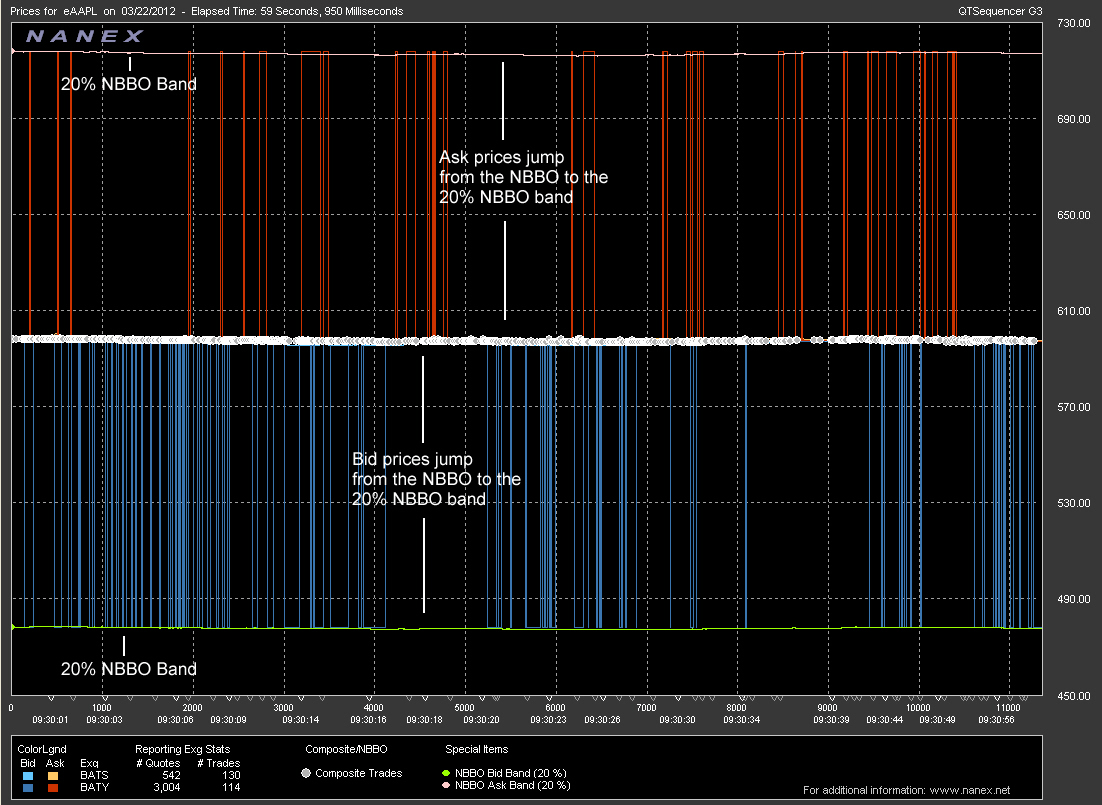

The following chart is of Apple (AAPL) on 03/22/2012, one day prior

to a quote/trade (executed on the BATS-Y exchange)

halting trading in AAPL.

While the bad trade on 03/23/2012 may have been a random event, the

chart below shows that BATS-Y was consistently quoting 20% away from the NBBO

the day prior (during the time frame shown).

For those of you unfamiliar with the SEC stub quote rule (particularly the NBBO

quote banding guidelines), a good refresher can be found here

The

Legal Limit Algo. Clarifying this further, only market makers are subjected

to the rule (the rule has loopholes the size of the sun) and an exchange is not

a market maker.

The quotes shown below are within the NBBO banding boundaries for AAPL during

the first 15 minutes of trading (20%), so there is no rule being broken.

However, quoting far outside the NBBO range is quite common and it is

surprising to see reports of the AAPL halt being a one time error that can't

happen again. With quoting like this, what's surprising is that is does not

happen every single day!

In the chart below, the red lines represent ask prices from the BATS-Y exchange

and the blue lines represent bid prices from the BATS-Y exchange. Note the

prices jumping from the NBBO (were trading is occurring, represented by white

dots) to 20% away from that level and then back. The 20% NBBO banding range is

shown as a pink line for the ask side and a green line for the bid side.

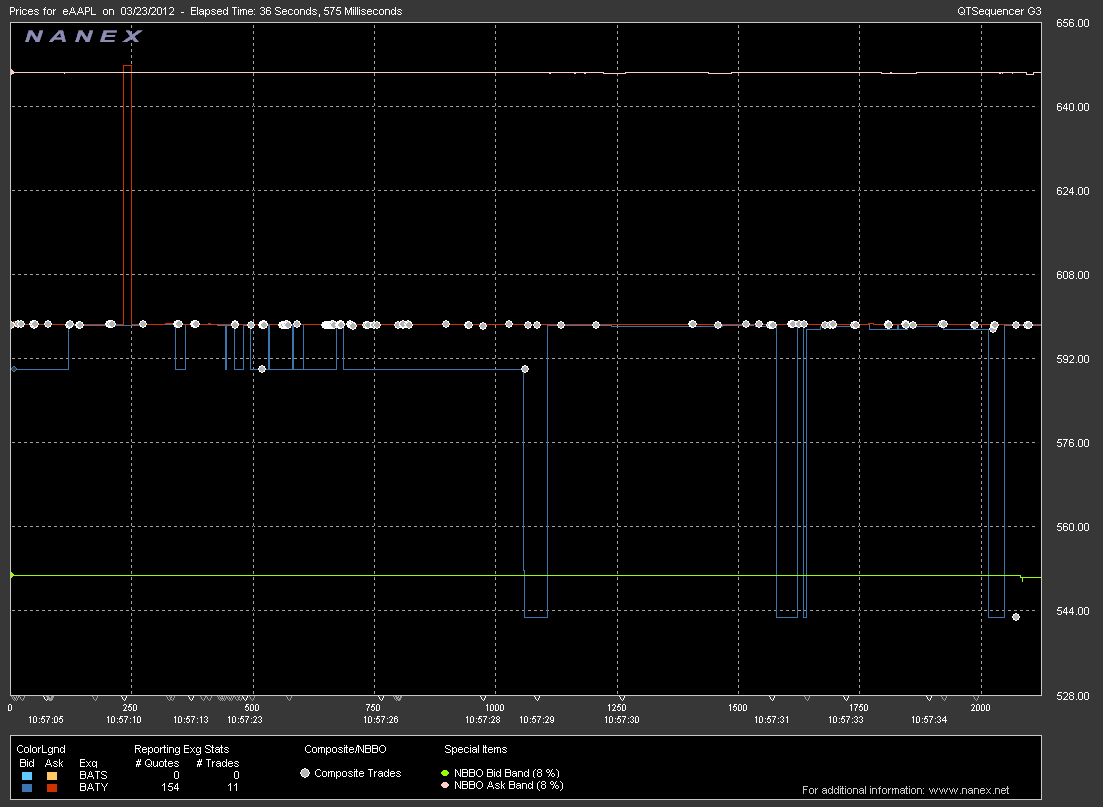

After the first 15 minutes of trading, the NBBO banding parameter shrinks to 8%. As the AAPL trade on 03/23/2012 took place at approx 10:57:37, the 8% banding range would have been in effect. Looking at AAPL on 03/23/2012 we can see quoting on BATS-Y fell just below that range and a trade executed on it:

To say this type of quoting (at the far outside of the NBBO banding range) is a mystery or a one time error is troublesome, since these quotes are generated frequently on a daily basis, and frequently on the BATS-Y exchange. While the AAPL event may have been isolated to a technical glitch, with quoting practices such as these the "glitch" is only doomed to repeat itself.