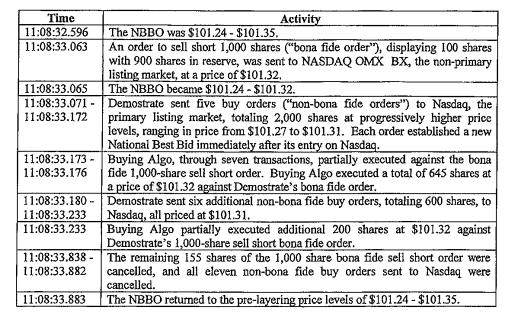

We used the information in the table to search our database of trades and quotes for June 4, 1010 (the date that was indicated in the text) to determine which symbol was involved. Minutes later, the program spit out the symbol GWW which is listed on the NYSE (the table mistakenly states Nasdaq is the listing market).

Then we ran another program which created a few sub-second charts of GWW during this event so that we could get a look at this algo visually. When we first saw the charts, we were stunned, because we have seen this pattern before, and gave it the name "whac-a-mole".

See also: Other manipulation patterns.