Nanex Research

Nanex ~ 30-Nov-2012 ~ The 2012 November Close

November trading went out with a bang,

similar to trading action in the three previous years. One

difference however, was the price action seemed much more contained. There were few

examples of prices spiraling out of control in one direction or another, but there was

something new. Wild trading oscillations and fast shifting bid/ask spreads: see

charts below.

See also: Gaming the Last Millisecond

of the Day, SPY

Close Anomaly, EMini

Wipe Out, and Market

Close of 21-Sep-2012.

This event was predicted before

market open, and several times during the day:

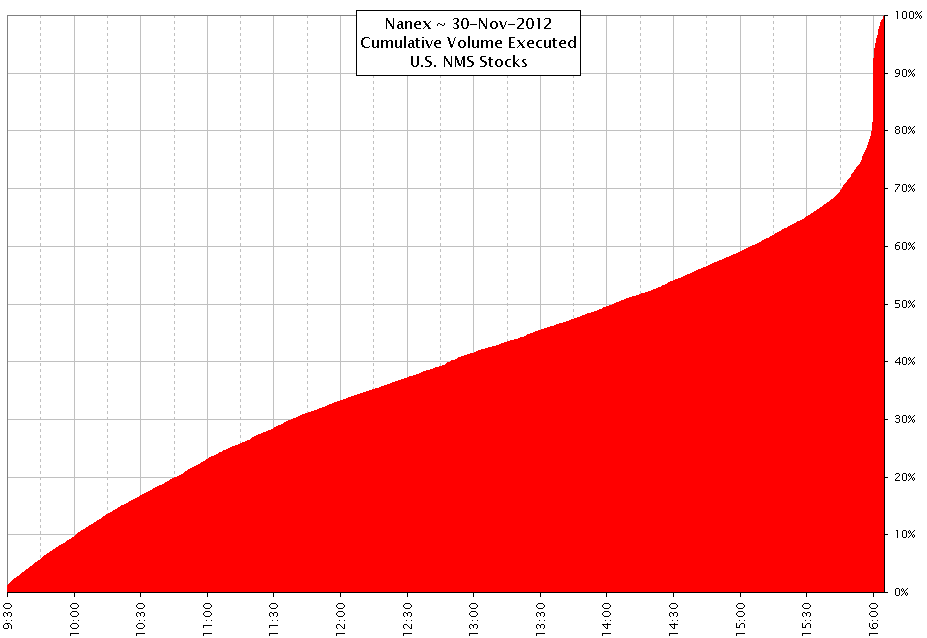

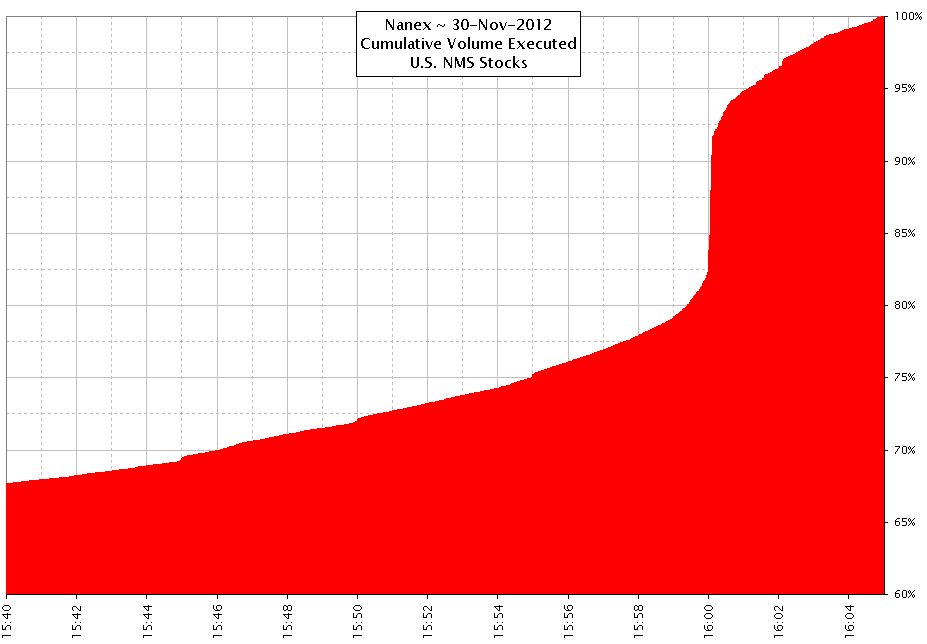

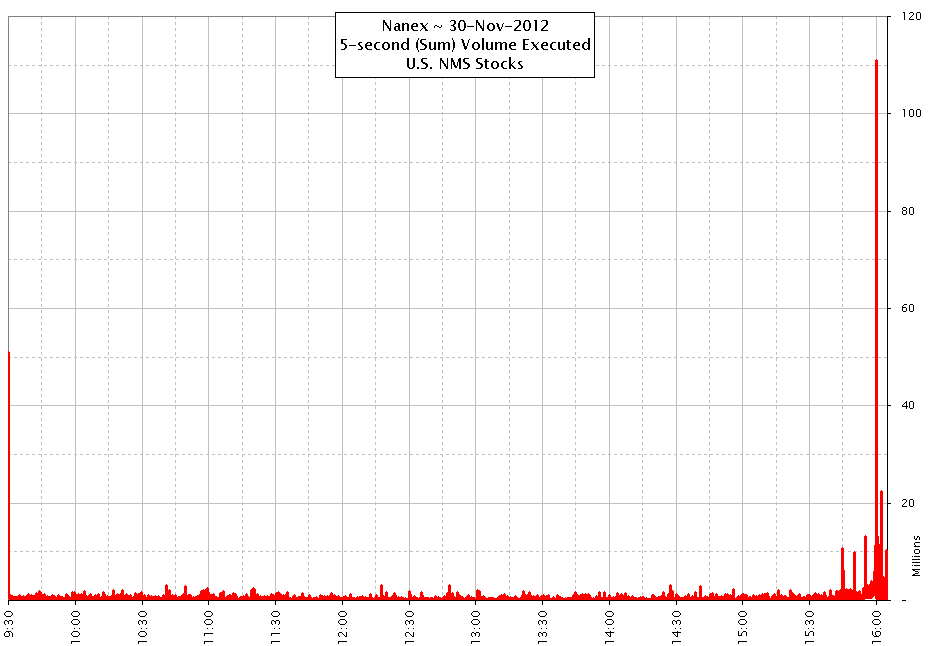

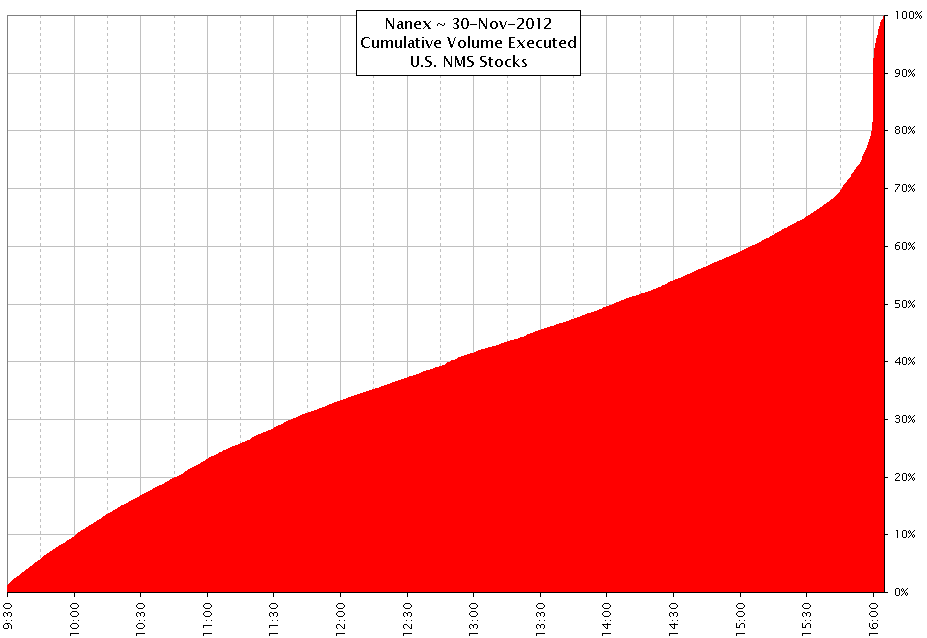

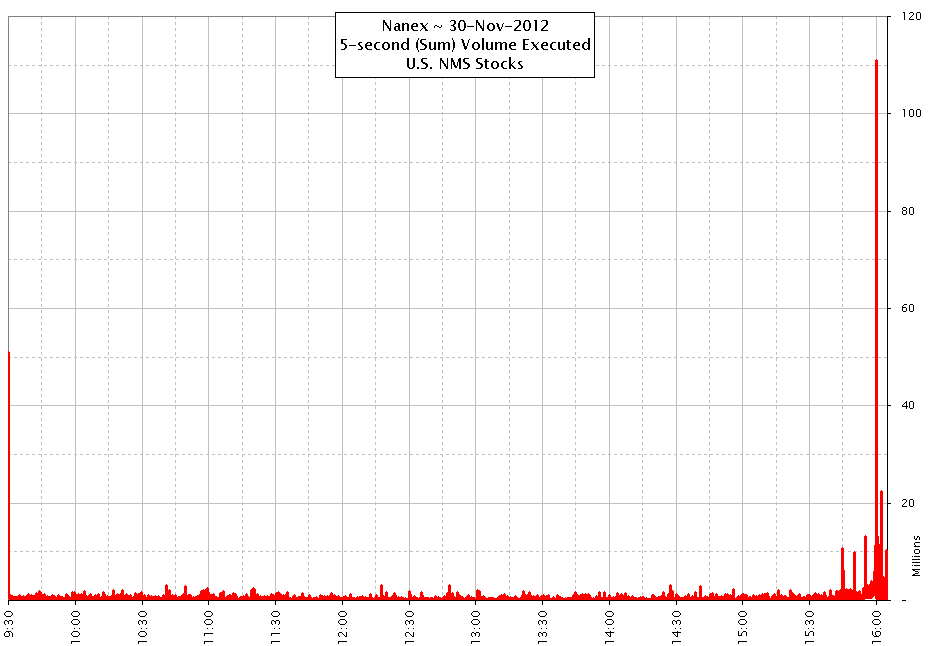

The first 3 charts illustrate how much trading volume (about 10% of the entire trading

day) occurred in the last few

seconds.

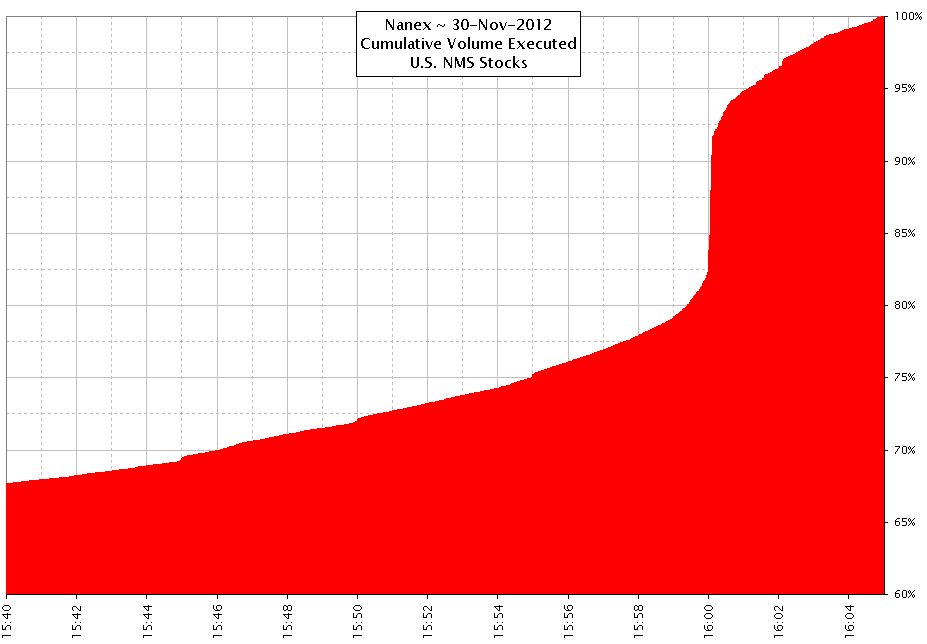

1. Cumulative volume executed in NMS Stocks for each second of the trading day.

2. Zoom of chart above.

3. Rolling 5 second volume traded in NMS Stocks for each second of the trading

day.

Click Start/Stop to run a slide show of all 34 images. Or click Prev/Next to step through them one

at a time.

Nanex Research

Inquiries: pr@nanex.net