High

Freak Volatility

An example of HFT causing explosive volatility

|

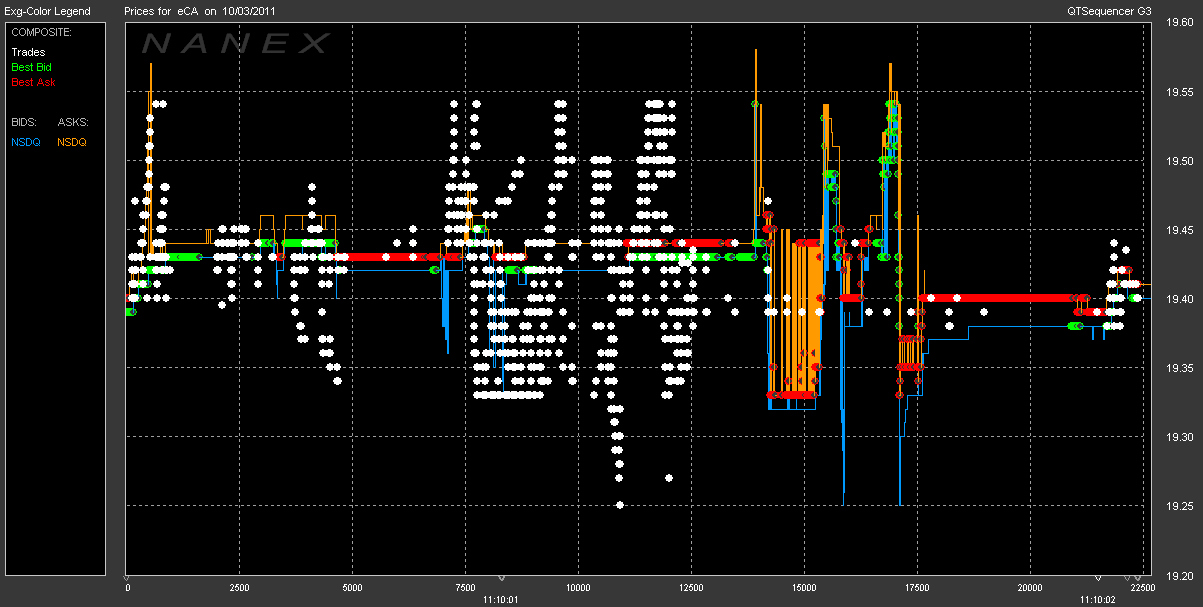

On October 3, 2011 beginning at 11:10:00.450, in the stock CA Technologies (symbol

CA), a bizarre interaction between multiple HFT algorithms caused a wild oscillation

in the NBBO with over 1,000 trades executing in a 30 cent range. Just before and after

the event, the bid-ask spread was a narrow 1 cent, and trades executed normally in

a 1 cent range. Essentially HFT caused the bid-ask spread to widen from 1 cent to

30 cents in the blink of an eye.HFT caused the spread to widen from 1 cent to 30 cents in the blink of an eye

During the event, the quote rate exceeded 25,000 quotes/second, which caused significant

quote delays of up to 1/2 second for this stock (and probably others processed on the

same exchange equipment). Note that this is similar to an event which occurred in

YHOO that we

described as HFT trading faster than the speed of light (satire).

The one question that needs to be answered and addressed:

Why are trades printing with earlier timestamps than the orders (quotes) on

which they were executed? Up to 1/2 second earlier, which we have been told is an

eternity these days.

|

Below is a 1 minute OHLC bar chart of CA with trade

volume shown as a histogram at the bottom. The event occurred in the area circled in yellow. That spike occurred

in less than 1 second. Note the massive spike in trading volume (yellow arrow). Wasn't

this called

"painting the tape" at one time?

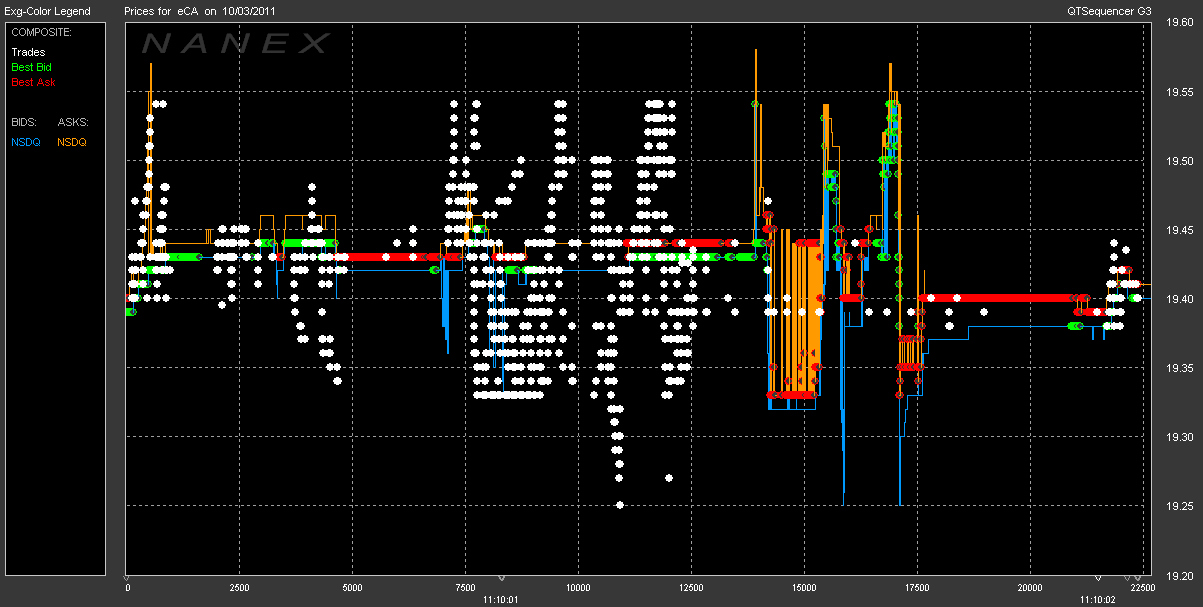

Below is a tick chart showing the NBBO along with trades and quotes from one exchange.

The time scale on the bottom shows both tick count and time.

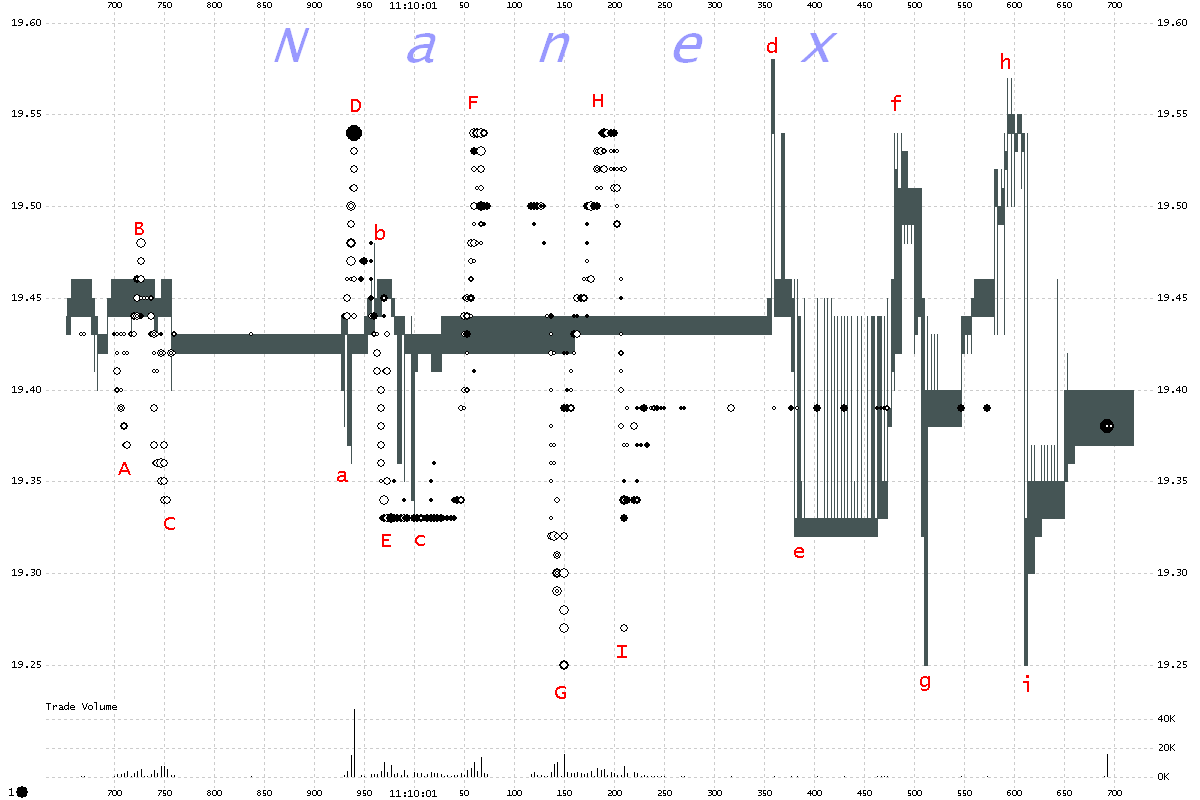

Below is a 1 millisecond interval chart showing trades as circles and the bid-ask

spread as vertical lines from one exchange (Nasdaq). To

get an idea of the extent of the delay, simply match the upper case letters (where trades occurred) to the lower case letters (where the corresponding quotes occurred). We could fantasize that this is

HFT trading faster than the speed of light and call the negative difference fantaseconds, but we know better.

Below is a 2 millisecond interval chart of the NBBO in CA which is plotted as vertical

lines and colored red if the NBBO was crossed during the interval, yellow if it was

locked, and gray if it was normal. The implied quote rate is scaled in quotes/second

and shown at the bottom as a stacked histogram colored by contribution from each exchange.

Note that when quotes from Nasdaq dissipate (black decreases -- see red arrows), the

quote rate from the other exchanges increases to take up the difference. This is an

indication of saturation.

The chart below is the same as the one above, with trades added. Trade volume is shown

in place of Quote Rate.

The chart below shows the bid-ask spread and trades from two exchanges: Nasdaq (black)

and NYSE/ARCA (red).

|

Inquiries: pr@nanex.net

Publication Date: 10/03/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|