May 6'th 2010 Flash Crash Analysis

Continuing Developments

SEC Report Response

An inspection of several key items included or omitted from the SEC's

Final Flash Crash Report.

Publication Date: 10/13/2010

Back to

Table Of Contents

|

I. Waddell & Reed Sell Algorithm

The SEC report identified a Sell Algorithm selling 75,000 contracts as the

primary cause of the flash crash. If the "Sell Algorithm" in the SEC

report refers to the Waddell & Reed trades, then there is a problem.

Sell

Algo Trades - Analysis of the Waddell & Reed (W&R) May 6, 2010 trade

executions.

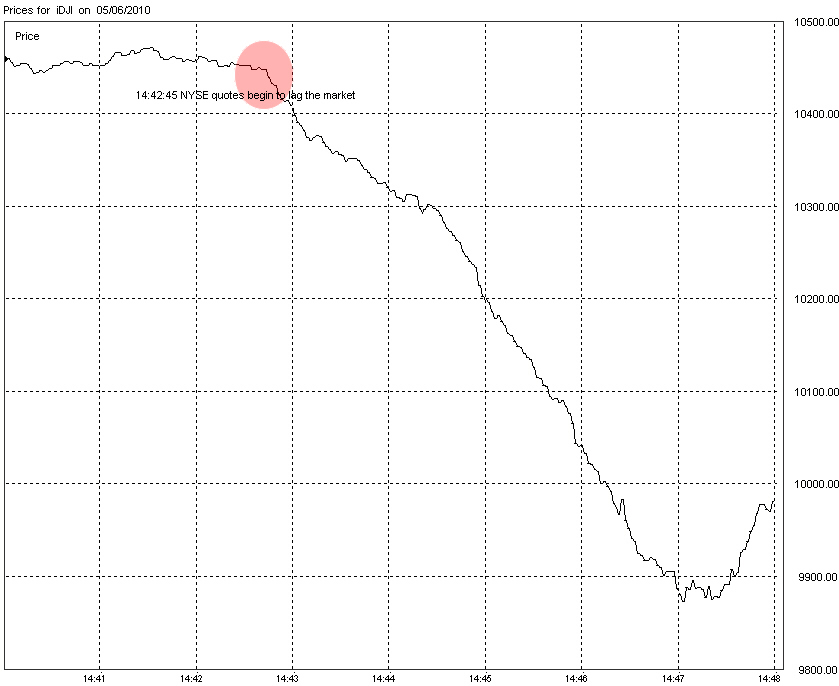

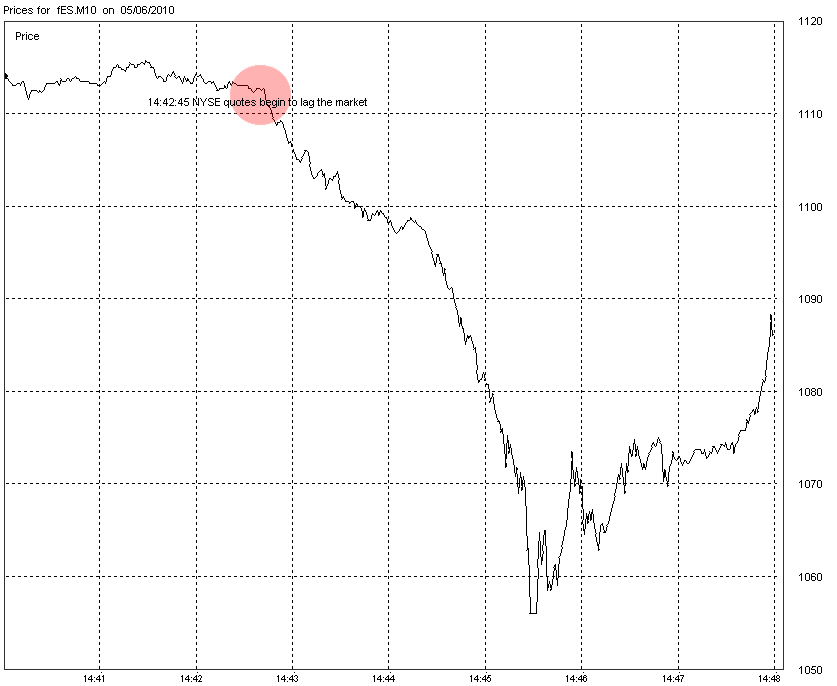

II. NYSE Delays

Page 76 of the SEC's Final Flash Crash Report states:

| |

- Between 2:44:45 p.m. and 2:46:29 p.m. on May 6, NYSE quotes in the 1665

Symbols had average delays to the CQS of over 10 seconds. Between 2:45 p.m. and

2:50 p.m., over 40 of the 1665 Symbols had an average delay to CQS of more than

20 seconds, and the average delay for all of the 1665 Symbols was just over 5

seconds.

- NYSE also experienced delays disseminating transaction information to

the consolidated feed and through at least one of its proprietary data feeds.

Between 2:45 p.m. and 2:50 p.m.

|

As reported in our

Initial

Flash Crash Report and

Flash

Crash Summary Report, the delays in NYSE stocks began at 14:42:45. We

are not sure why the report mentions the first delay time 2 minutes later, when

delays already exceeded 10 seconds. The delays started 2 minutes earlier and

gradually built up to 10+ seconds in about 1/2 of the symbols.

|

As shown above, the final plunge of the day corresponds precisely to when

the NYSE began to delay quotes. This fact was omitted from the report.

|

|

III. The NBBO

As we have reported, as the NYSE quotes that were lagging were time stamped as

current, CQS

(responsible for determining the NBBO) would designate NYSE quotes as the

NBBO even though the quotes were stale and crossed with other

markets.

On 05/06/2010 there were approx 3,300 stock listed on the NYSE exchange. As

1665 stock were determined to have delays and were incorrectly designated as

the NBBO, approx. 50% off all stocks listed on the NYSE had incorrect NBBO

pricing. Therefore any analysis using the NBBO for these stocks after 14:42:45

would be invalid.

| |

From Page 80:

In this report we have extended our analyses to include the full order books

of many thousands of securities and ETFs. To do so we obtained NYSE OpenBook

Ultra and NYSE ArcaBook data, Nasdaq ModelView and similar data from BATS.

These sources provided minute-by-minute “snapshots” of the order

book, for all listed securities.71 These data allowed us to calculate the

number of shares represented by buy and sell limit orders on these exchanges at

a wide range of price points. We measured the price points in terms of the

relative distance from the midpoint of the NBBO. These data provide a detailed

picture of the available liquidity for each security, throughout the day.

|

| |

From Page 83:

ORDER DEPTH. The blue bars show the market depth for resting buy-side

orders, and the green bars show the depth for resting sell-side orders. There

is a separate bar for each minute during trading hours, and the height of the

bars in the lightest shades show the number of shares available for

purchase/sale within 10 basis points of the midpoint of the NBBO.

...For each security there are two sets of charts: the first presents

liquidity limited to within 500 bp of the NBBO midpoint, and the second

presents all available liquidity. |

| |

From Page 84:

From 2:43 p.m. through 2:44 p.m., selling liquidity fell sharply, perhaps as

orders were executed, and buying liquidity declined less, so that at 2:44 p.m.,

there were approximately 33,000 shares with orders to purchase within 500 bp of

the NBBO midpoint, but only approximately 22,000 shares with orders to sell

within 500 bp. |

IV. Importance of CQS/CTS

| |

From Page 38:

Most of the firms we interviewed that are concerned with data latency in the

milliseconds (such as market makers, internalizers, and HFTs) subscribe

directly to the proprietary feeds offered by the exchanges. These firms do not

generally rely on the consolidated market data to make trading decisions and

thus their trading decisions would not have been directly affected by the delay

in data in this feed. However, some of these firms do use the consolidated

market data feeds for data-integrity checks, and delay-induced data

discrepancies certainly contributed to the general sense of unease experienced

that day.

Other firms that are not concerned with data latency in the milliseconds (such

as many asset managers and other lower-frequency traders) tend to rely on the

consolidated market data feeds for trading decisions. A number of those

interviewed reported pulling back from the market as general volatility

increased, and those seeing delays and price-discrepancies on the consolidated

market data feeds did report that was a contributing factor in their decision

to curtail or halt further trading. The source and potential implications of

data delays in the consolidated market data feeds will be explored further in

Section 3.

From Page 76:

The CTS and CQS systems represent a consolidated view of trading and

top-of-book quoting across all national exchanges and ECNs, and trading at

internalizers and dark pools. As such, the relative timing of trades and quotes

within these systems are subject to some aggregation delays, which generally

are less than 10 milliseconds. As discussed in Section 2, many large market

participants route orders directly to exchanges and subscribe to the

proprietary feeds from each exchange in order to minimize aggregation delays

and receive depth-of-book quotes. Accordingly, automated systems making trading

decisions based on these feeds should not have been directly affected by delays

in the CTS and CQS system. It is important to note that retail order flow is

generally handled by internalizers who are also among those participants that

use proprietary exchange feeds to make trading and routing decisions.

However, firms that use proprietary feeds to make trading decisions may still

have been impacted by delays on the CTS and CQS feeds. As discussed, concerns

about data integrity contributed to pauses or halts in many automated trading

systems, which in turn led to a reduction in general market liquidity. Most

firms reported to us that the primary drivers of their integrity-based halts

were observed, rapid changes in the E-Mini and observed, rapid changes in

individual securities.But data-integrity checks based on the CTS and CQS feeds

would have been directly affected by delays in the consolidated market data,

and firms using those integrity-checks reported that this influenced, and to

some extent supported, their decisions to pause or halt trading.

For firms employing trading strategies that are less time-sensitive, and whose

automated systems rely solely on data from the CQS and CTS, data delays on

these feeds could have directly triggered integrity-pauses. Some such firms

reported that delays on the CQS and CTS were a more significant part, though

not the sole reason, for their decision to curtail or halt trading on the

afternoon of May 6. We note, however, that while these types of firms are not

generally market makers or liquidity providers, they can be significant

fundamental buyers and sellers. |

Shown above are four paragraphs (from two separate pages) regarding how many

firms were effected by CQS/CTS and in fact influenced by CQS/CTS in trade

decisions, regardless of receiving premium feeds, CQS/CTS or both.

Again from page 78:

| |

Our investigation to date reveals that the largest and most erratic

price moves observed on May 6 were caused by withdrawals of liquidity and the

subsequent execution of trades at stub quotes. ...However, the evidence does

not support the hypothesis that delays in the CTS and CQS feeds triggered or

otherwise caused the extreme volatility in security prices observed that day.

|

Loss of liquidity really means buyers pulled out -- few buyers means lower

prices. The reason the buyers pulled out? As evident by the SEC's statements

above, one of the primary reasons was lack of confidence in data integrity and

much of that was due to delays experienced on the NYSE.

In regards to volatility levels when trades began to hit stub quotes, actual

execution of trades at stub quotes did not begin to occur until the market had

bottomed and played no role in the actual crash itself.

Furthermore, from Page 76:

| |

Rule 603(b) of Regulation NMS requires equity exchanges and FINRA to act

jointly to disseminate consolidated information, including an NBBO, on

quotations for and transactions in NMS stocks. The consolidated information is

disseminated through securities information processors that collect, process,

and prepare for publication such information including the price, size, and

symbol of quotations and executions. |

As stated in Item II of this report, approx. 50% of all NYSE stocks had

incorrect NBBO values after 2:42:45. A simple search for "NBBO" in

the report is all that is needed to determine how much of the analysis relies

on the NBBO (and NBBO mid-point). Given this, 50% of the analysis in the report

which uses the NBBO for NYSE listed stocks after 14:42:45 must be considered

void, as the NBBO was incorrect. This should underscore the importance of

CQS/CTS.

|

V. Time Stamping of Quote Data

As we reported in both our

Initial

Flash Crash Report and

Flash

Crash Summary Report, when quotes from the NYSE were lagging the

market, they were time stamped when disseminated from CQS and not when the

orders were placed. Therefore the orders appeared to be current (which led to

the NYSE

bids being designated as the NBBO even though they were severely

crossed with other markets). This was a key issue -- the lag in NYSE quotes was

not detected and sell order flow routed to the NYSE.

Proper time stamping of quotes should be the cornerstone of market structure

and should apply equally to both proprietary exchange feeds and CQS/CTS. When

quotes that are 20 seconds (or more) behind the real market and time stamped as

current, the ability to detect latency in that feed is diminished

significantly. This is most likely the reason no one knew the NYSE feed was

delayed (including the NYSE).

Changing the current procedure to time stamp at the time a quote or trade is

generated is a near trivial exercise. It probably comes as a surprise to many

that time stamping isn't done this way now. In both our

initial

and summary

reports we make this recommendation.

Despite the ramifications of incorrect time stamping, the issue is not

addressed in the report.

VI. Data Used

There are currently 11 reporting exchanges for US securities (NYSE, Nasdaq,

ISE, BATS, Boston, Cincinnati (National Stock Exchange), CBOE, ARCA, Chicago,

EDGX and EDGA). The SEC report analyzed data from 5 exchanges which represented

90% of trade executions on 05/06/2010.

| |

Page 80:

In this report we have extended our analyses to include the full order books

of many thousands of securities and ETFs. To do so we obtained NYSE OpenBook

Ultra and NYSE ArcaBook data, Nasdaq ModelView and similar data from BATS.

These sources provided minute-by-minute “snapshots” of the order

book, for all listed securities. These data allowed us to calculate the number

of shares represented by buy and sell limit orders on these exchanges at a wide

range of price points. We measured the price points in terms of the relative

distance from the midpoint of the NBBO. These data provide a detailed picture

of the available liquidity for each security, throughout the day.

In addition, we obtained order audit trail files from several sources,

including NYSE, NYSE Amex, NYSE Arca, Nasdaq and BATS, each containing detailed

data on orders received, modified, canceled, and executed. In total, this data

contained 5.3 billion records.

These exchanges, combined, reflect approximately 90% of the executions on

exchanges on May 6.

Page 47-48:

To assess HFT trading during the market decline in a more comprehensive

fashion, we also examined a data set obtained from the largest public quoting

markets on May 6 – each of the equities exchanges and Direct Edge (EDGA

and EDGX). This data included total dollar volume on those markets across all

securities by 15-minute increments, and was further categorized according to

liquidity-taking and liquidity-providing buys and sells. Specific participant

data was also provided for each executing broker-dealer that was among the top

20 48 May 6, 2010 Market Event Findings aggressive sellers on each market

during the rapid price decline on May 6. From this list of aggressive sellers,

we aggregated data for 17 executing broker-dealers that appear to be primarily

associated with HFT firms in order to compare trading patterns of these firms

with the rest of the market. The group should not be used to extrapolate the

overall percentage of trading volume of HFTs because it does not include, for

example, the proprietary trading desks of multi-service broker-dealers that may

engage in HFT strategies. Moreover, this data set does not include trading in

the OTC market (except for Direct Edge). |

The majority of the analysis appears to have been conducted with 1 minute

shapshot data or 15 minute interval data. At best, one minute snap-shot data

shows what the data looked like at the end of (or start of -- the report does

not specify) each minute. 5,000 stocks using one-minute snap-shot data would

represent 5,000 data points. However, actual exchange data would represent 12

million data points. So essentially, 1/2400 of the data available was examined.

In regards to the analysis of HFT trading using 15 minute data increments, many

HFT algorithms quote at rates exceeding 5,000 orders per second.

VII. Other Omissions

- Quote Saturation

The

quote

saturation event that triggered delays in the NYSE and CQS/CTS are

absent from the report. From our Flash Crash Summary Report:

| |

It appears that the event that sparked the rapid sell off at 14:42:44:075

was an immediate sale of approximately $125 million worth of June 2010 CME

eMini futures contracts (not originating from Waddell & Reed) followed 25ms

later by the immediate sale of over $100 million worth of the top ETF's such as

SPY, DIA, QQQQ, IVV, IWM, SDS, XLE, and EEM. Both the eMini and ETF sales were

sudden and executed at prevailing bid prices. The orders appeared to hit the

bids. The volume in these sales are not considered to be extreme.

However, approximately 400ms before the eMini sale, the quote traffic rate for

all NYSE, NYSE Arca, and Nasdaq stocks surged to saturation levels within 75ms.

This is a new and surprising discovery. Previously, when we looked at time

frames below 1 second, we thought the increase in quote traffic coincided with

the heavy sales, but we now know that the surge in quotes preceded the trades

by about 400ms. The discovery is surprising, because nearly all the trades in

the eMini and ETFs occurred at prevailing bid prices (a liquidity removing

event).

The quote traffic surged again during the ETF sell event and remained at

saturation levels for nearly 500ms. Additional selling waves began seconds

later sending quote traffic rates back to saturation levels. This tidal wave of

data caused delays in many feed processing systems and networks. We discovered

two notable delays: the NYSE network that feeds into CQS (the "NYSE-CQS

Delay"), and the calculation and dissemination of the Dow Jones Indexes

(DOW Delay).

|

- As we also show in our Flash Crash Summary report, the

DJI

(Dow Jones Industrial Average) also became significantly delayed for 2

reasons:

- Delay in the input data (NYSE-CQS delay) and the methodology used in

computing the DJI - they only use prices of trades from the NYSE for NYSE

component stocks.

- A second and larger delay appears to originate within the feed processors

that compute the index values. To find the second delay, we calculated DJI

using the same methodology as Dow Jones and compared the result to the value

disseminated in the feed. Our prices during the periods prior to and shortly

after the crash matched the prices disseminated by Dow Jones; however, during

the crash, we noticed significant delays. We confirmed the prices of DJI in the

feed matched or were ahead of other sources.

No mention is made of the DJI delay in the report.

- A near identical occurrence of the Flash Crash one week prior to

05/06/2010.

As we reported, on

04/28/2010

the market experienced a "Mini Flash Crash" with near

identical circumstances as 05/06/2010.

Analysis of 04/28/2010 and any correlation it might have to the events of

05/06/2010 are absent from the report.

- We note there was no mention of

Options

in the report, .

|

|

Inquiries: pr@nanex.net

Publication Date: 10/13/2010

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|