Nanex Research

Nanex ~ 01-Nov-2012 ~ The Denial of Service Algo

Update:

When this algo ran, it effectively shut down trading in that stock:

see charts here.

We found that this algo completely jammed up the consolidated quote when it ran in Nasdaq

stocks. See this animation.

Themis Trading

believes they found what caused the high quote spam traffic. End of Day Final Counts

Algo responsible for:

- 95% of entire days quotes in KEY

- 74% of entire days quotes in the 7 affected symbols.

- Almost 4% of entire days quotes in all 7,813 NMS stocks.

- Averaged 4,120 order cancels per trade.

- In the 6 minutes it ran in KEY, produced the equivalent of 20 trading days worth

of quotes for that stock.

Key Corp (symbol KEY)

On November 1, 2012 starting at 12:33:31 and lasting until 12:39:42, there

were 5.8 million quotes (orders) and only 137 trades. The entire session up to that

time had less than 200,000 quotes and about 12,000 trades. On the day of the flash crash

(May 6, 2010), KEY had 1.8 Million quotes and 127 thousand trades over the entire trading

day! This algo blasted over 3 times as many quotes in 6 minutes as occurred on the most

active trading session ever in KEY.

Bank of America (symbol BAC)

On November 1st, there were 369 seconds where the number of quotes

in BAC exceeded 17,000; a total of 6.6 million quotes. During those seconds, only 1,879

trades executed. Between

market open (9:30am) and 12:45, BAC had 7.8 million quotes and 116,000 trades. Which

means 85% of all BAC quotes occurred in those 369 seconds.

Which means it is likely that one algo from one firm (all of this quote spam is from Nasdaq) is responsible for 85% of all canceled

orders in BAC.

See also this page.

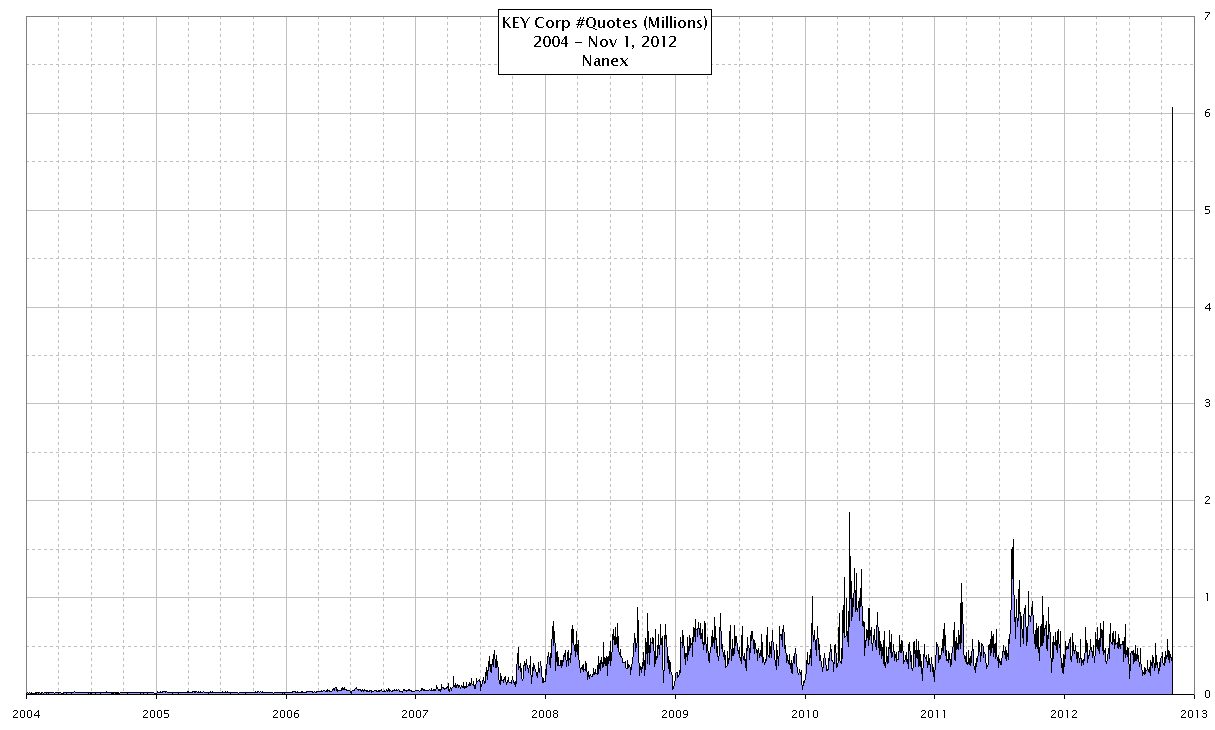

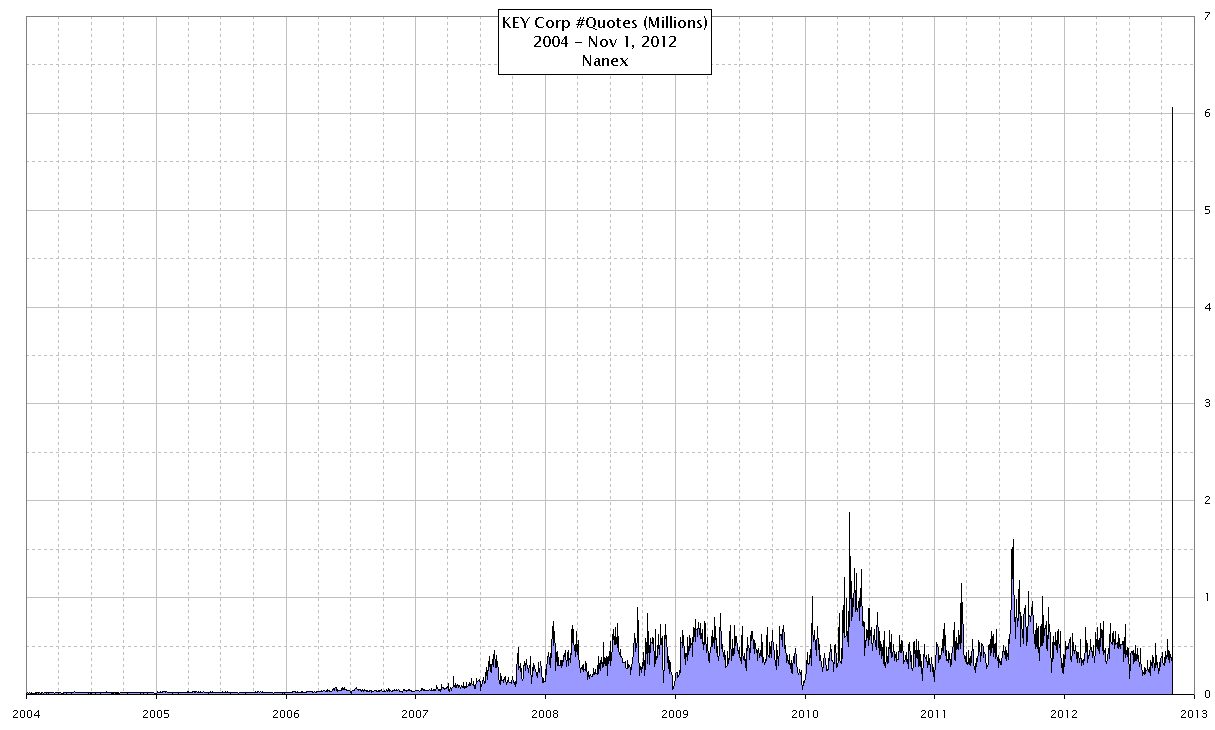

1. KEY - Daily Quote Counts between 2004 and November 1, 2012 (up to 12:45pm)

The spike on the right at 6.1 million is through 12:45pm on November 1st: 5.7

million of those quotes occurred over a span of just 6 minutes, which had only 137 trades.

Compare this to the flash crash, where over the entire day, KEY had 1.8 Million quotes

and 127 thousand trades.

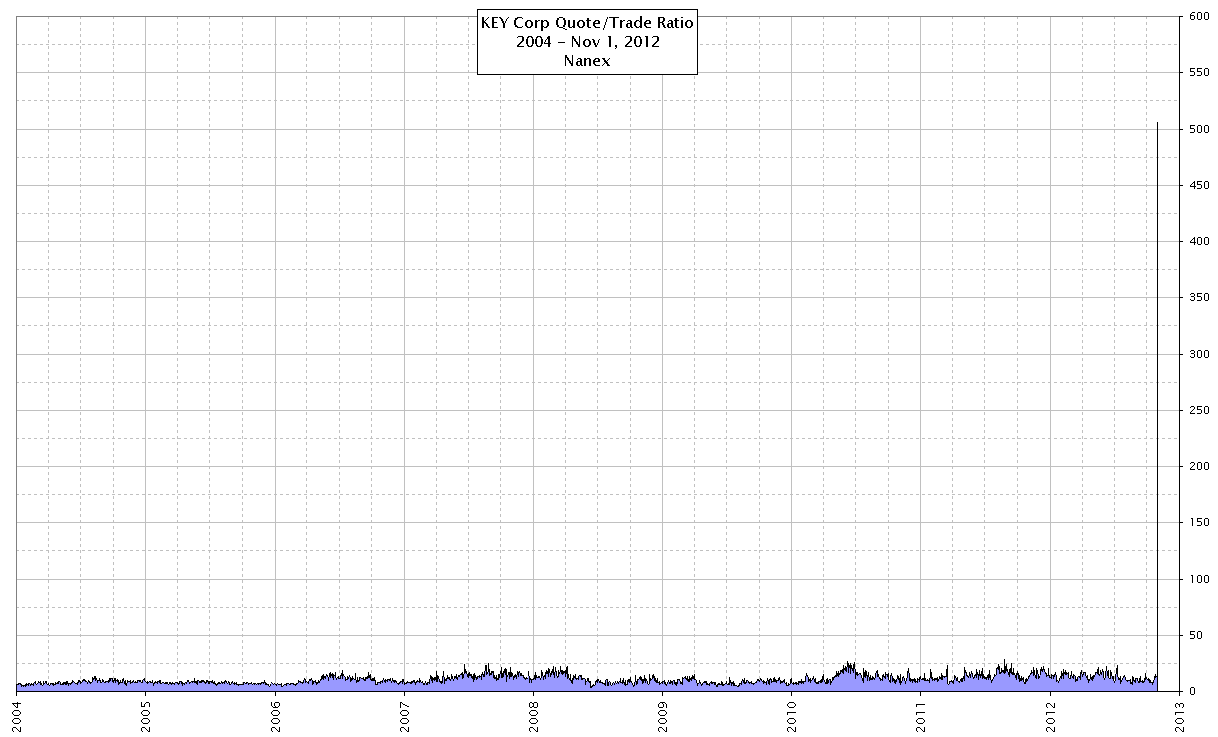

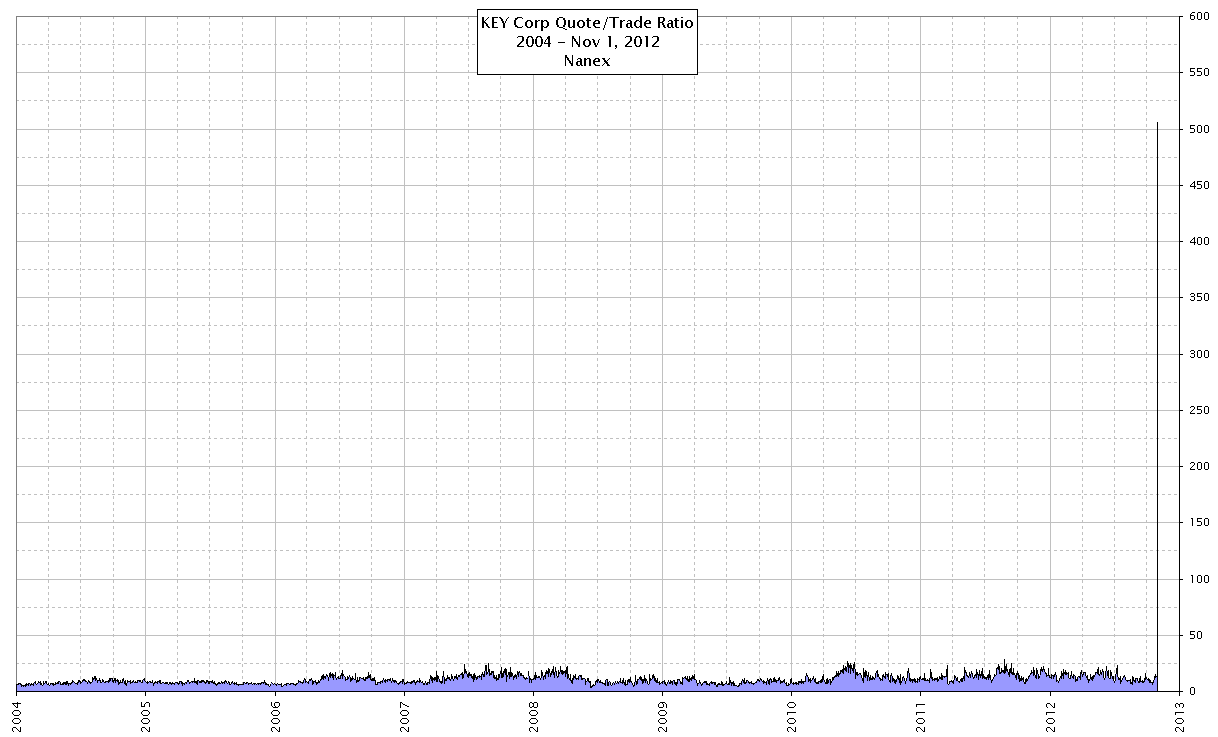

2. KEY - Daily Quote to Trade Ratio between 2004 and November 1, 2012 (up to 12:45pm)

The spike on the right at 505 is through 12:45pm on November 1st: over 20 times higher than normal.

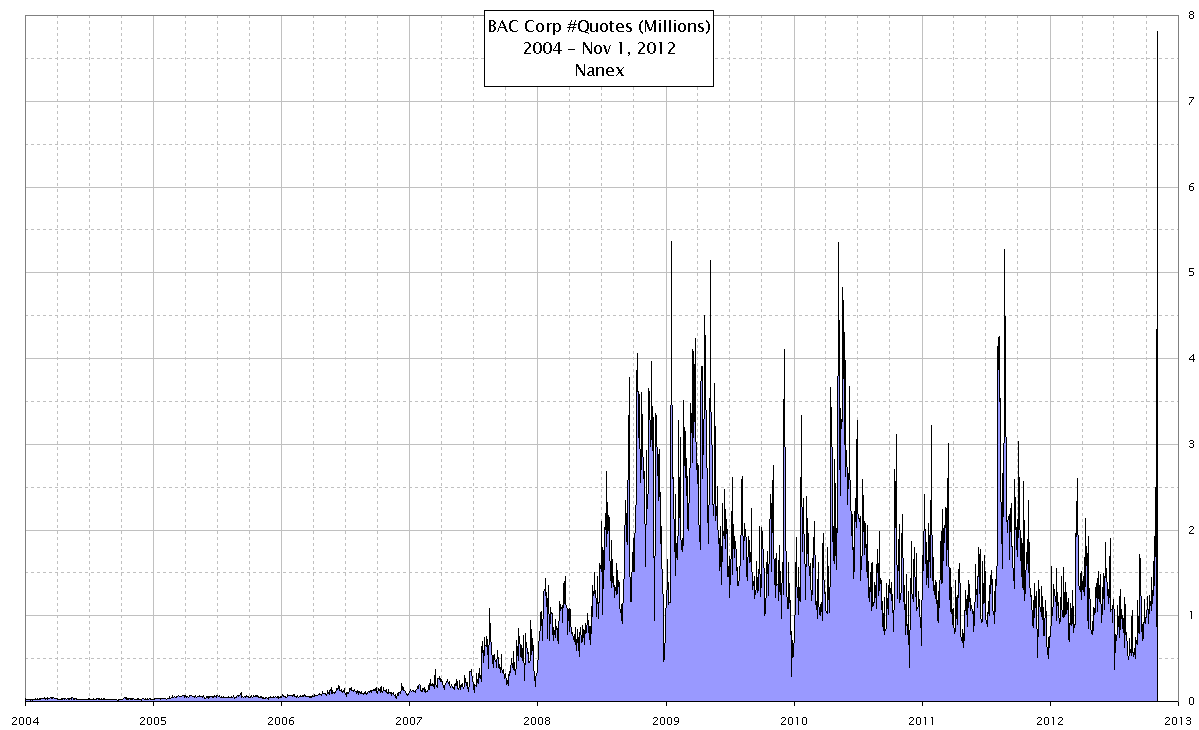

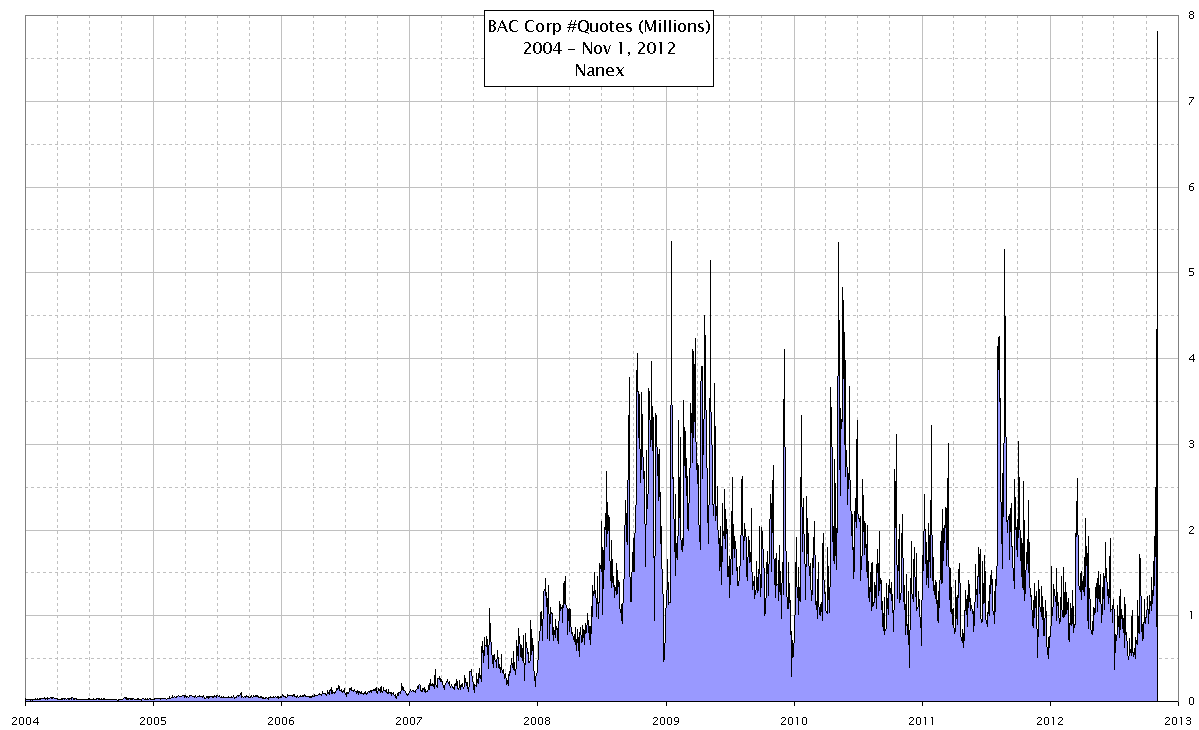

3. BAC - Daily Quote Counts between 2004 and November 1, 2012 (up to 12:45pm)

The spike on the right at 7.8 million is through 12:45pm on November 1st.

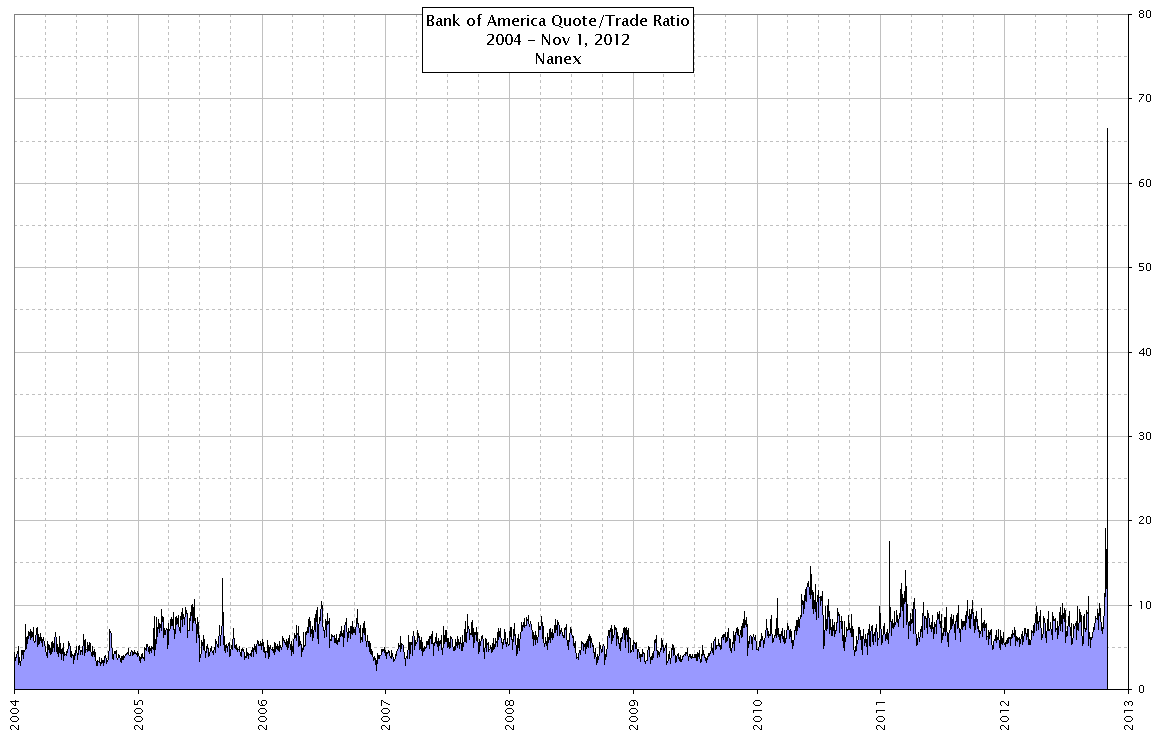

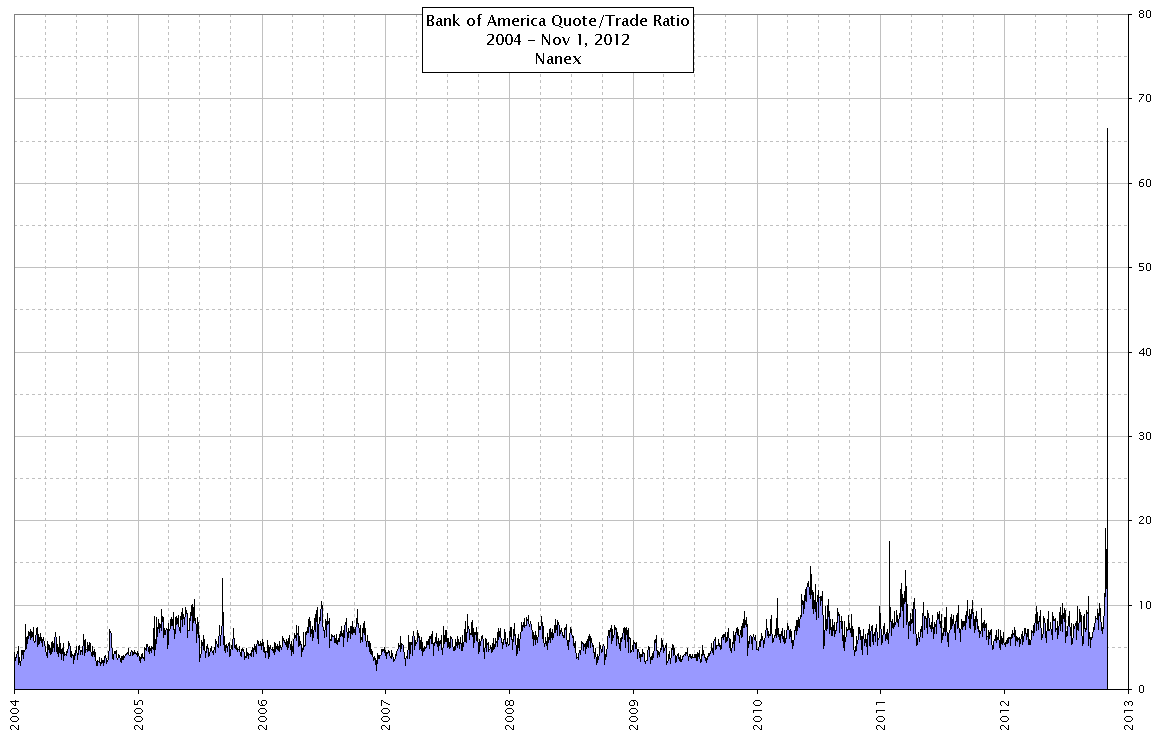

4. BAC - Daily Quote to Trade Ratio between 2004 and November 1, 2012 (up to 12:45pm)

The spike on the right at 67 is through 12:45pm on November 1st:

7 times higher than normal.

5. Percentage of Quotes coming from High Quote Rate Stocks vs All NMS

Stocks - 5 Minute Average - From January 2010 through 1pm on November 1, 2012.

KEY makes up nearly all of the spike in the center.

Nanex Research

Inquiries: pr@nanex.net