| Date | Time (EDT) | Update |

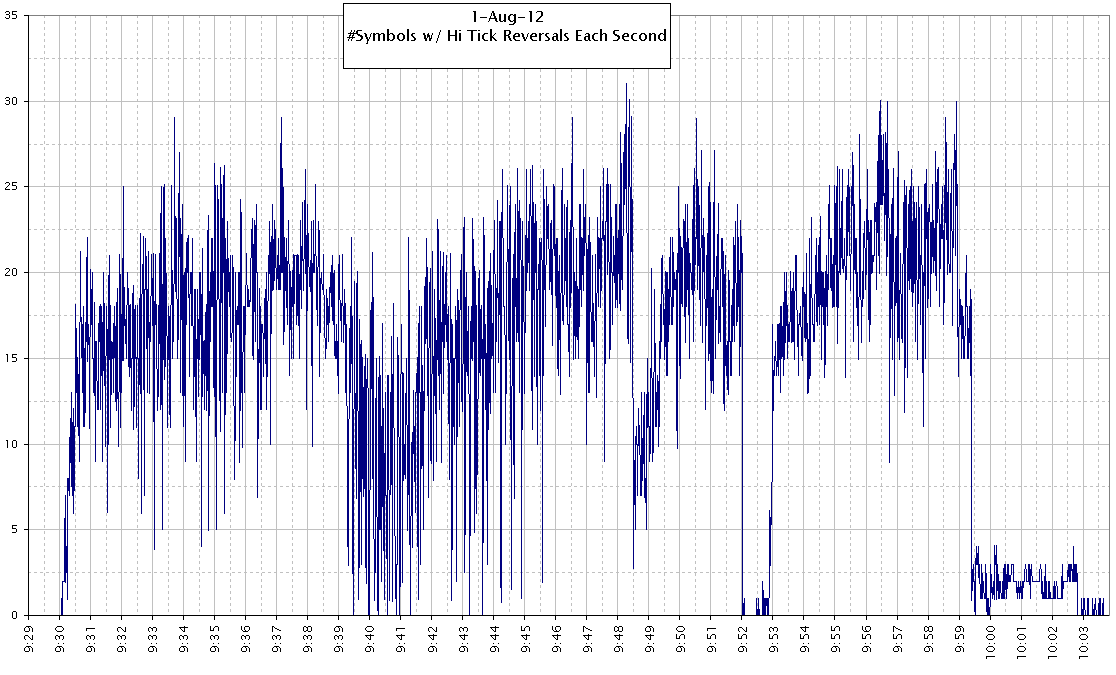

| 03-Aug-2012 | 10:00pm | The Knightmare Explained - why it took so long for them to detect the problem. |

| 07-Aug-2012 | 11:15am | We added 375 New Charts here. |

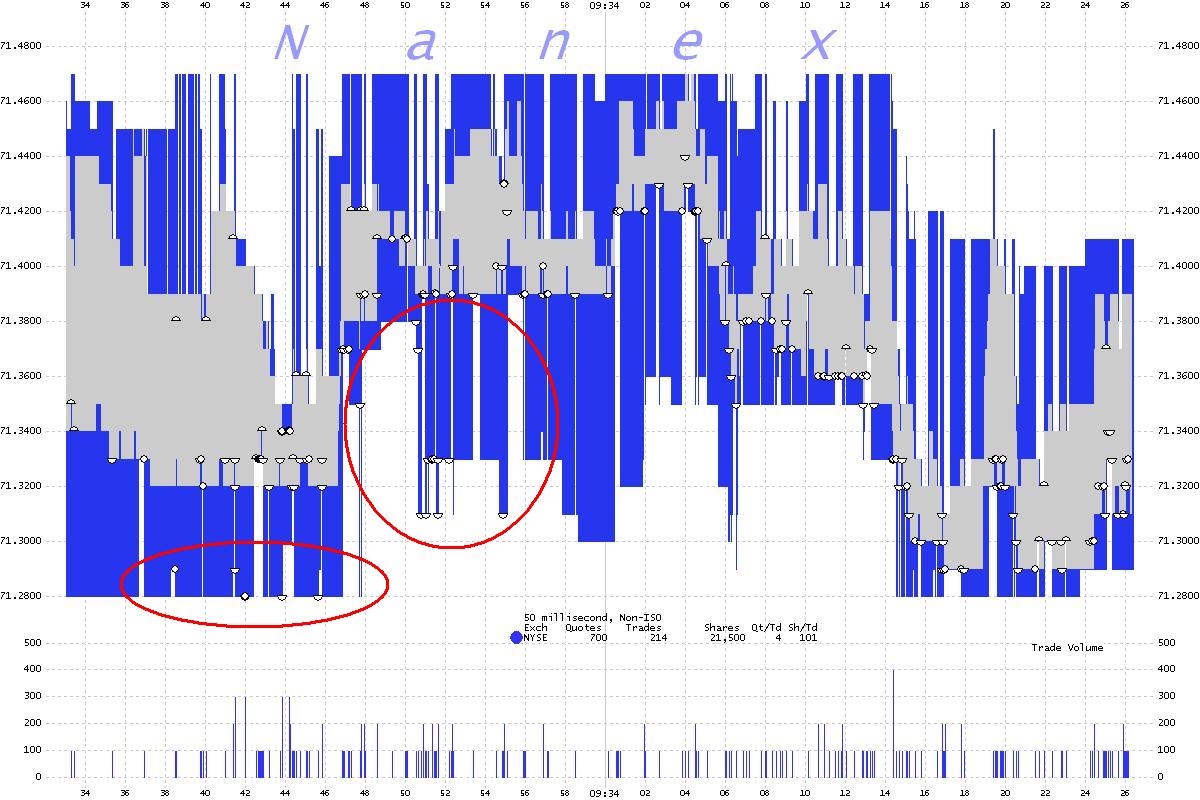

| 08-Aug-2012 | 10:00am | Video of a hot-list quote screen showing the Knight algo in action. |

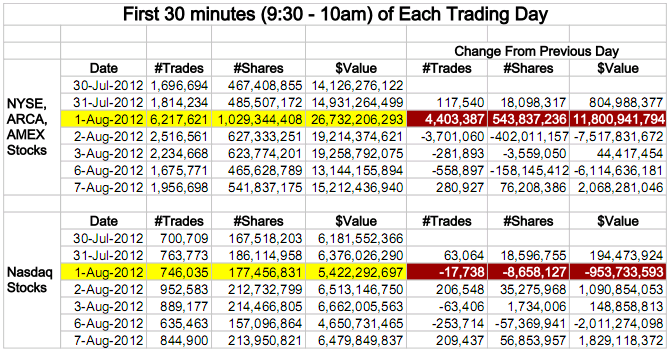

| 09-Aug-2012 | 18:30am | Added table showing Impact of Knight onTrading Volume. |

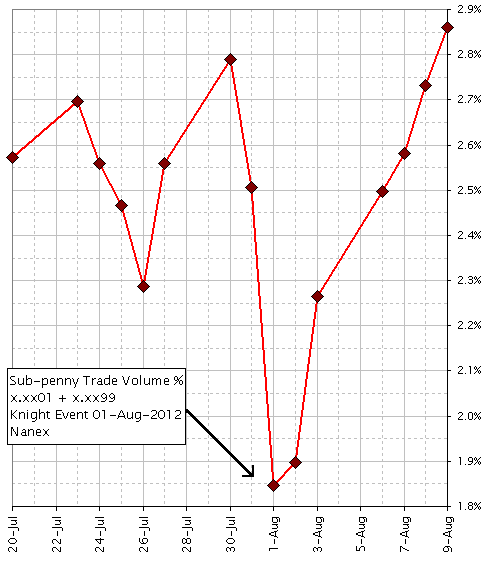

| 10-Aug-2012 | 10:20am | Added chart showing Impact of Knight on Sub-Penny Trading. |

| 13-Aug-2012 | 07:00am | Nanex tweets during this event |

This would explain several unsolved mysteries that we've reported in the past.If this is true, then this firm would not have incurred any trading losses. They would have just ended up painting the tape. With a fire-hose.