Nanex Research

Nanex ~ Crude Oil Liquidity Evaporation

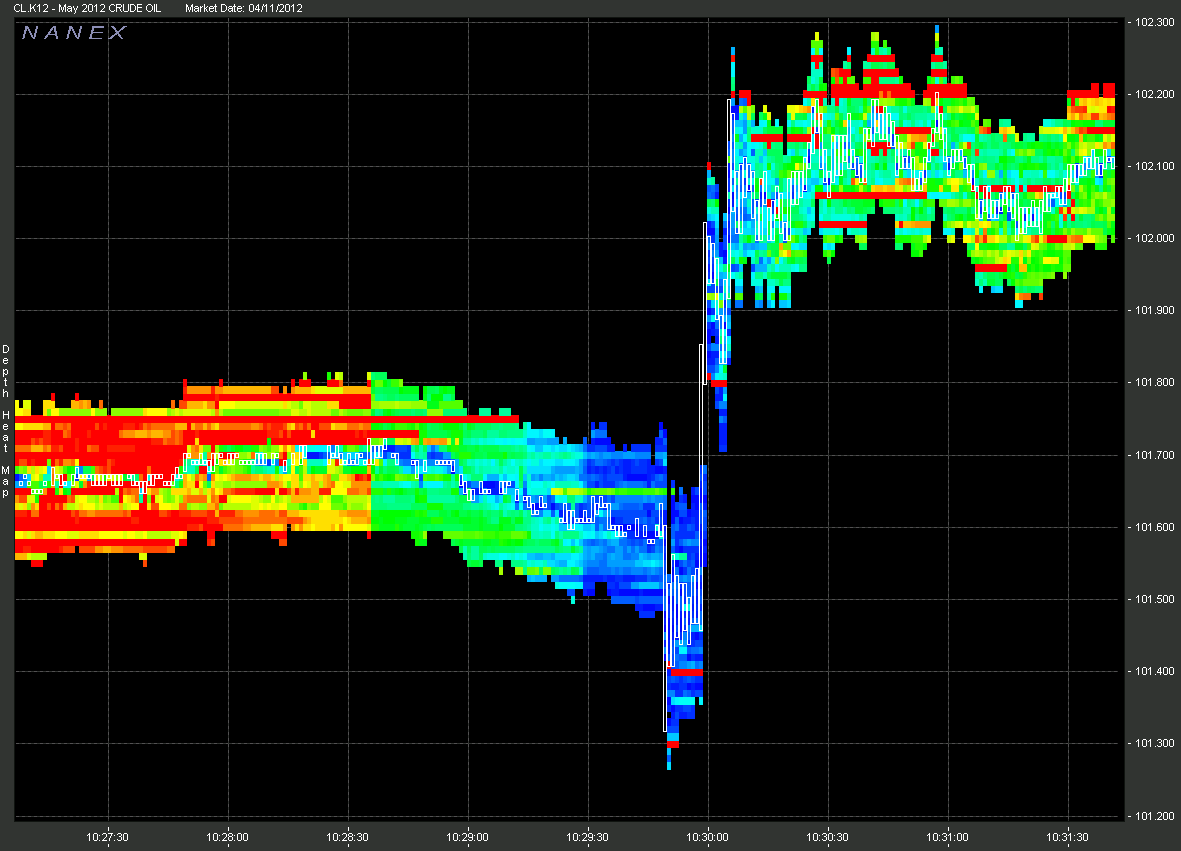

April 11, 2012 ~ CL.K12 (May 2012 Crude Oil Futures) Depth of Book Liquidity

Evaporation Ahead of News.

See also this example in the S&P 500 futures.

The chart below shows last sale and 10 depth of book bid levels and offer levels for

the May 2012 Crude Oil Futures.

Levels are color coded by how many contracts are at that price. Higher sizes (more

liquidity) are colored towards the red end of the spectrum, while lower sizes (less

liqudity) are colored towards the violet end of the spectrum.

Note

the evaporation of liquidity (loss of size) during the minute before 10:30 am, when a

scheduled market moving news event took place (the EIA Petroleum Status Report).

When there are fewer contracts in the book, there is less liquidity, and the market

can move substantially on much lower volume.

Also note how the market actually spiked down about 10 seconds before the news release.