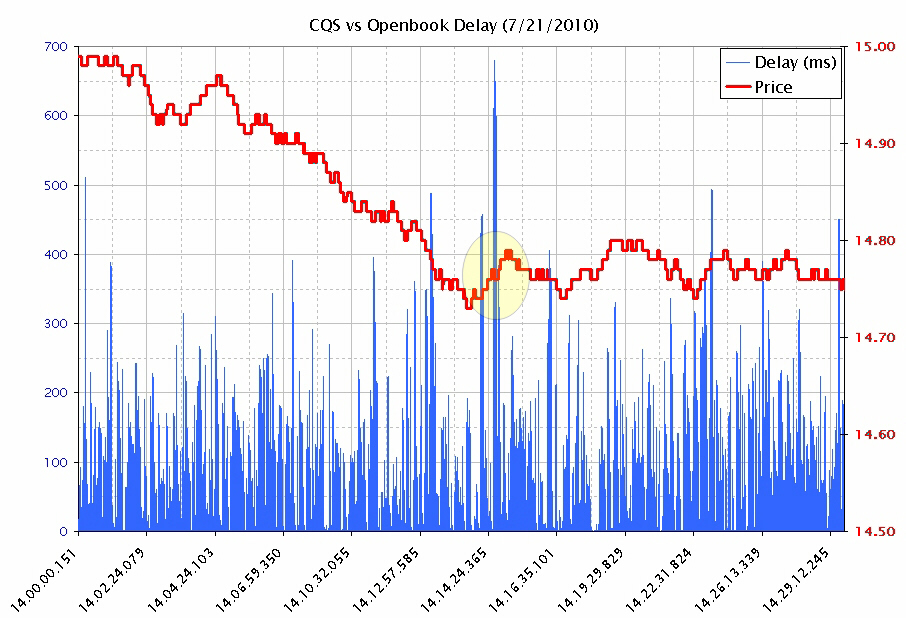

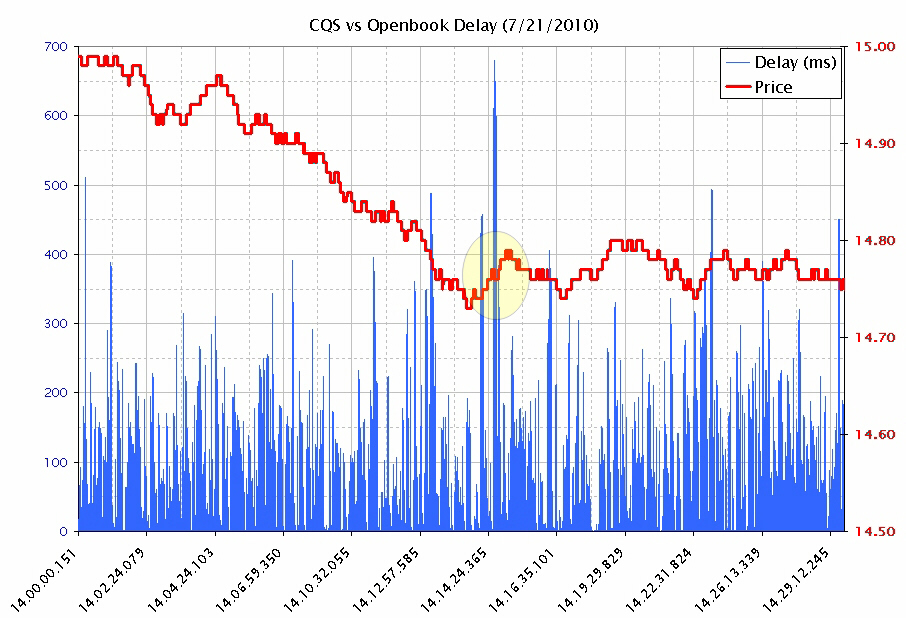

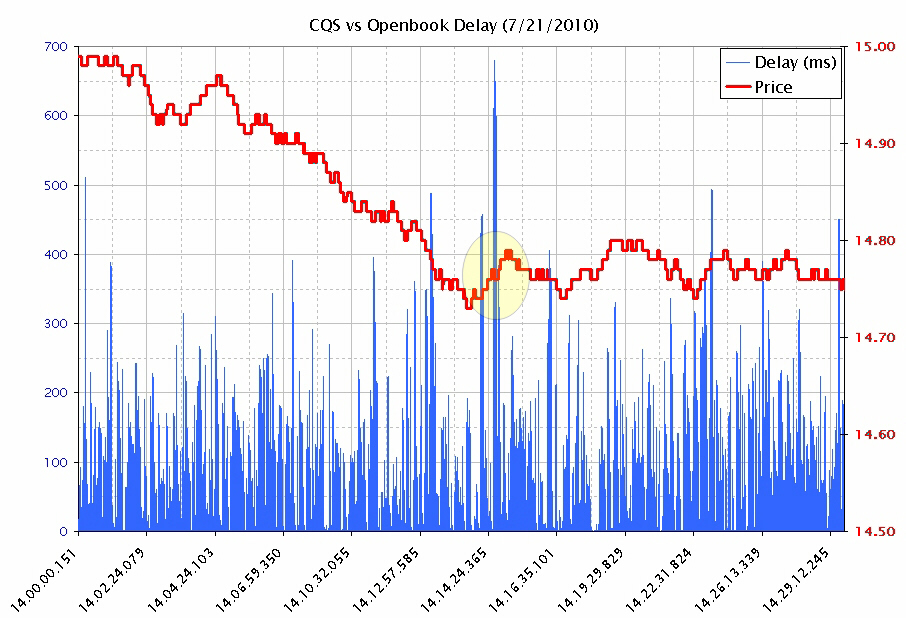

We wanted to see the extent of the delay between NYSE quotes from CQS and

OpenBook on a more recent trading day. So we synchronized quotes from CQS and

OpenBook for GE between 1pm and 4pm Eastern time and plotted 30 minutes worth

of timestamp differences along with the quote price which are shown in Chart 1

below. We were surprised to see the frequency and magnitude of the delay. We

thought high quote activity in a stock would cause a delay in that stock's

quote, but could not find any correlation between the quote activity in GE and

the delay.

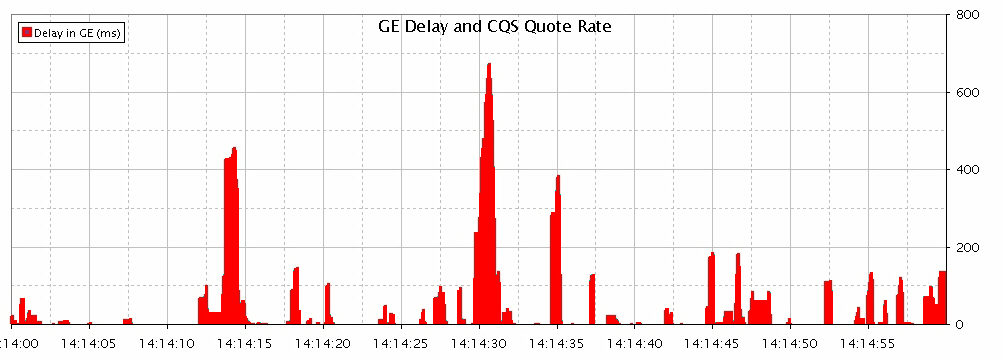

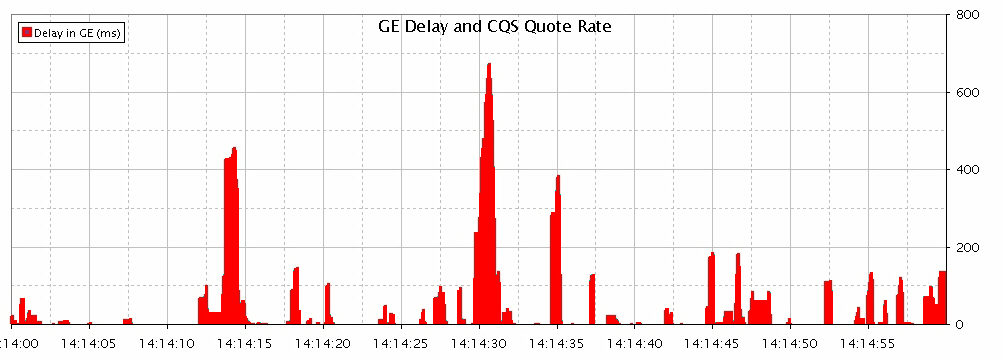

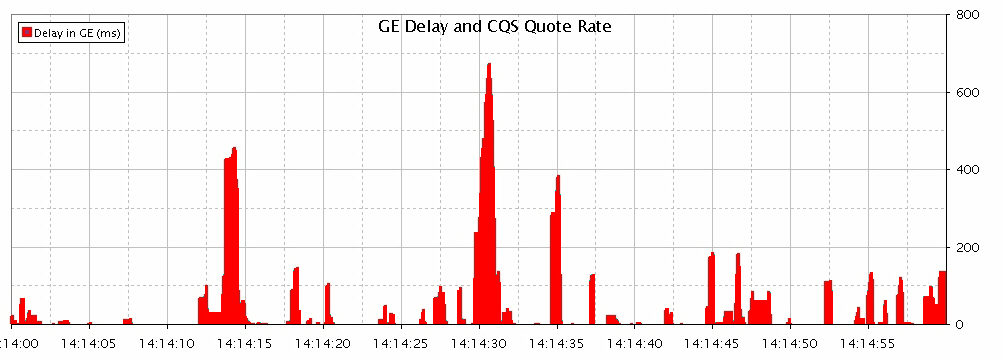

Then we decided to focus on the one minute that had the highest delay, which is

highlighted with a yellow circle in Chart 1. This one minute sample of the

delay is plotted in Chart 2. |

Chart 1:

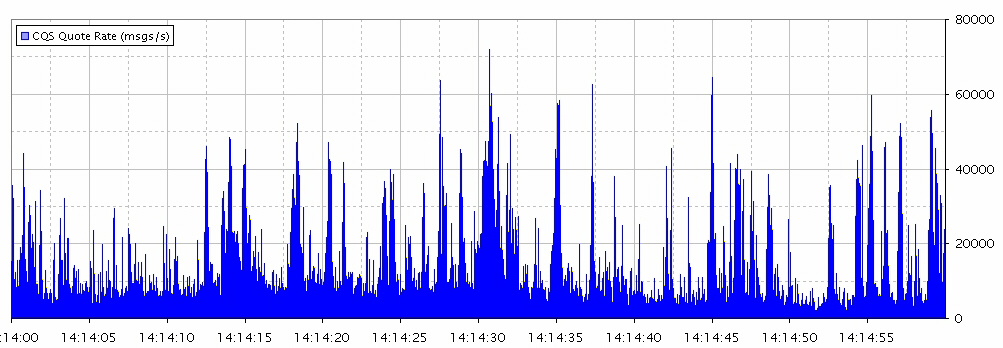

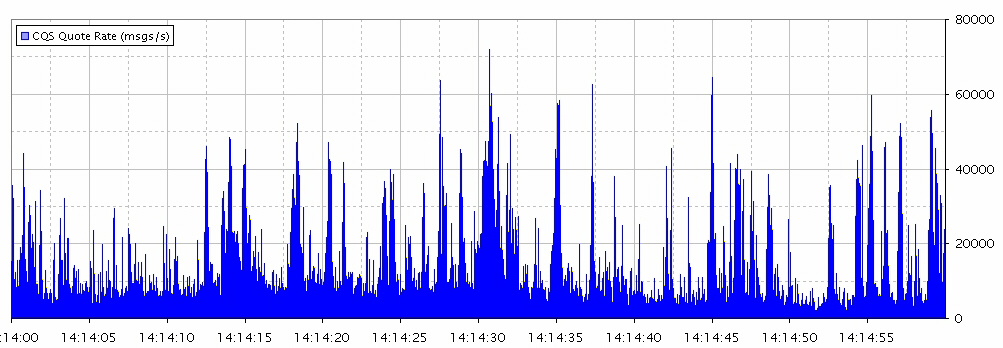

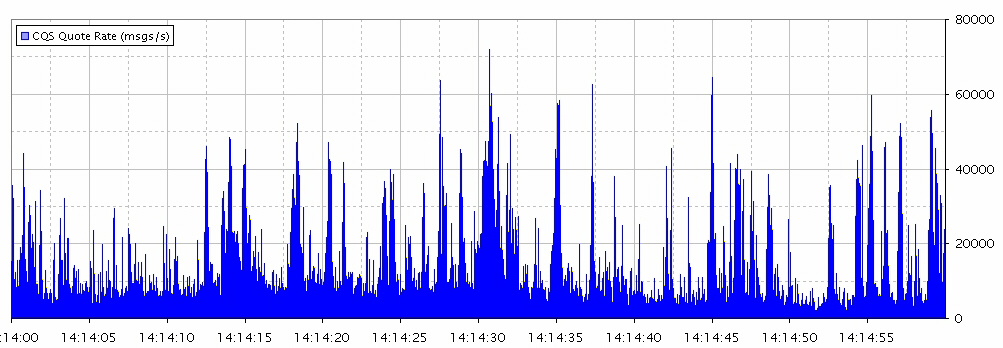

Instead of looking at the quote rate for just GE, we decided to plot the

quote rate for all stocks that NYSE sends to CQS. In other words, we plotted

the sum total number of quotes where the listed exchange and reporting exchange

are NYSE. This is plotted in Chart 3, which has the same time interval as Chart

2.

You can see that there is a very strong correlation between the quote rate in

Chart 3, and the delay in Chart 2. Whenever the quote rate in Chart 3 exceeds

20,000/second, a corresponding delay is seen in Chart 2. The higher or longer

the quote rate exceeds 20,000/second, the greater the delay.

We then looked at all 3 hours and noticed the same relationship between total

NYSE to CQS quote rate and a delay in GE.

Then something very disturbing dawned on us. If the average or base quote rate

is around 10,000/second, then it only takes an additional 10,000 quotes/second

to reach the magic 20,000 quotes/seconds where a corresponding delay is seen in

NYSE quote from CQS. This 10,000 quotes/second can be in any stock or

combination of stocks that NYSE sends quotes to CQS for.

The high occurrence of strange crop

circles we have noted elsewhere, are suddenly beginning to make

sense.

|

Chart 2:

Chart 3:

| |

Inquiries: pr@nanex.net

Publication Date: August 23, 2010

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|