Nanex Research

Nanex ~ 07-Dec-2012 ~ Spinning Time into Gold

On December 7, 2012, approximately 600 milliseconds before the release of the Jobs Report

someone aggressively bought gold futures clearing out all sell orders and sending the

price $5 higher. A half second later, even more aggressive selling took the price immediately

down $10. We checked other symbols for activity when gold first rocketed higher, and

only found Silver futures and a small amount in Yen currency.

Was the Jobs news leaked? Did someone try to fool other algorithms that the news was

leaked? Or is this just a stupid algorithm that misread the text?

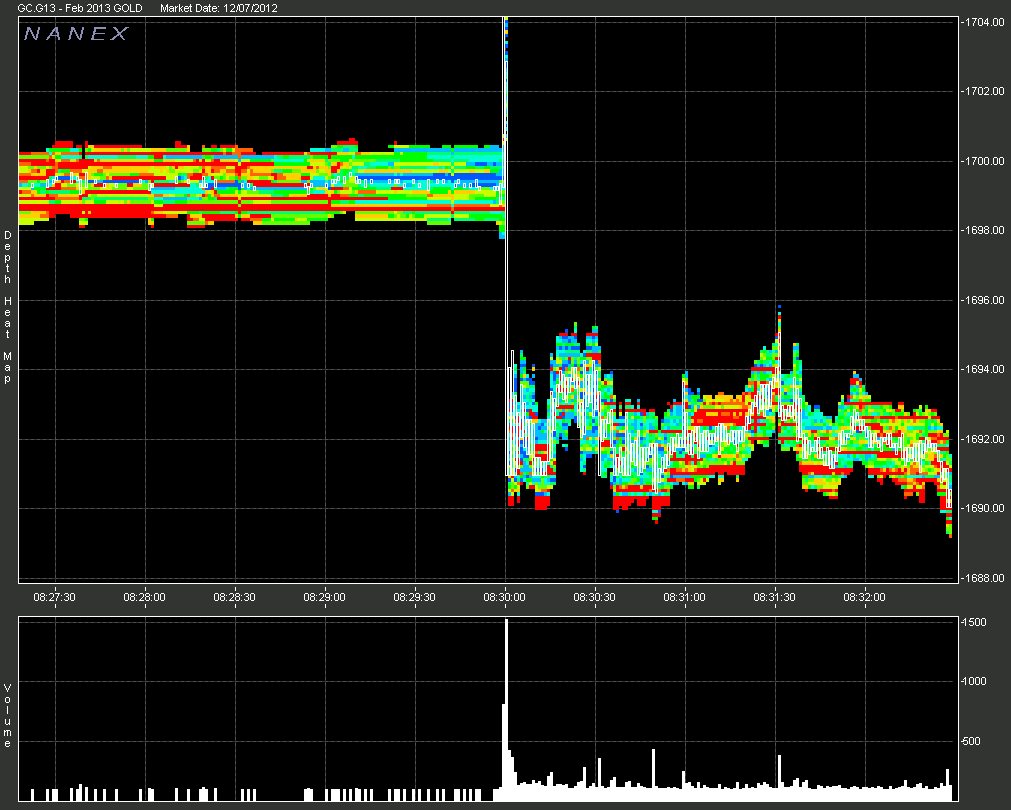

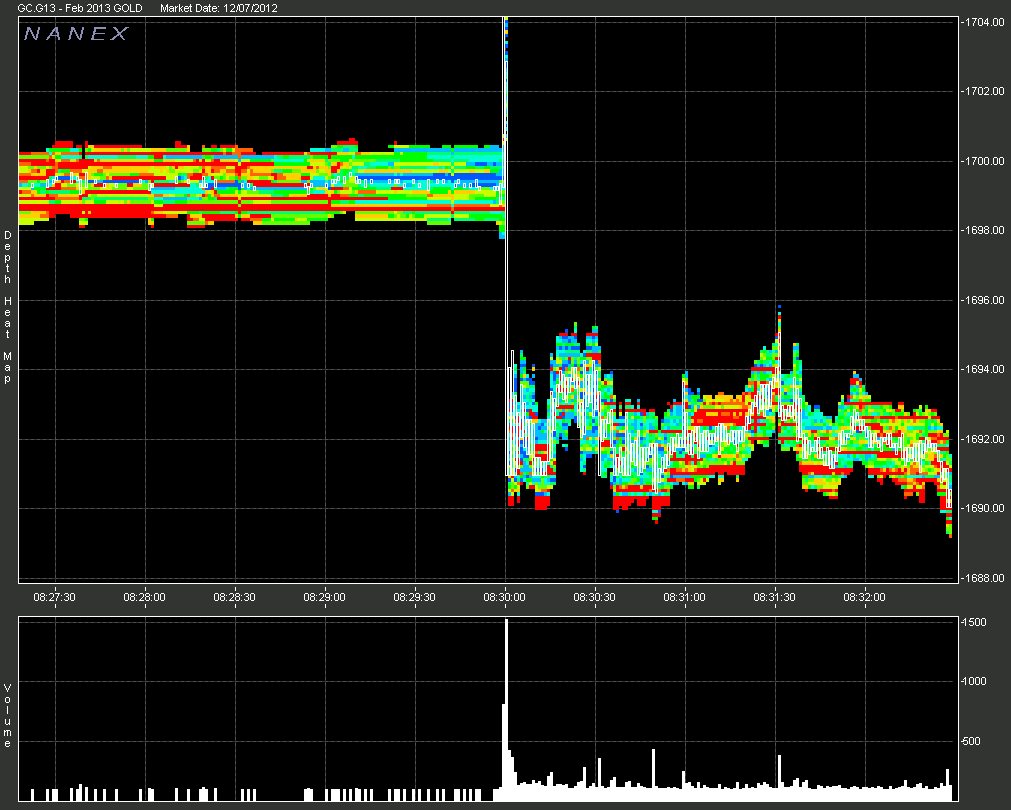

1. Gold futures depth of book.

2. Gold Feb 2013 futures contract. Squares are trades, shade is bid/ask spread,

chart shows about 2 seconds of time.

About 600 milliseconds before the 8:30 Jobs Report, aggressive buying clears sell orders

out $5 higher. A half second later, even more aggressive selling took the price immediately

down $10.

3. ES March 2013 futures (eMini) 5 millisecond interval chart. Squares

are trades, shade is bid/ask spread, chart shows about 2 seconds of time.

This chart aligns in time with Gold above. Note there is no activity for at least 50ms

after Gold first explodes.

4. Silver

Futures moves at the same time as Gold futures.

5. SPY for the same time period as charts above.

6. GLD - an ETF based on gold. The trading is probably arbitrage in reaction

to the move in gold futures.

7. A longer view of Gold, showing the impact of trading around the Jobs news.

8. A longer term view of trading in GLD

9. GLD - showing bids and asks color coded by exchange.

10. ES futures on a longer time scale.

11. SPY on a longer time scale showing trades color coded by exchange.

12. SPY on a longer time scale showing bids and asks color coded by exchange.

13. Silver futures on a longer time scale.

Nanex Research

Inquiries: pr@nanex.net