Additionally, in our Flash Crash "Recommendations" page, one of our recommendations states:

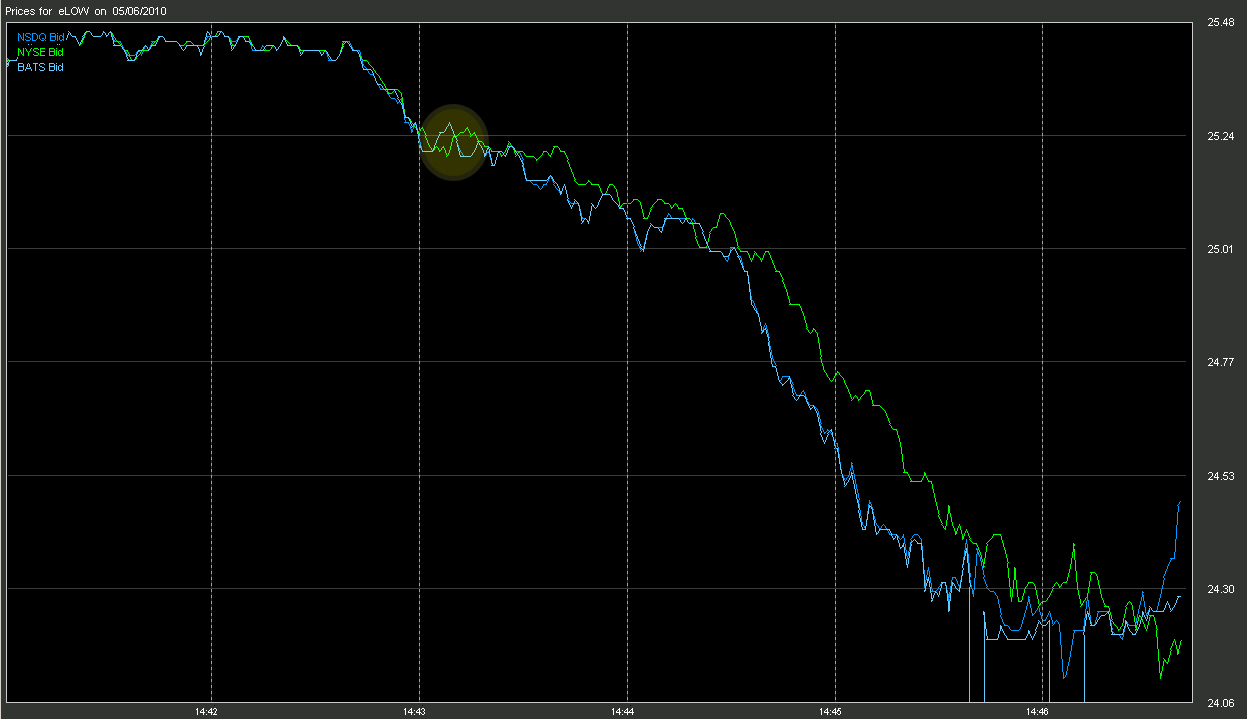

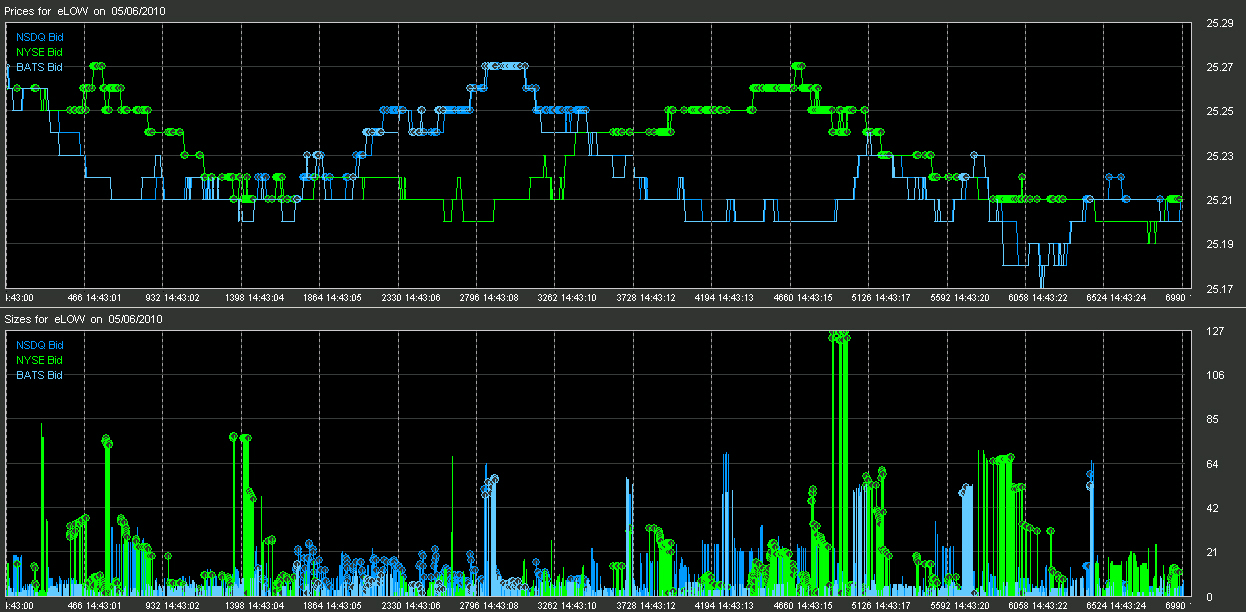

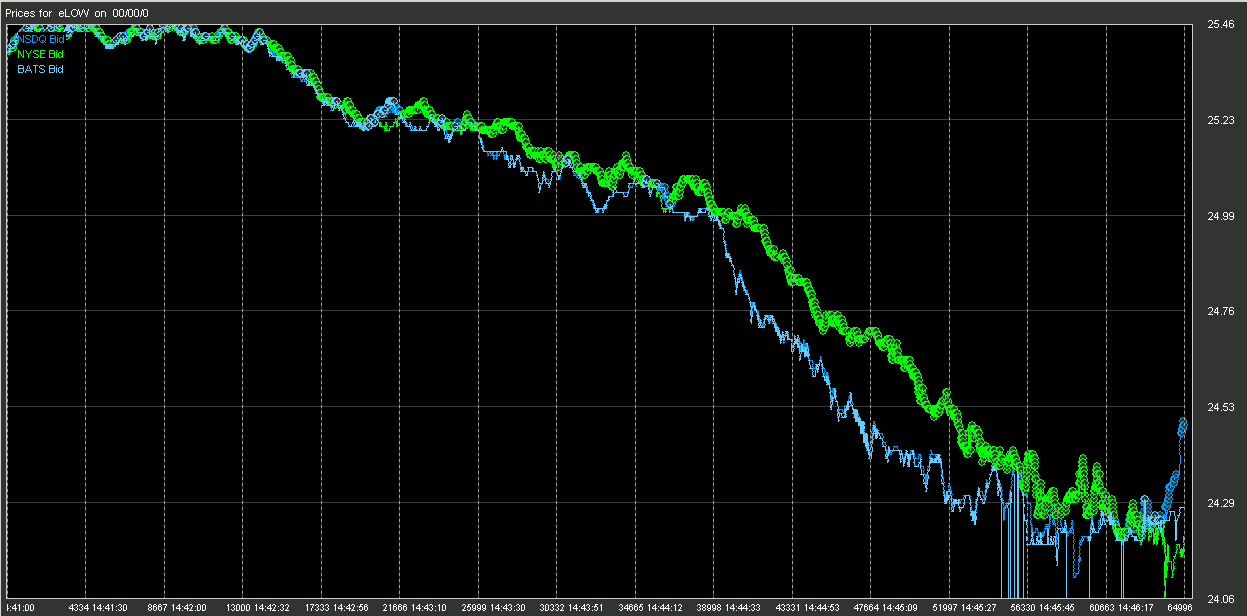

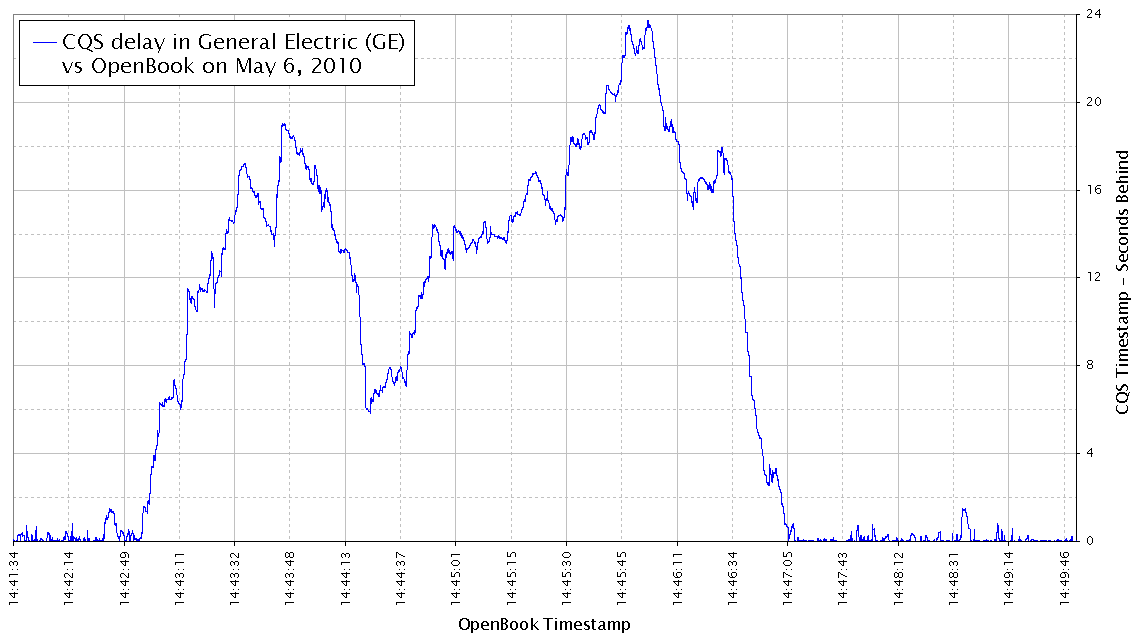

The following charts demonstrate how an exchange's quotes can be chosen as the NBBO for that stock even when the quotes are woefully stale. Chart 1 - 05/06/2010, Symbol LOW. The NYSE feed begins to delay at approx 14:42:40. We take a close look at the exchange crosses at 14:43. From peak to peak it is easy to determine the NYSE quotes are slightly behind although the time stamps are current.  In the detailed charts below, when an exchange has the BBO quote it is tagged with a circle on the exchange's price and size line in the exchange's designated color. Chart 2 - 05/06/2010, Symbol LOW. In this chart you can see a detailed slice of time (from 14:43:00 through 14:43:24 and highlighted in the above chart) when quotes were initially crossing, CQS would choose NYSE, NSDQ, BATS or PACF (not shown for clarity) quotes as the BBO.  Chart 3 - 05/06/2010, Symbol LOW. In this chart you can see the full picture again from 14:41 through 14:46. Notice that when the price began to plunge the NYSE quote was consistently picked as the best bid despite the fact that during the plunge NYSE quotes were significantly behind.  Conclusion: Put simply, if CQS (Consolidated Quotation System) does not determine that quotes from a given exchange are stale, the possibility of it choosing those quotes as the BBO is inevitable. It is obvious from these charts (and from those presented in out original Flash Crash Analysis) that the NYSE quotes are stale. Furthermore, since the quotes are time stamped when exiting CQS, other market participants could not detect the NYSE quotes (and therefor the current BBO) were stale. As small lags in time from quotes sent through CQS happen every day, the NBBO system cannot be relied upon and is meaningless until the time stamping mechanism has been fixed. This situation also makes the potential for latency arbitrage even more suspect as participants receiving premium NYSE products (as opposed to CQS) can detect these delays where-as others cannot. In the age of HFT's, where quotes can be sent at rates exceeding 5,000 quotes per second for one issue and can effect the BBO, delays of even 200 milliseconds (or less) become a lifetime. CQS (Consolidated Quotation System) is the method in which 95% of all US market participants receive their data and is also responsible for calculating the NBBO for all listed stocks. There are however premium products direct from the exchange which are not disseminated through CQS. One such product is OpenBook from NYSE. In comparing time stamps of quotes from CQS to OpenBook, it is clear this time delay exceeded 20 seconds. The following is a chart of GE (one of the stocks we pointed out as lagging in our initial analysis) for 05/06/2010 comparing the time stamps of OpenBook vs. CQS:

|