Strange Days - Citigroup Split and Dead Robots

|

Back to

Table Of Contents

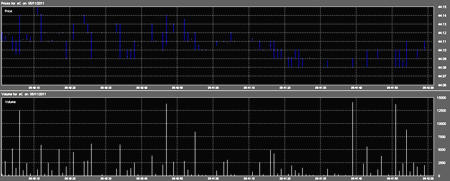

Trade/Quoting Activity:

We chose two random days for Citigroup and looked at a detailed 2 minute time

slice on each day to compare the differences in trading/quoting activity

previous to the 10-1 split and after the 10-1 split. Click on any chart for a

high resolution image.

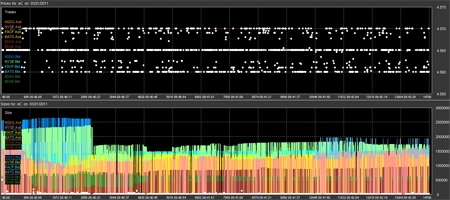

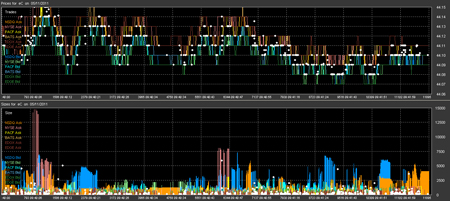

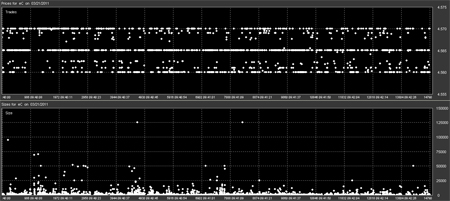

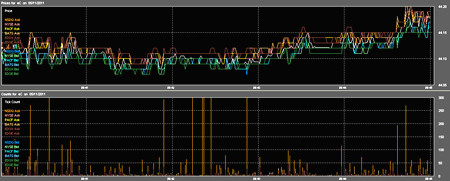

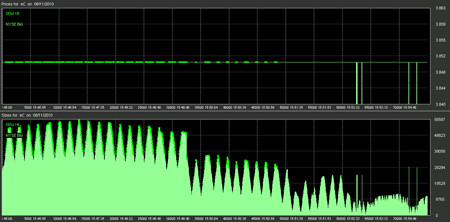

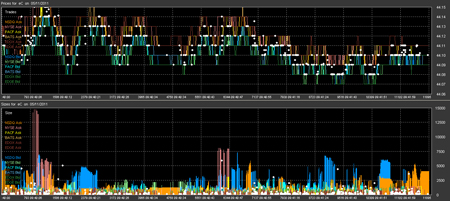

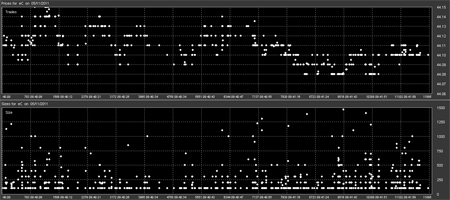

Quote and Trade Price and Size (note the extreme difference in quote sizes).

Trades and Quotes are plotted sequentially as they occur.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

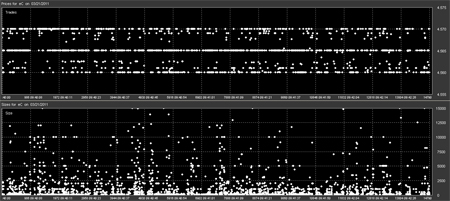

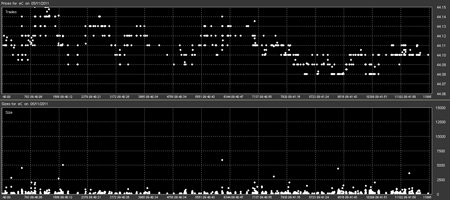

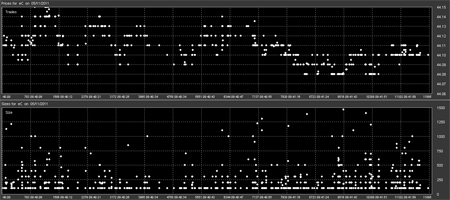

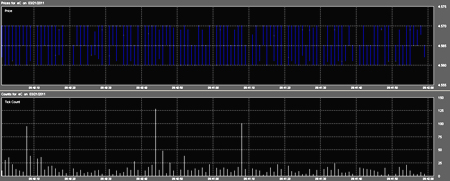

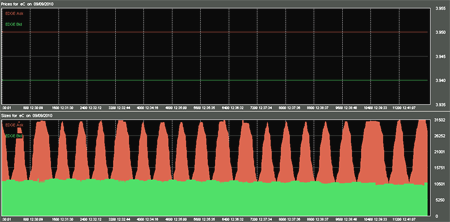

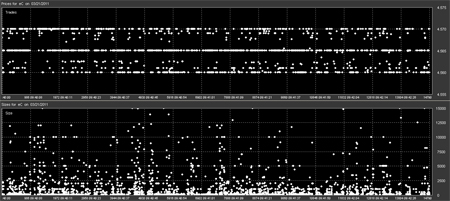

Trade Price and Size. Size is scaled to the same amounts pre and post split.

Trades are plotted sequentially as they occur.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

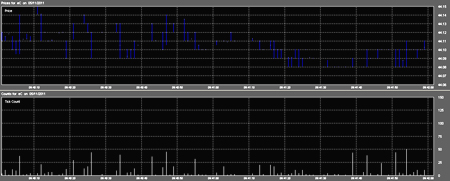

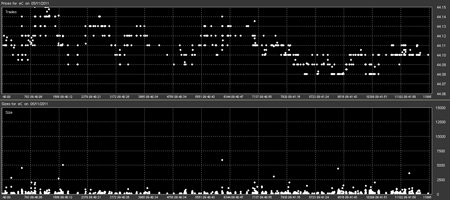

Trade Price and Size. Size is scaled by a factor of 10 (as this was a 10-1

split). Trades are plotted sequentially as they occur.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

Quote Counts per second.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

Quote Counts per second (5 second view).

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

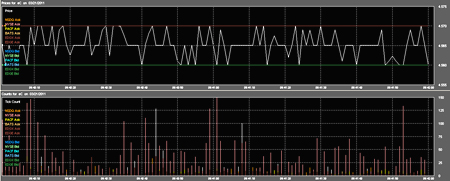

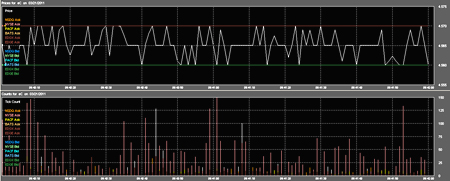

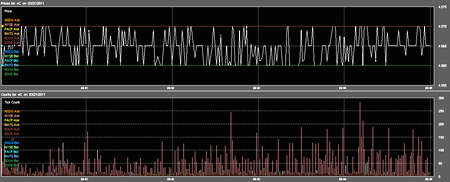

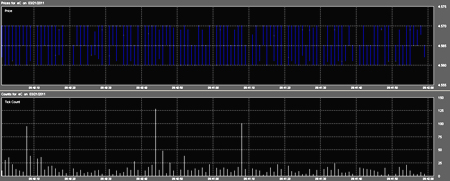

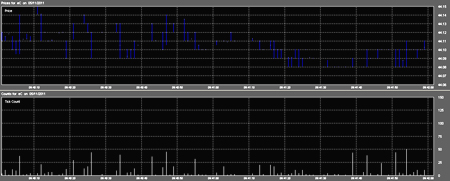

Price and Tick Counts per second.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

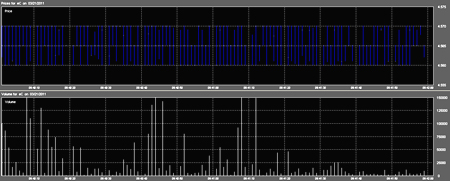

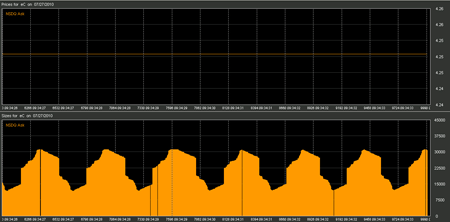

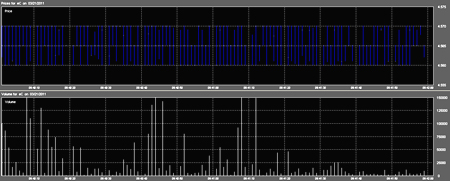

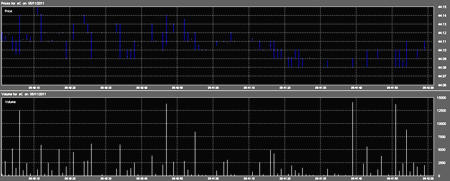

Price and Volume (scaled according to split factor of 10) per second.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

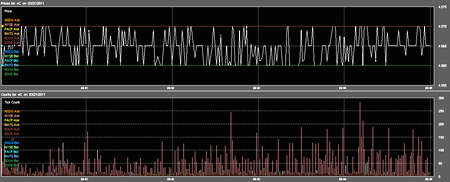

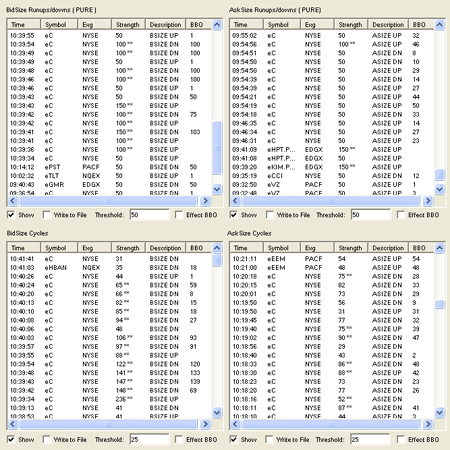

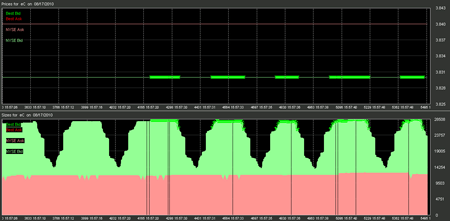

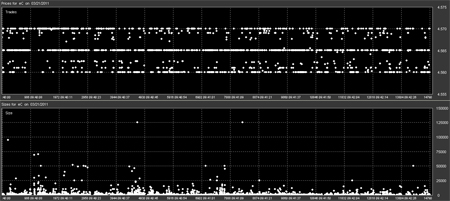

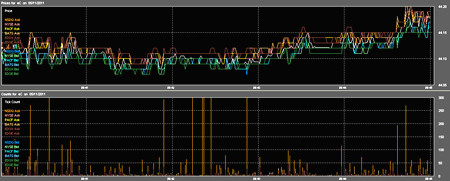

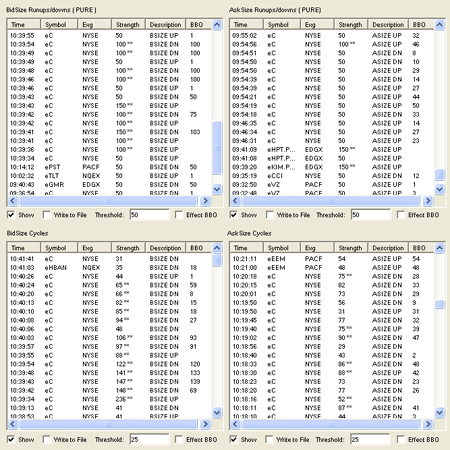

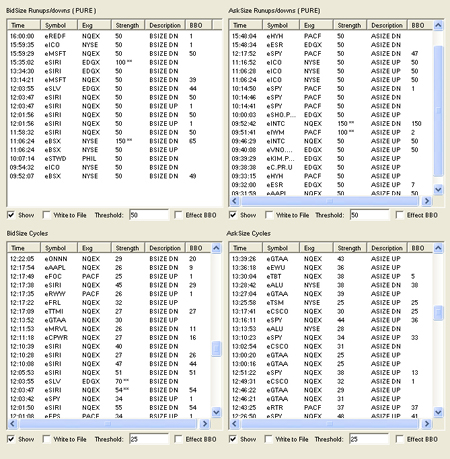

Dead Robots

It was common to see Citigroup ("eC") in our simple size algo filters

everyday, all day. These were usually low grade repeaters (such as the algo

images below demonstrate) that ran at fairly low to moderate quote rates. We no

longer see any from Citigroup.

| 03/21/2011 - Pre Split |

05/11/2011 - Post Split |

|

|

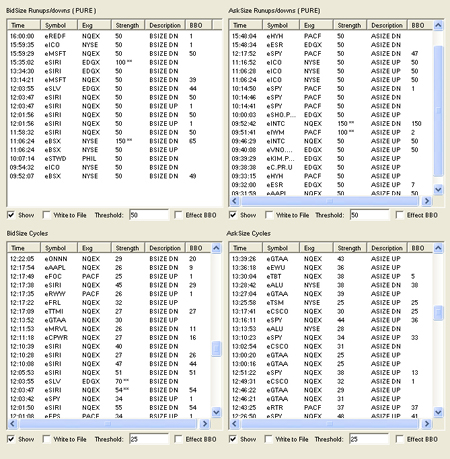

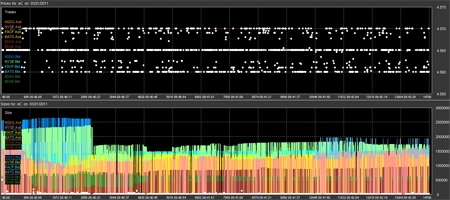

Some of the most fascinating size algos could be found in Citigroup prior to

the split.

(from Nanex's Crop Circle of the Day archive)

|

Inquiries: pr@nanex.net

Publication Date: 05/12/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|