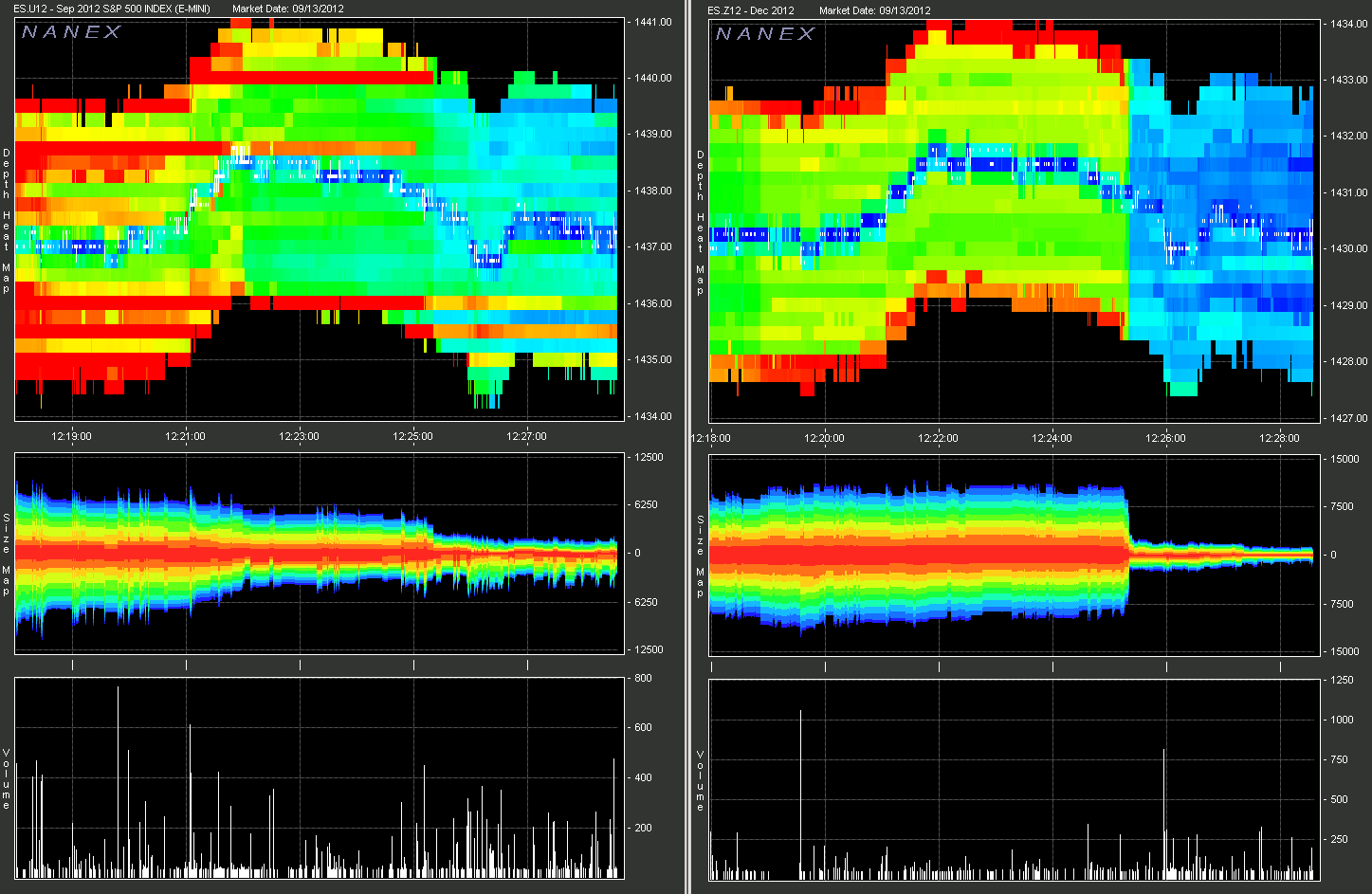

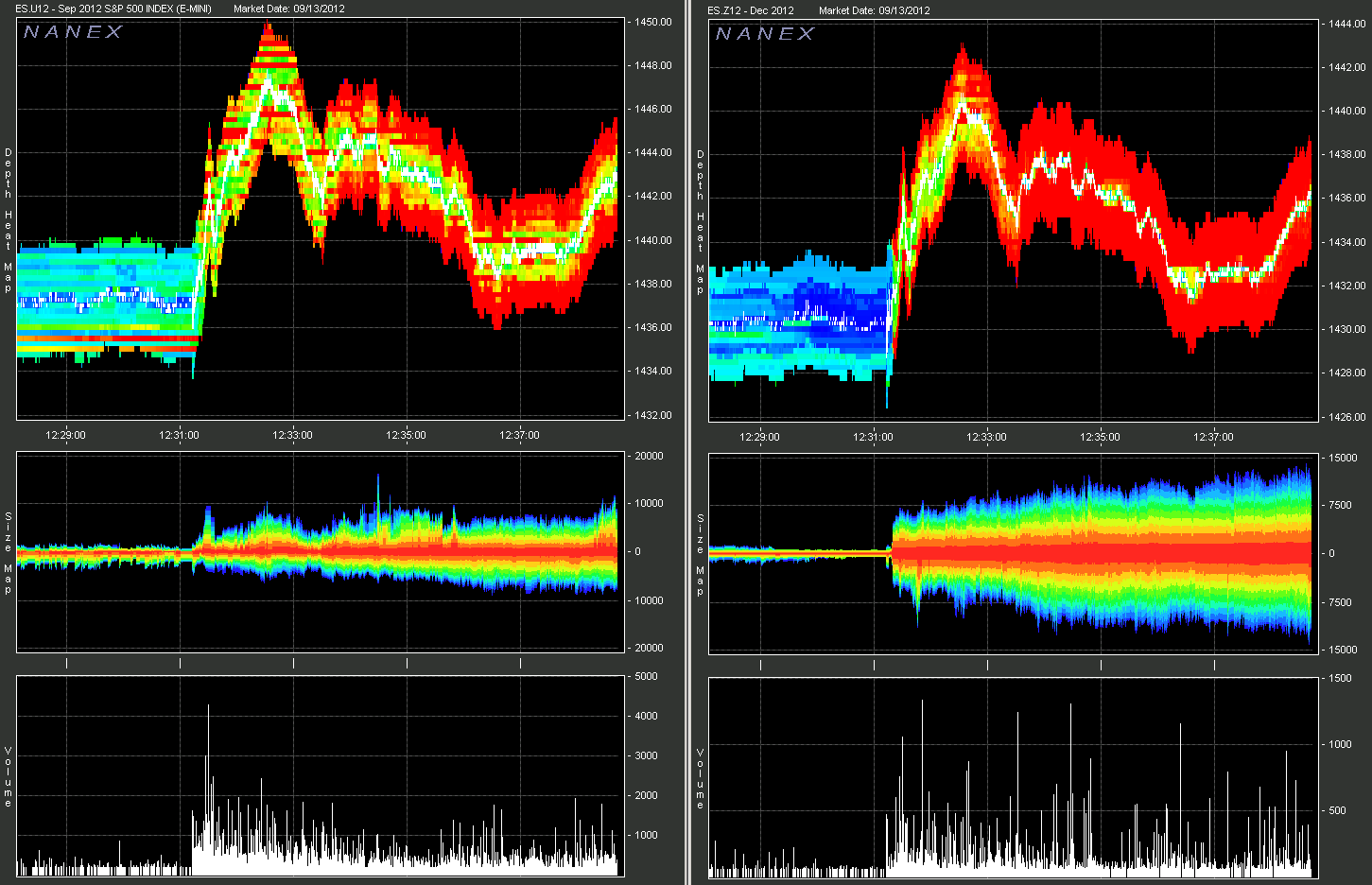

Nanex ~ 13-Sep-2012 ~ SEC Sanctioned Trading in SPYOn September 13, 2012 at 12:31:15, during a very important FOMC Meeting Announcement, the machines took over, and SPY stopped resembling a stock market. The follow charts capture some of that mayhem. Viewer discretion is advised. See also SPY Intentional Bad Tick . |