Nanex Research

Nanex ~ 02-Oct-2012 ~ New Quote Stuffing Algo

Update: Check out

this animation showing the impact on a millisecond level.

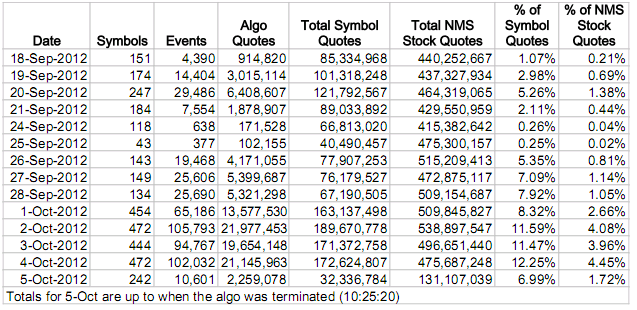

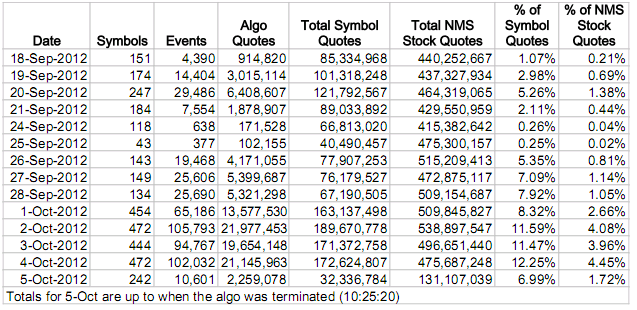

Update: Algo counts for each day it was detected:

On October 1, 2012, we detected a new form of quote stuffing that tries to hide under

the radar. It involves hundreds of stocks and millions of bogus quotes during the trading

day. The algo that generates them is very careful to spread out the stocks targeted

and limits each test to a blast of exactly 200 quotes in 25 milliseconds or less. The

quotes all come from Nasdaq, and sometimes affect the Best Bid or Offer: the only change

appears to be a fluttering of the bid or offer size. Here

is a list of times and stocks affected on October 1, 2012. In the

afternoon, several stocks were affected every second of trading. Over the entire day, this one

algo from one High Frequency Trader accounted for 13.6 million quotes out of 510 million

for all NMS Stocks. And it's just getting started.

We believe that this

algo will continue to grow and if left unchecked, could very well contribute to the

next flash crash because it removes precious network capacity and provides zero economic

value such as price discovery.

1. IDTI 1 second interval chart showing bids and asks color coded by exchange.

You cannot see the quote stuffing in the price panel because only the bid or ask size changes. However, the lower panel shows the quote rate at a constant 200 quotes/sec from Nasdaq

(the vertical black lines). There are 2 groups, one between 10:12 and 10:13, and another

starting after 10:23.

2. IDTI 200 millisecond interval chart showing best bids and best asks color coded by exchange

3. IDTI 25 millisecond interval chart showing best bids and best asks color coded by exchange

From a network capacity point of view, the actual impact is much higher because the

quotes are blasted over short times. This algo effectively hits the network with traffic

equivalent to about 5,000 to 8,000 quotes per second per stock.

Nanex Research

Inquiries: pr@nanex.net