Nanex Research

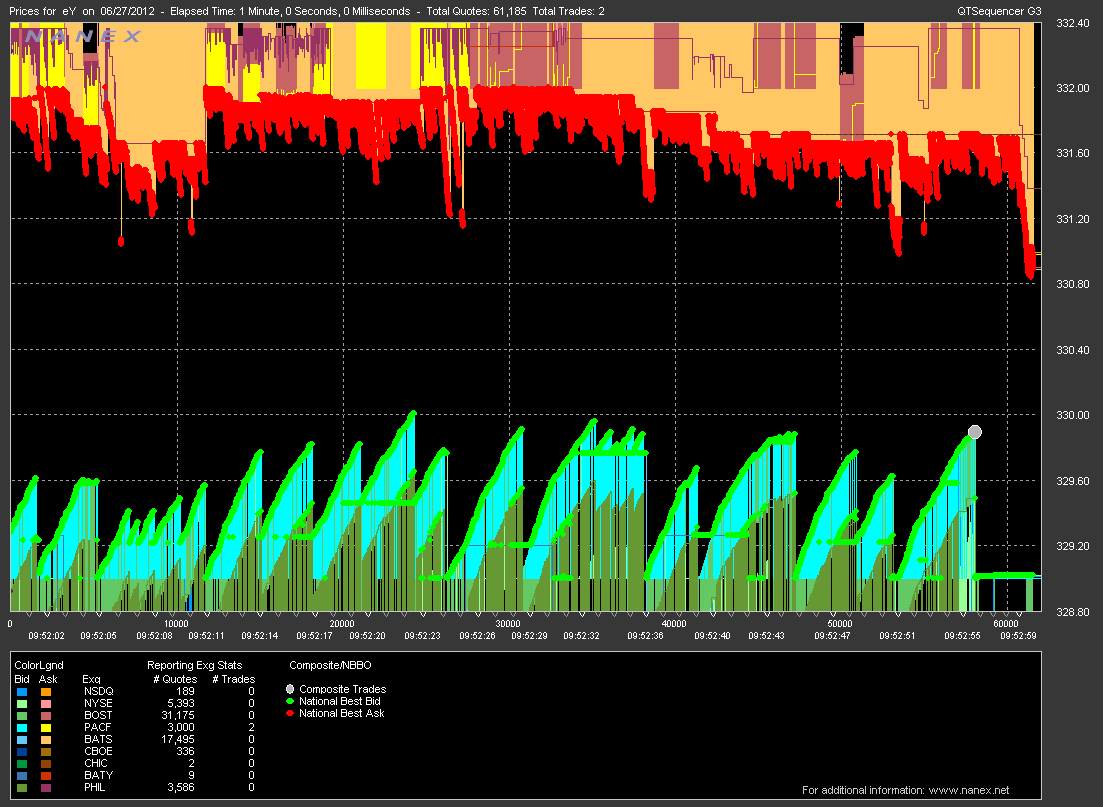

Nanex ~ 27-Jun-2012 ~ Freaking out in Alleghany Corp.(Y)

#HFT caught manipulating the NBBO for profit.

On June 27, 2012 between 9:46 and 9:54 Eastern time, it took a whopping 141,213 quotes

to get 200 shares traded in Alleghany Corp common stock (symbol Y). In contrast, 5 years

ago, it took 35,000 quotes to get 4.5 million shares traded in IBM, and that took place

over the course of an entire trading session.

It wasn't that long ago that a trader was

fined by the SEC because they:

" interfered with the free forces of supply and demand and undermined the

integrity of the NBBO."

and

"repeatedly engaged in a precise pattern of conduct meant to affect the NBBO"

Furthermore, in

similar

SEC case, another trader was fined for using limit orders to move the

public bid or offer quote.

The SEC lectures:

The investing public and other market participants, including broker-dealers

who rely on the integrity of the NBBO, were unaware that the NBBO quotes altered

as result of [traders] orders, reflected not genuine market activity, but the [traders]

coordinated actions.

In both cases, the guilty trader manipulated the NBBO a few times. This borders on comedy,

because this sort of thing happens

all the time, like in Alleghany. And it's not like you could miss this event. There were over 100,000 unnecessary and manipulative quotes during

over a span of 8 minutes (or in exchange-speak, 480,000,000 microseconds).

Guess it depends on who you

are or who you know.

One beneficiary of having so many multiple NBBO prices, are internalizers that internally

match customer orders. They fill these orders based on the NBBO during a 1 second interval.

Having many NBBO prices to choose from can be handy.

A link showing an example of this.

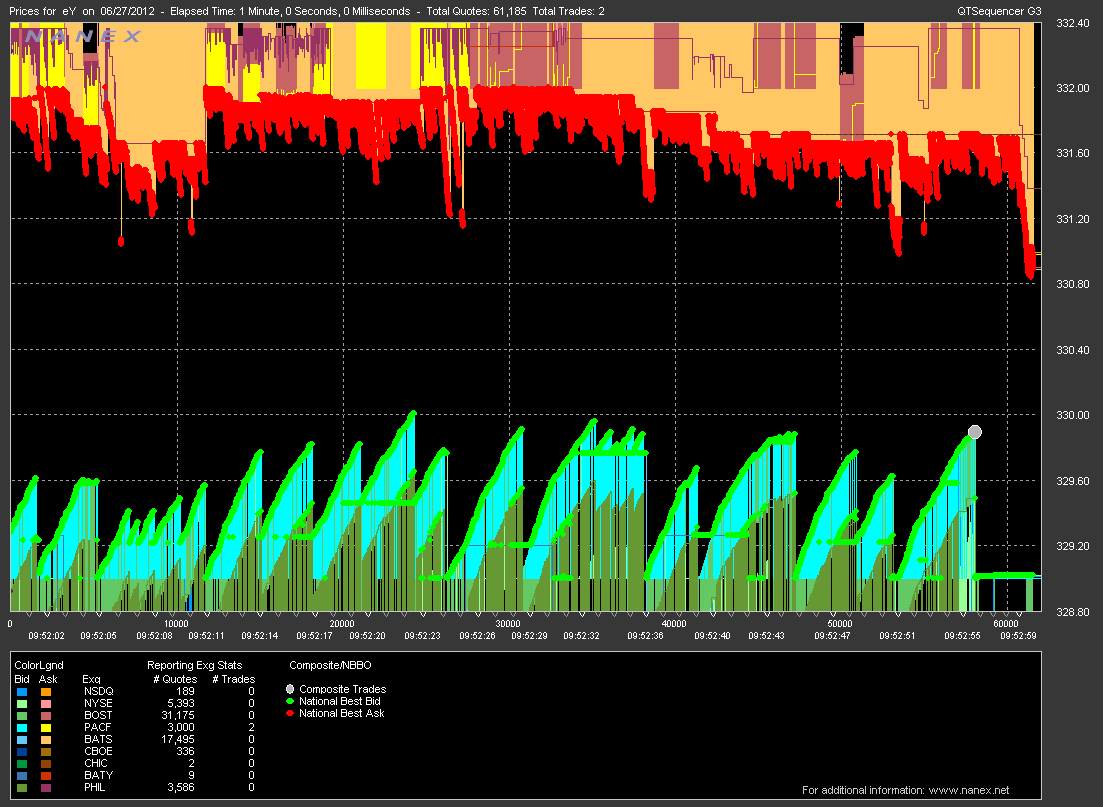

Let's look at some charts showing NBBO manipulation in Alleghany.

First, the trade.

1 second interval chart showing NBBO and trades color coded by exchange (both overlap

and show up as the red dot).

Now let's look at just the NBBO quotes. Pretty, isn't it?

Now we'll add in the other exchange quotes (the ones that don't set the NBBO,

but are top of book for each exchange).

Let's zoom into this disaster.

Let's zoom even closer.

And finally, a tick chart.

Nanex Research