Strange Days June 7'th, 2011 - Stub Quoting still occurs in

broad daylight.

|

Back to

Table Of Contents

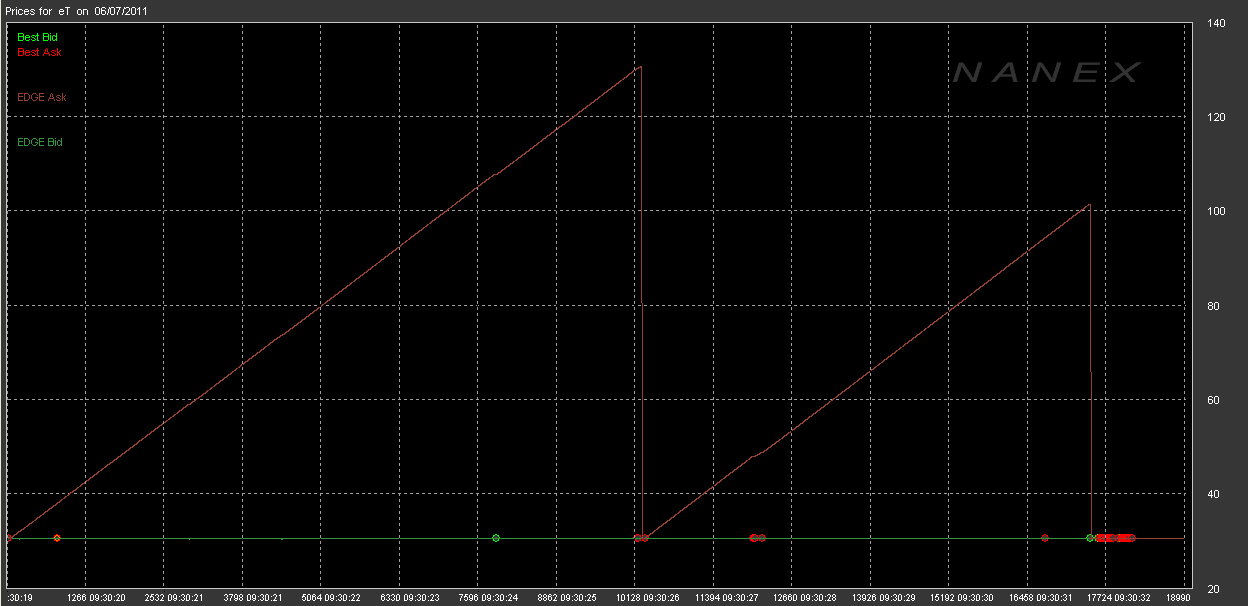

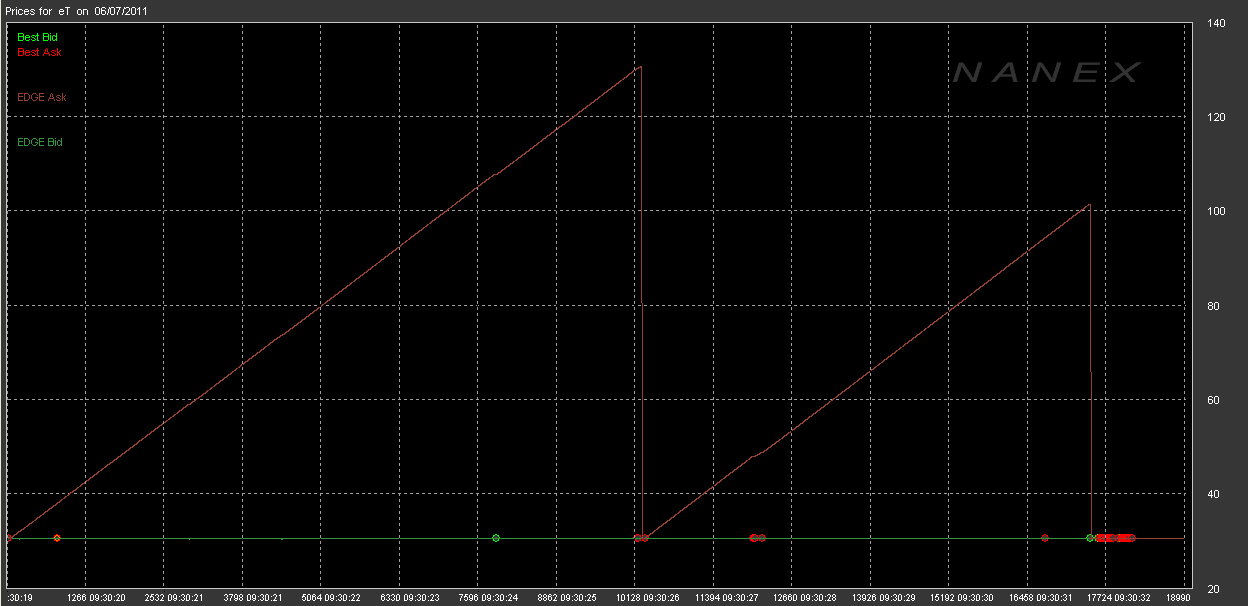

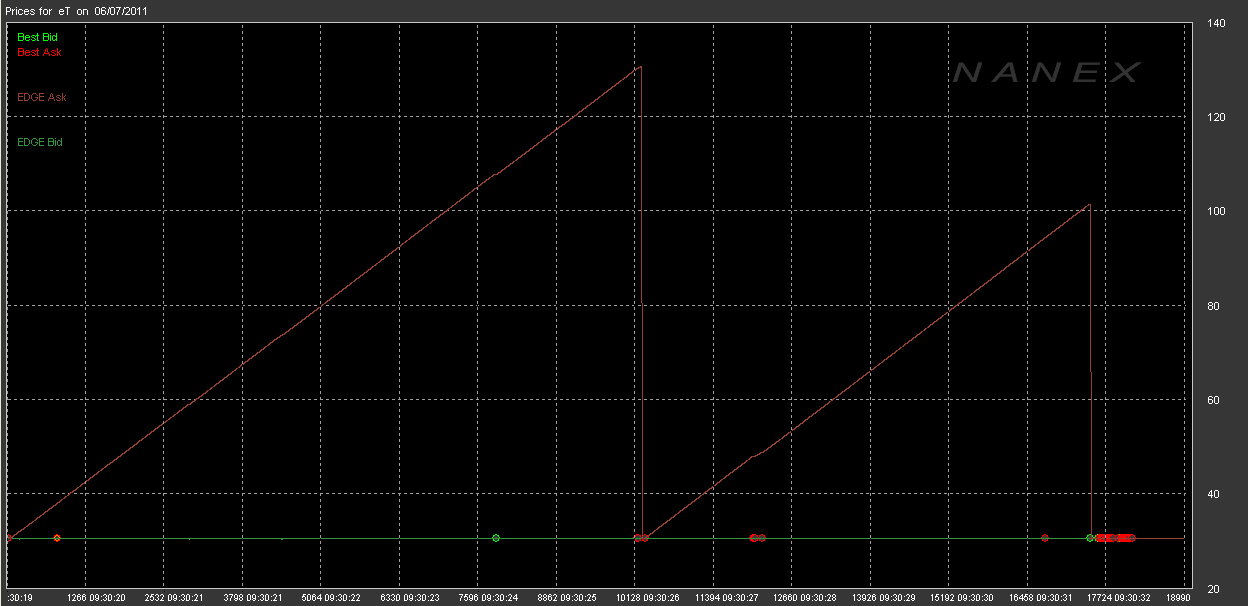

On June 7'th, 2011, in AT&T's stock (symbol T), a quoting algorithm

originating from the EDGE exchange blasted over 10,000 quotes during a 6 second

period which moved the ask price from $30.50 to $130.48 and then without

warning, it dropped right back to the $30 range. It must have been beneficial

to someone, because they repeated the procedure again; only this time taking

the price to just over $100. This second move rules out our first thought that

the person responsible for this wild quoting was another victim of the

fat-finger epidemic that is apparently sweeping through the trading

industry.

This was not hard to find. Dozens of examples of this behaviour can be found

every day.

Question for the SEC: According to

this, we

should not find stub quoting behaviour occurring after December 2010. Here's

our condensed understanding of the new stub quote rules:

- For securities subject to the circuit breaker pilot program approved this

past summer, market makers must enter quotes that are not more than 8% away

from the NBBO.

- For the periods near the opening and closing where the circuit breakers

are not applicable, that is before 9:45 a.m. and after 3:35 p.m., market makers

in these securities must enter quotes no further than 20% away from the NBBO.

- For exchange-listed equities that are not included in the circuit breaker

pilot program, market makers must enter quotes that are no more than 30% away

from the NBBO.

- In each of these cases, a market maker's quote will be allowed to

"drift" an additional 1.5% away from the NBBO before a new quote

within the applicable band must be entered.

So in the case of AT&T, let's see which rules should apply:

According to this site, all

members of the Russell 1000 are in the circuit breaker program. This

site

tells us AT&T is in the Russell 1000.

However, this particular example occurred near the open, when circuit breakers

are not applicable. In this case, quotes must be no further away than 20% away

from the NBBO. 20% above the prevailing best ask price of $30.50 is $36.60, so

we should not see ask prices above $36.60.

The ask price of $130.48 was just 328% over the NBBO. The ask price of $100 --

a mere 228% over the NBBO.

In the following chart, trades and quotes are plotted sequentially as they

occur. As such, no data is lost. Exchange's bid and ask prices are colored

according to the legend on the left. When quotes are the NBBO, a red circle is

drawn for the Best Ask, and a Green circle for the Best Bid.

|

T - AT&T

Quote Prices:

As there were over 10,000 EDGE quotes in the first sequence (first run up),

and over 17,000 EDGE quotes in the second sequence (second run up), we will

only show a snippet of the time and sales prints. EDGE ask prices have been

shaded in light orange and the Best Ask has been shaded in light blue.

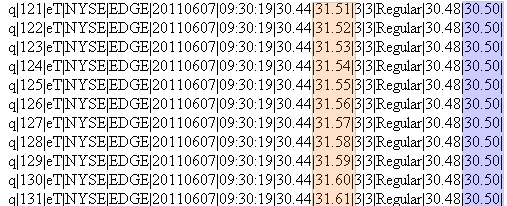

Quotes #121 through #131, the ask price begins to rise:

;ts|q|Index|Symbol|Listed Exg|Reporting Exg|Date|Exg Time|Bid|Ask|Bid Size|Ask Size|Quote Condition|Best Bid|Best Ask|

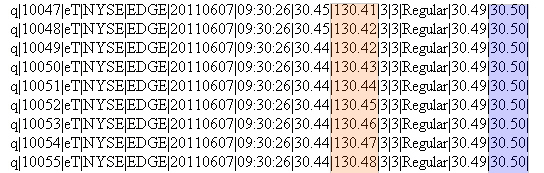

Quotes #10,047 through #10,055, the ask price continues to rise and is now over

$130.00:

;ts|q|Index|Symbol|Listed Exg|Reporting Exg|Date|Exg Time|Bid|Ask|Bid Size|Ask Size|Quote Condition|Best Bid|Best Ask|

|

|

Inquiries: pr@nanex.net

Publication Date: 06/08/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|