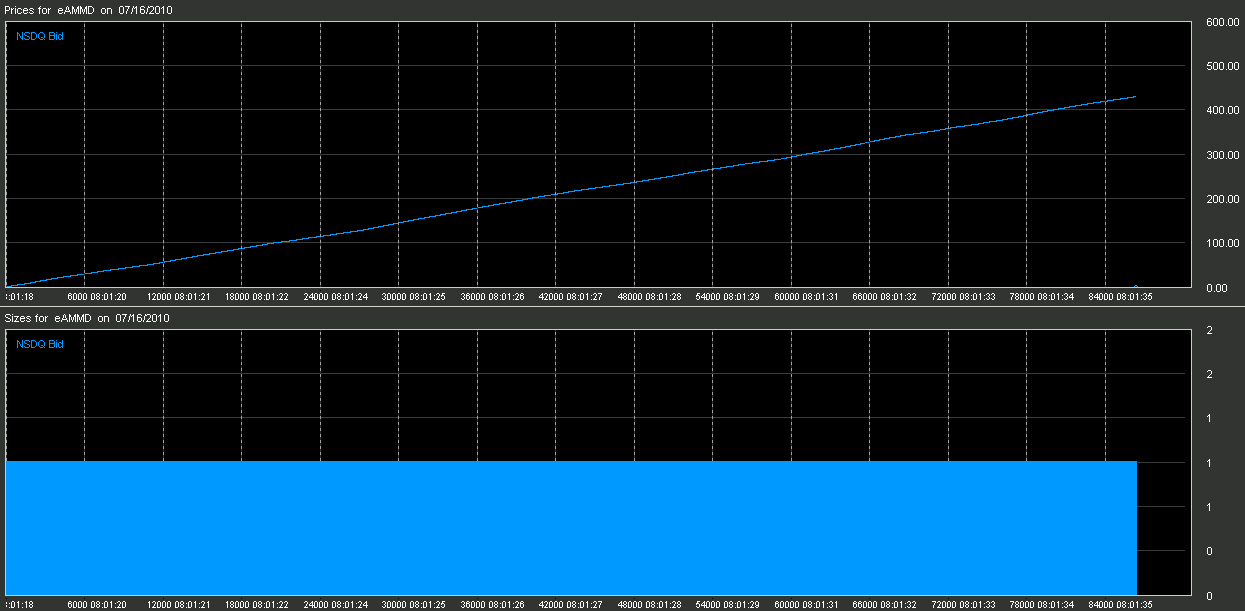

Chart 5 - Stock Symbol WYN. Over 84,000 quotes in just under 20 seconds.

Note the EXACT same sequence and pricing as WYN shown above.

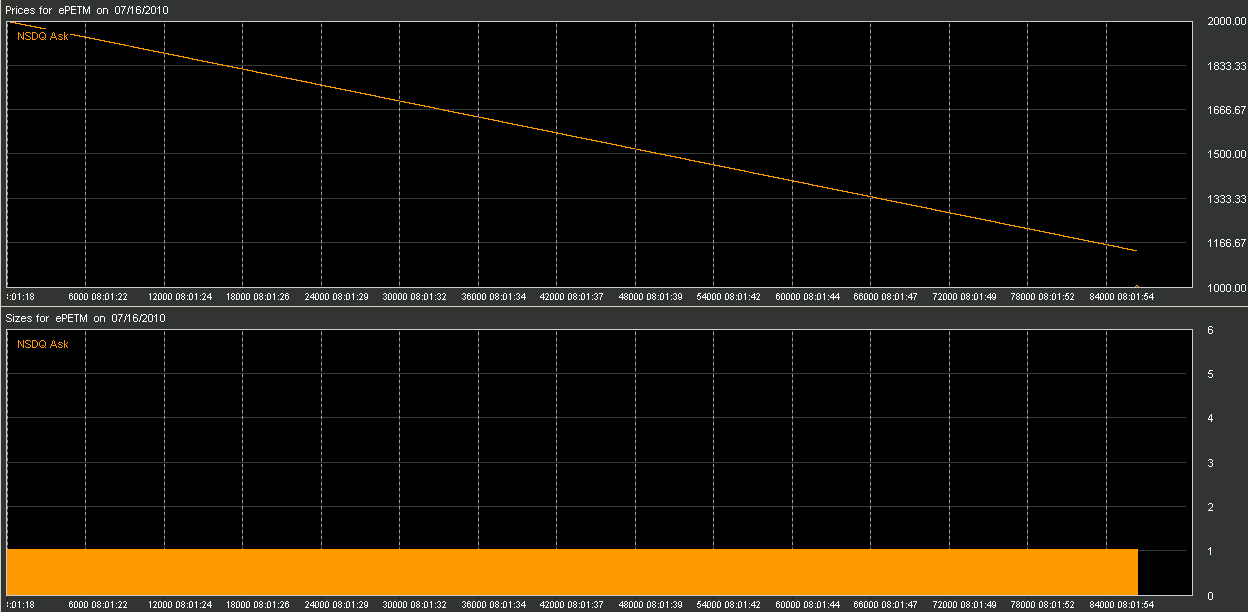

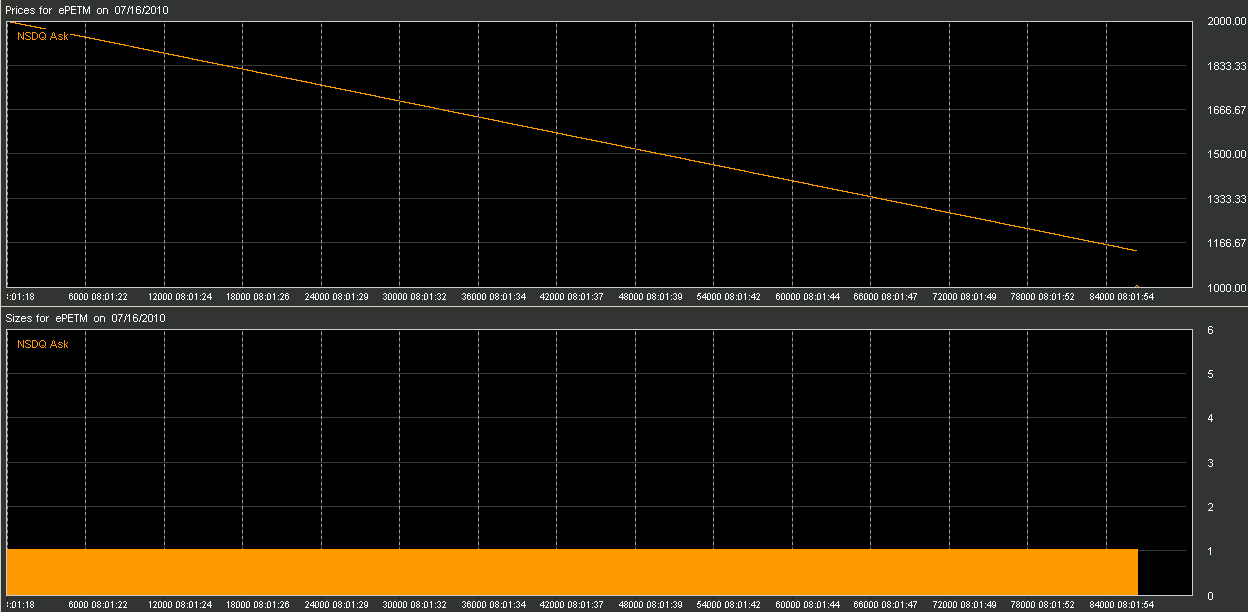

Chart 6 - Stock Symbol PETM. Over 84,000 quotes in just under 20

seconds. Note the BBO ask followed the NSDQ bid tick for tick.

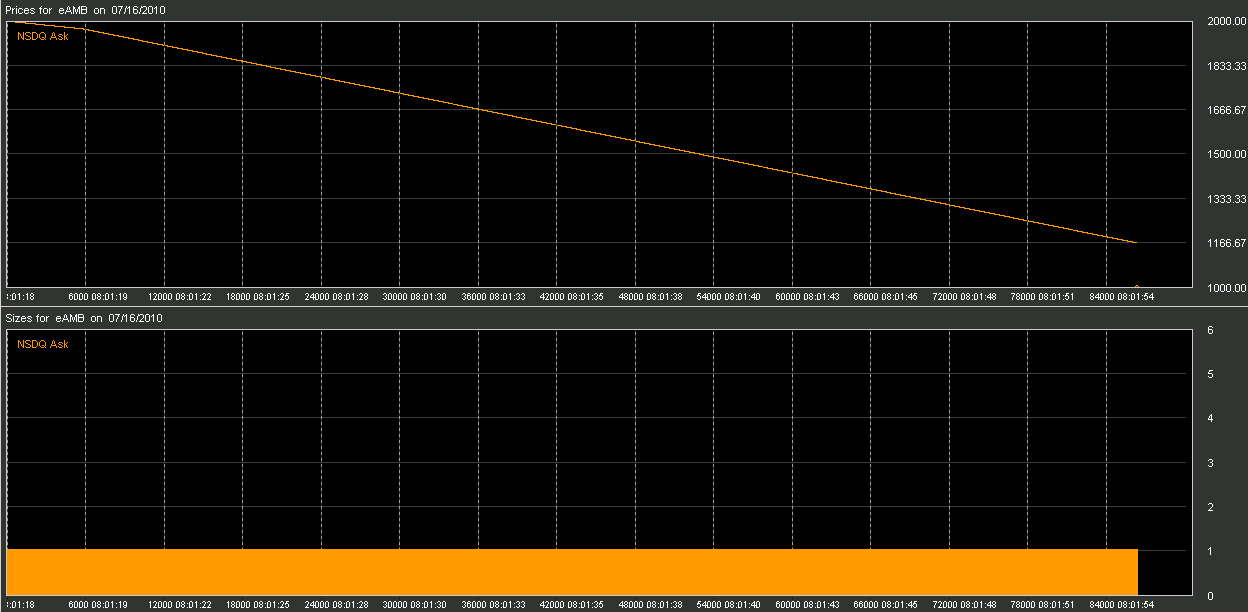

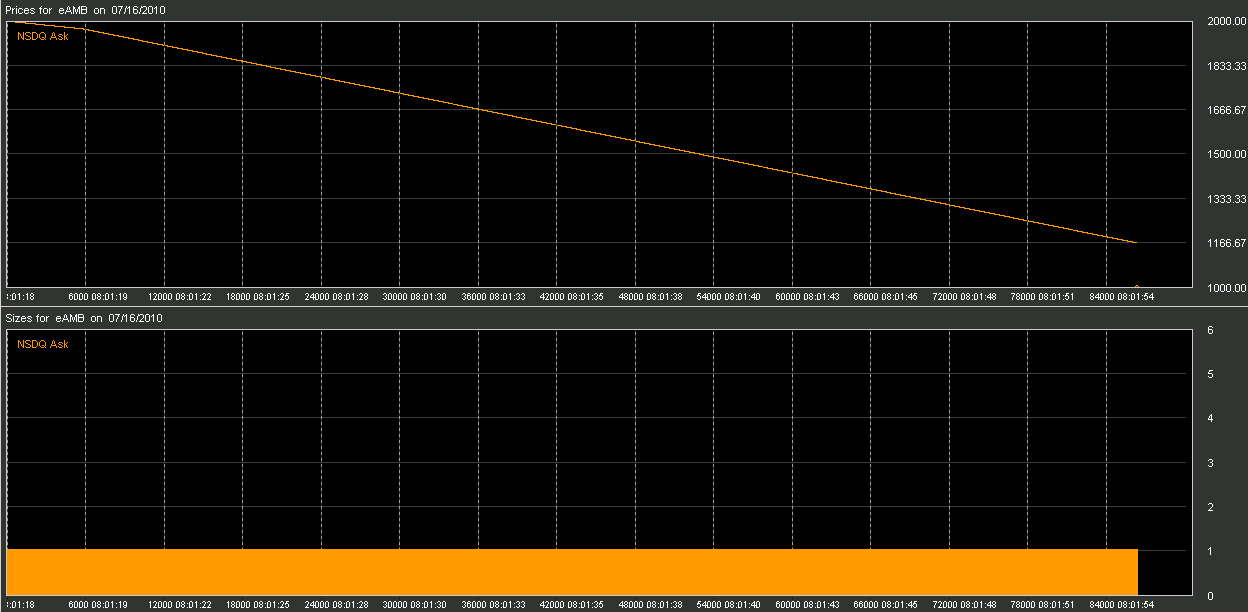

Chart 7 - Stock Symbol AMB. Over 84,000 quotes in just under 20 seconds.

Note the EXACT same sequence and pricing as PETM shown above.

| |

Inquiries: pr@nanex.net

Publication Date: July 08, 2010

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|