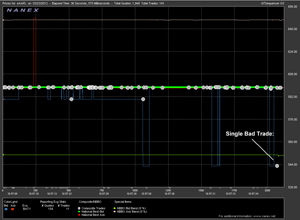

How the BATS Market Maker Quoter halted AAPL Trading on March 23, 2012.

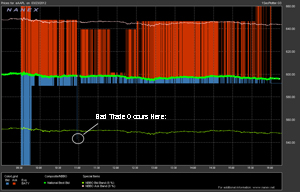

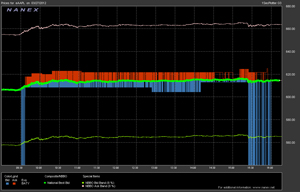

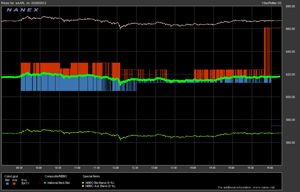

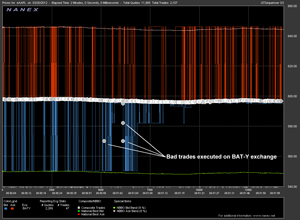

BATS has stated that this "bad quote/trade" in AAPL was related to the same system error that caused their own IPO to be obliterated that same day in just 900 milliseconds. We decided to look at the quoting patterns for AAPL on the BAT-Y exchange for three full weeks prior to the AAPL event of 03/23/2012. What we found was that quoting far away from the NBBO was frequent and common on the BAT-Y exchange. This is easily explained if the quotes in question are generated by the BATS Market Maker Quoter, the BATS version of an Automatic Market Maker. When one reads the specifications for the BATS Market Maker Quoter, it becomes painfully obvious these quote prices are correct and intentional.

By law, any order (quote) that is placed is intended to be executed on. As that is the case, the only surprise is that this type of event does not happen every single day.

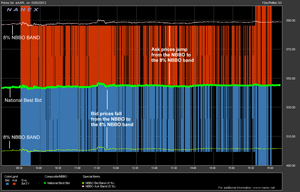

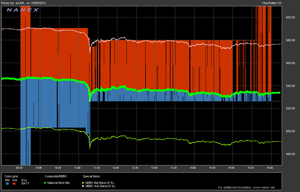

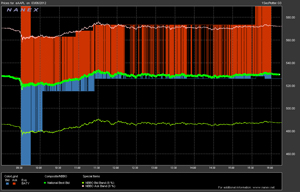

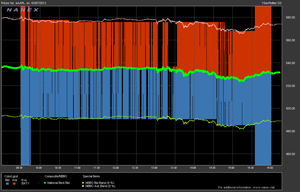

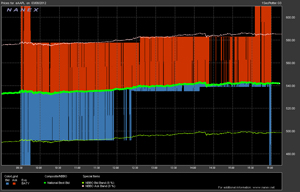

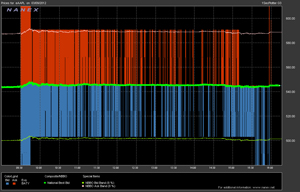

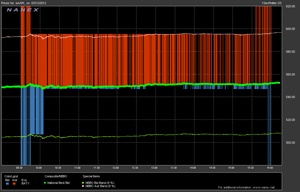

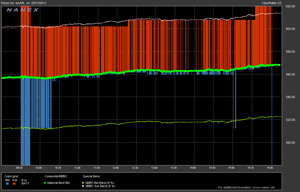

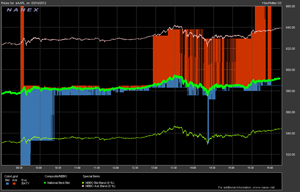

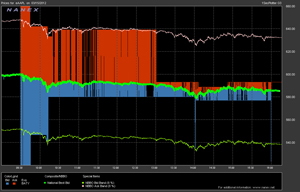

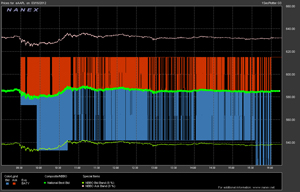

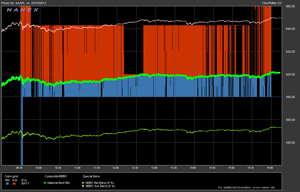

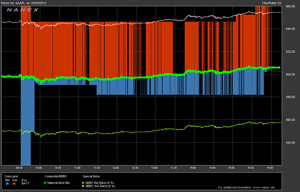

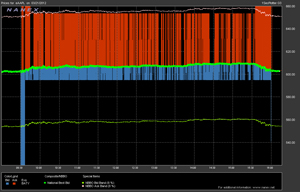

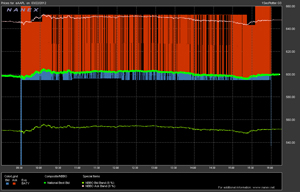

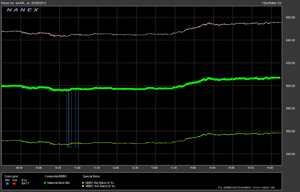

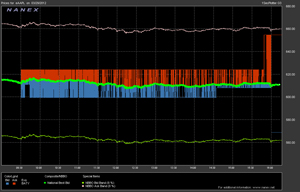

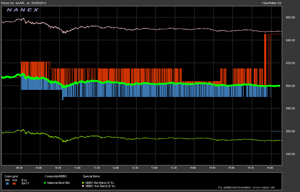

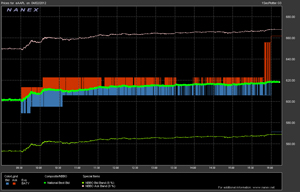

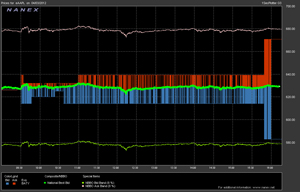

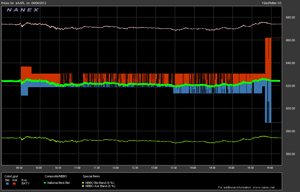

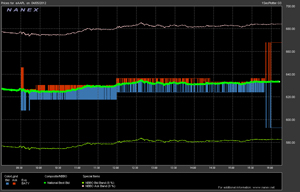

The following charts plot quotes over the course of an entire trading day, in one second increments. For clarity, the charts show only quotes from the BAT-Y exchange, the National best bid and the 8% NBBO bands market maker quotes must adhere to.

The first date of 03/02/2012 is used as a reference chart:

Three weeks of quoting from the BAT-Y exchange prior to the bad trade/halt in AAPL - Click on any chart for a high resolution image: