Usually when algorithms go haywire in the markets, they execute trades at

wild prices; many of which will later be canceled. 'Pretend it didn't

happen' is the current mantra of our regulatory agencies. The regulators

would also appreciate it if you

didn't talk about these events as they could harm

investor confidence. What country are we in?

Until firms are held responsible for their actions or the actions of their

technology, the haywire algo's (and the companies that deploy them) are free to

do it again and again.

Presented below are three examples. You won't find these trades in most

databases any longer, they have already been scrubbed (they didn't happen).

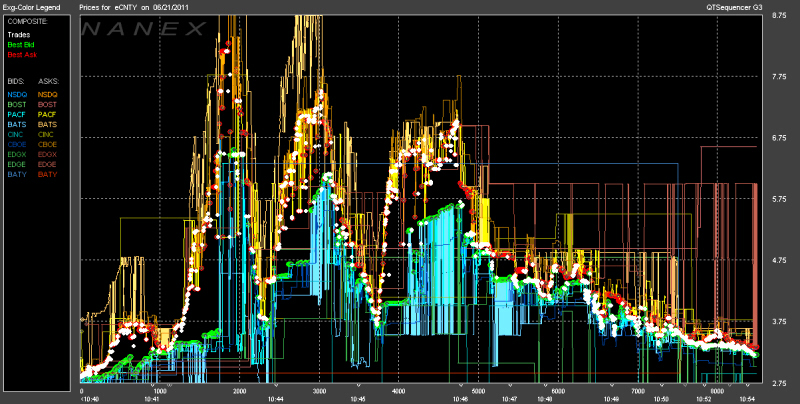

The following chart plots quotes and trades of the stock

CNTY on

06/21/2011. The stock cycled violently from approximately $2.75 to

$8.00 several times:

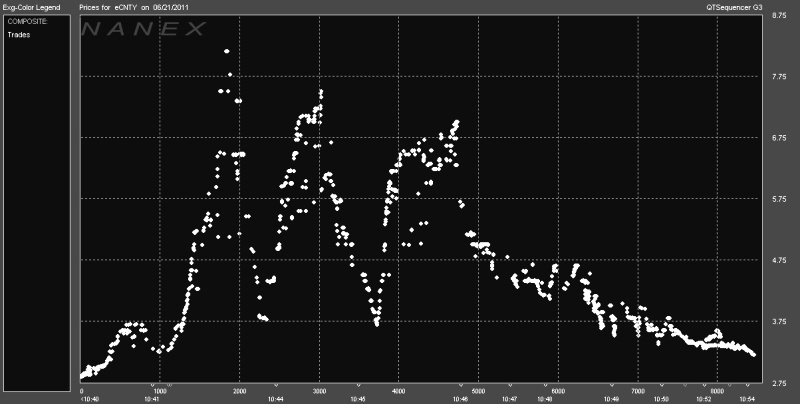

In this chart we have removed all quotes and plotted only trades:

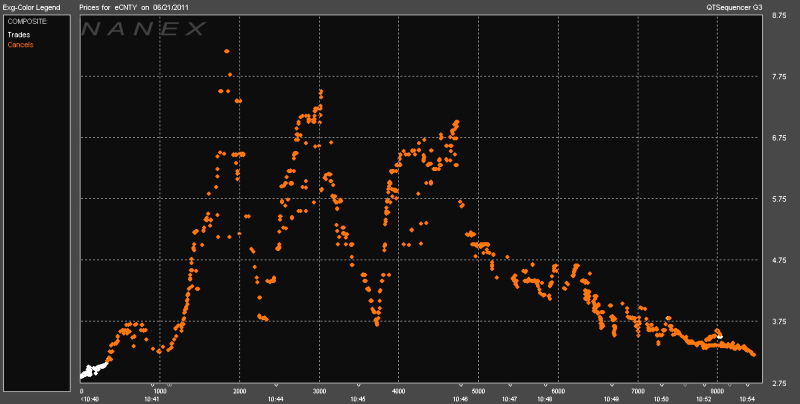

In this chart we color the canceled trades orange:

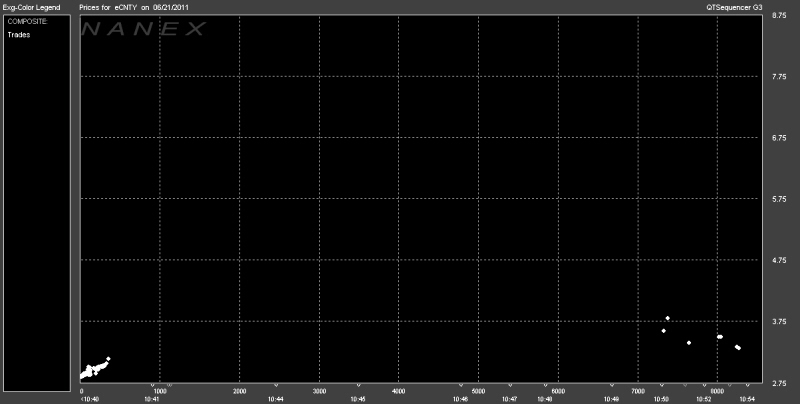

Finally, the next chart shows the trades with the now canceled trades absent.

"Nothing Happened", just another Algo In The Mist.

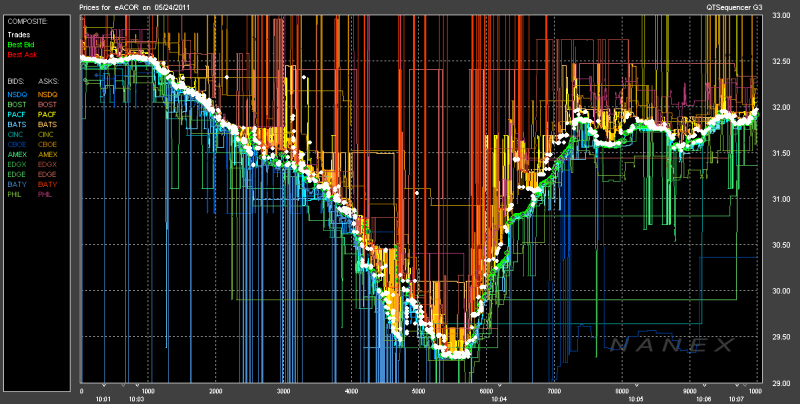

In the next example we show the stock

ACOR on

05/24/2011. The stock lost approximately 11% of it's value in under 5

seconds then quickly recovered. While many of these trades got canceled, it's

easy to see a few traders still got burned. Unfortunately, this trend will only

continue if algos are allowed to conduct bad business that simply gets swept

under the rug.

The following chart plots quotes and trades of the stock ACOR on

05/24/2011:

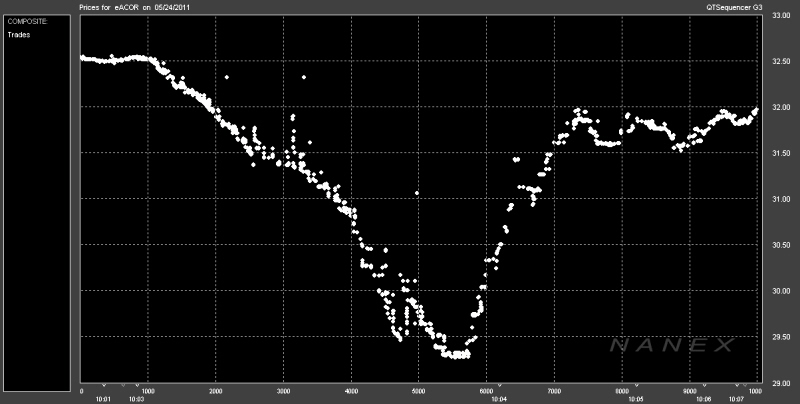

In this chart we have removed all quotes and plotted only trades:

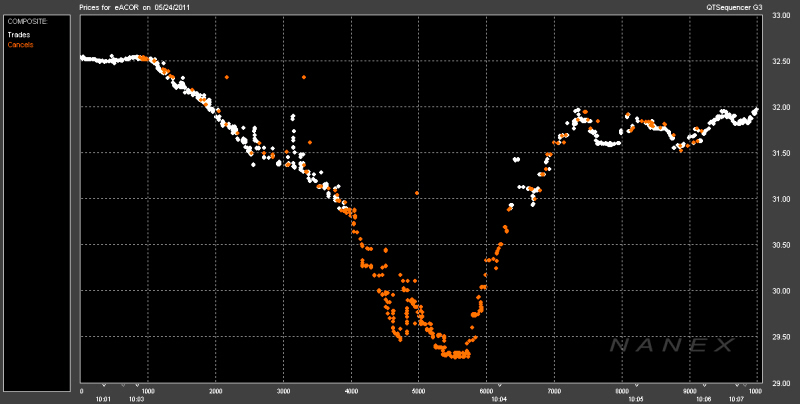

In this chart we color the canceled trades orange:

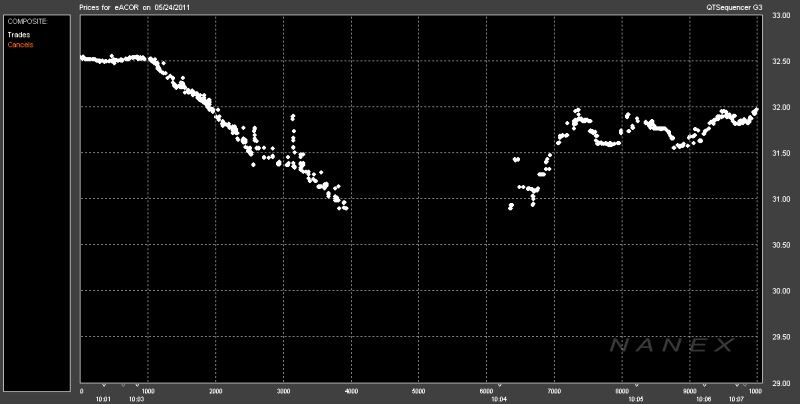

Finally, the next chart shows the trades with the now canceled trades absent.

Once again the regulatory agencies cancel the trades, close their eyes and

pretend it never happened.

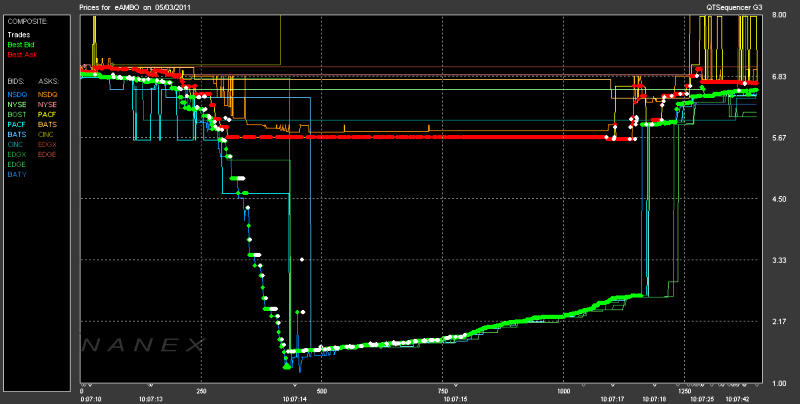

In the next example we show the stock

AMBO on

05/03/2011. Shares fell from $6.74 to $1.59 within a single second:

The following chart plots quotes and trades of the stock AMBO on

05/03/2011:

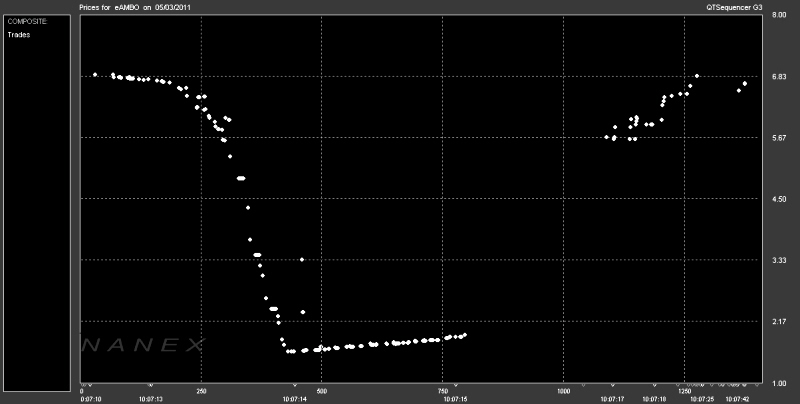

In this chart we have removed all quotes and plotted only trades:

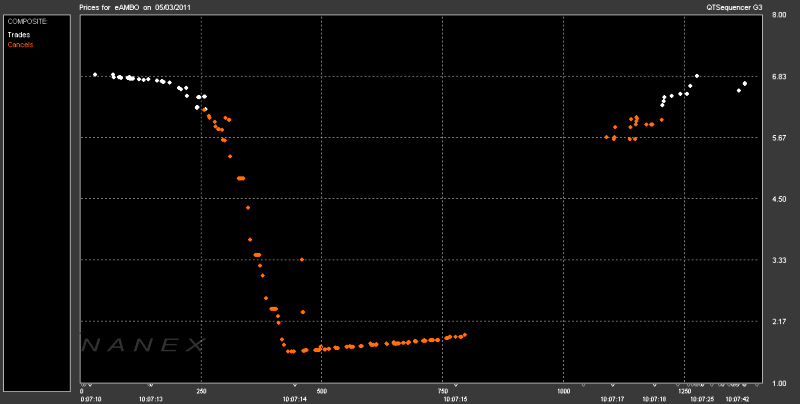

In this chart we color the canceled trades orange:

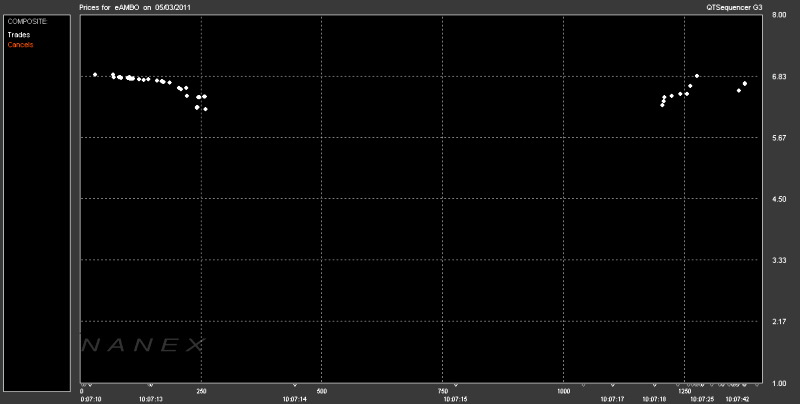

Finally, the next chart shows the trades with the now canceled trades

absent.

|

|

Inquiries: pr@nanex.net

Publication Date: 09/28/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|