Strange Days July 28, 2011 - RTSA Illustrates the Illusion of

Liquidity

|

Back to

Table Of Contents

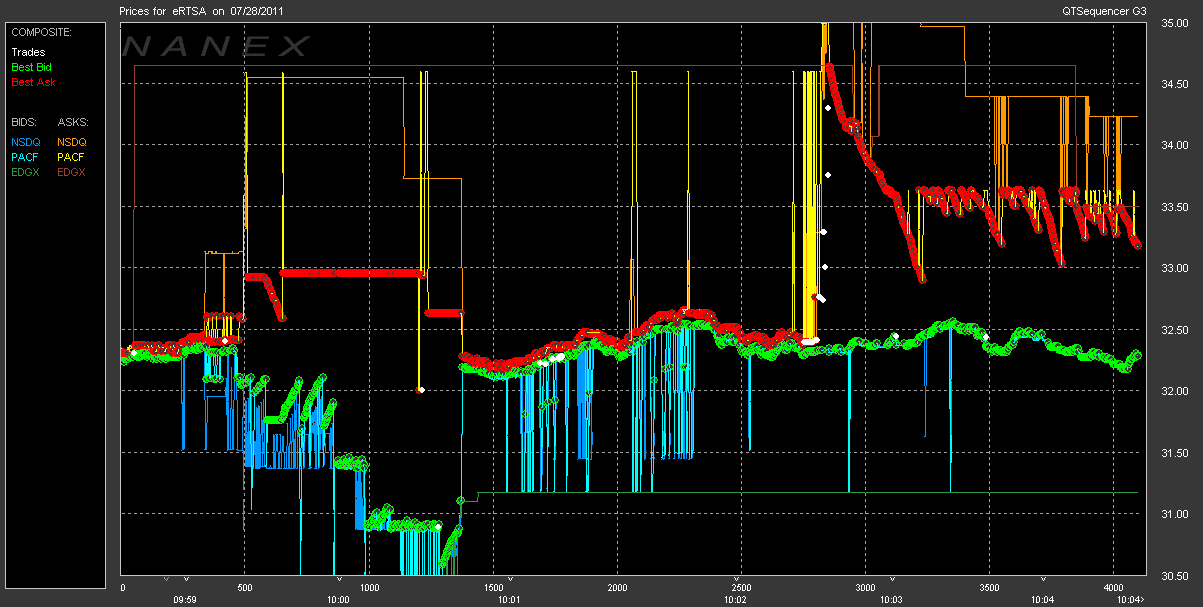

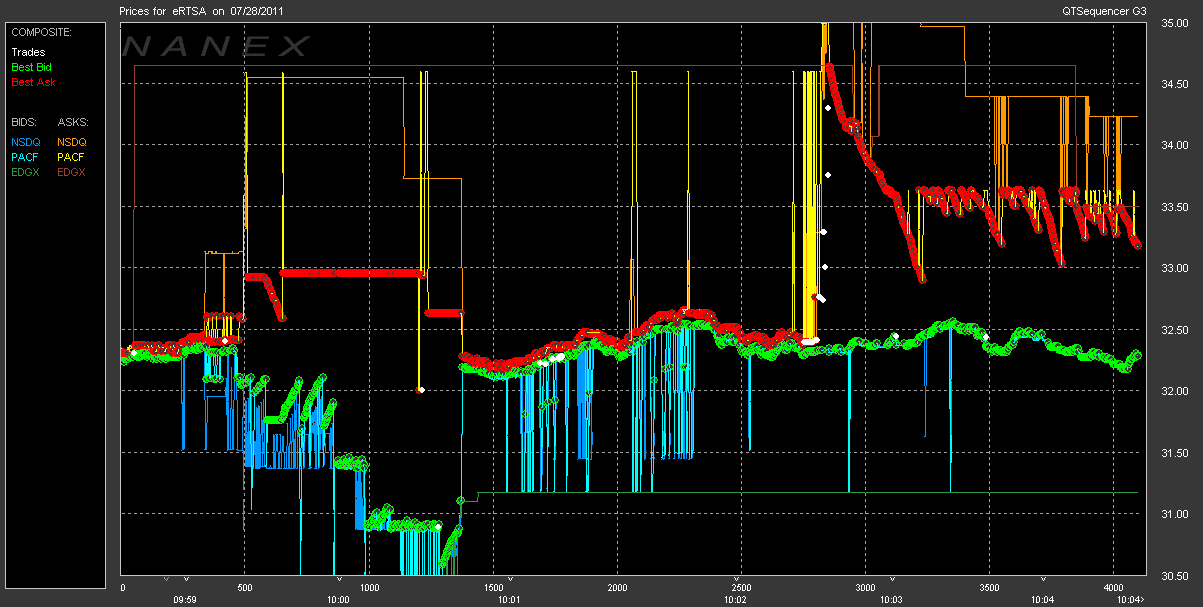

On July 28th the ETF iPath Short Extended Russell 2000 (symbol

RTSA) nicely illustrates quote price instability, or how the NBBO represents the

Illusion of Liquidity. This is the new normal. It is also what a broken

market looks like.

Every study we have read that looks at bid/ask spreads, uses a methodology that would

conclude the spread for RTSA averages around 5 cents. The reason for this, is that

they simple focus on averages over the trading day. For many stocks, when there

is low trading activity, the spreads are indeed tight. But the moment that HFT systems

detect an impending order, the tight spreads evaporate, often at the speed of light.

Just look how quickly the spread goes from about 5 cents to over $1 when

trades appear.

In some cases, just a few hundred shares will cause the spread to collapse and volatility

to explode.

Then again, as we have

already pointed out, no one uses the NBBO anyway.

|

Chart 1 Showing the NBBO, trade and trade volume.

Chart 2 Includes bid and ask prices for each market center.

Legend:

Shade indicates National Best Bid and Offer Spread.

Semi-circles indicate trades.

Trade volume shown in lower panel.

Triangles represent bid (up) and ask (down) prices from each market center. (Chart 2 only)

Chart 3 Sequential Chart of Quotes and Trades

|

Inquiries: pr@nanex.net

Publication Date: 07/28/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|