Nanex Research

Nanex ~ 13-Dec-2012 ~ High Frequency Pricing Failures

This happens at least once a week: within milliseconds of the release of an anticipated

news report, high frequency trading algorithms massively buy or sell way too many equity

shares and futures contracts, sending prices skyrocketing higher or cratering to new

lows. If the goal is to adjust the market price quickly to incorporate the new information,

then these algos are failing, miserably. With few exceptions, prices in the first few

seconds after a news release go to an extreme level that rarely holds for more than

a few hours.

Below is just one more example. Charts are of UNG (an ETF that tracks Natural Gas) and

Natural Gas Futures contracts around the

release of the EIA Natural Gas Report. Trading was so intense

in UNG, that some systems clearly overloaded.

1. UNG 1-millisecond interval chart showing trades color coded by exchange and NBBO (red: bid > ask, yellow: bid = ask, gray: bid < ask) for 1 second of time.

Trading is so fast, that some market networks overload, giving traders with direct feeds

an illegal speed advantage.

2. UNG 25-millisecond interval chart showing trades color coded by exchange and NBBO (gray shading). Zooming out from Chart above.

3. UNG 1-second interval chart showing trades color coded by exchange and NBBO

(gray shading). Zooming out from Chart above.

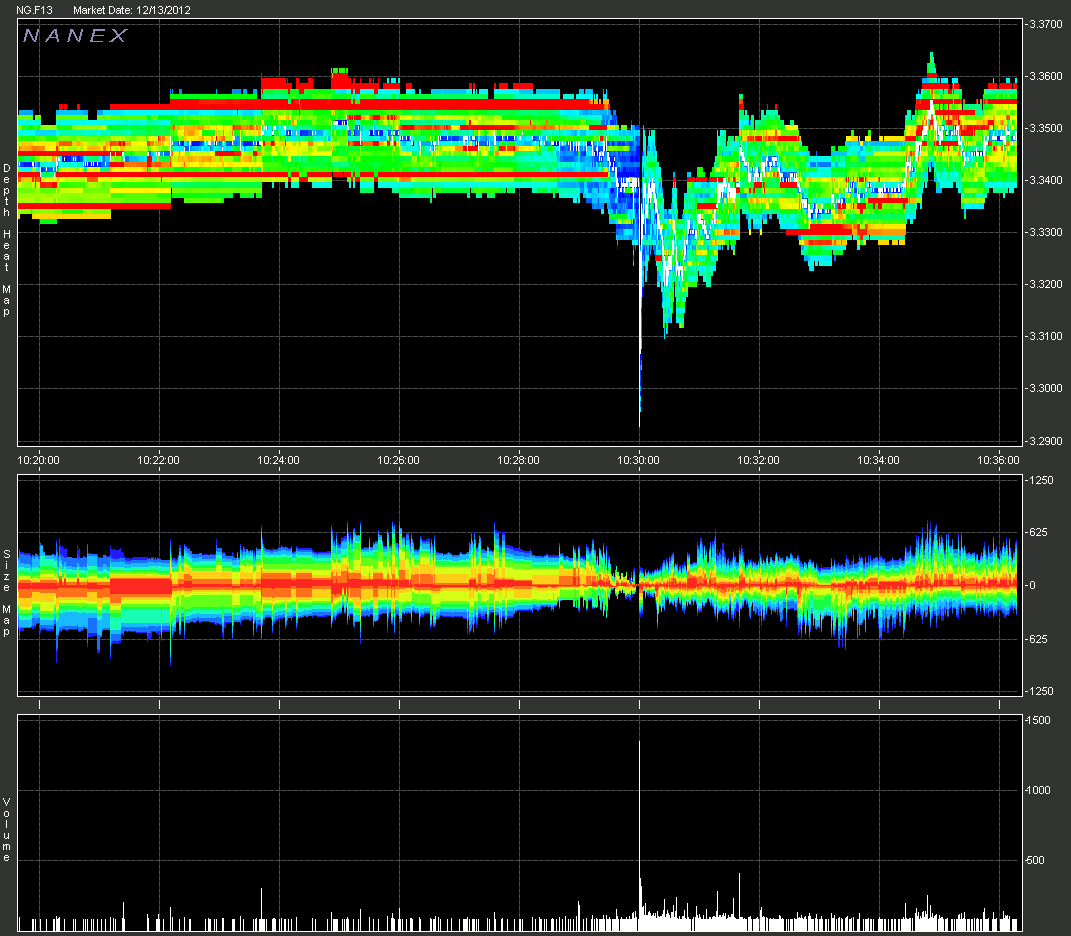

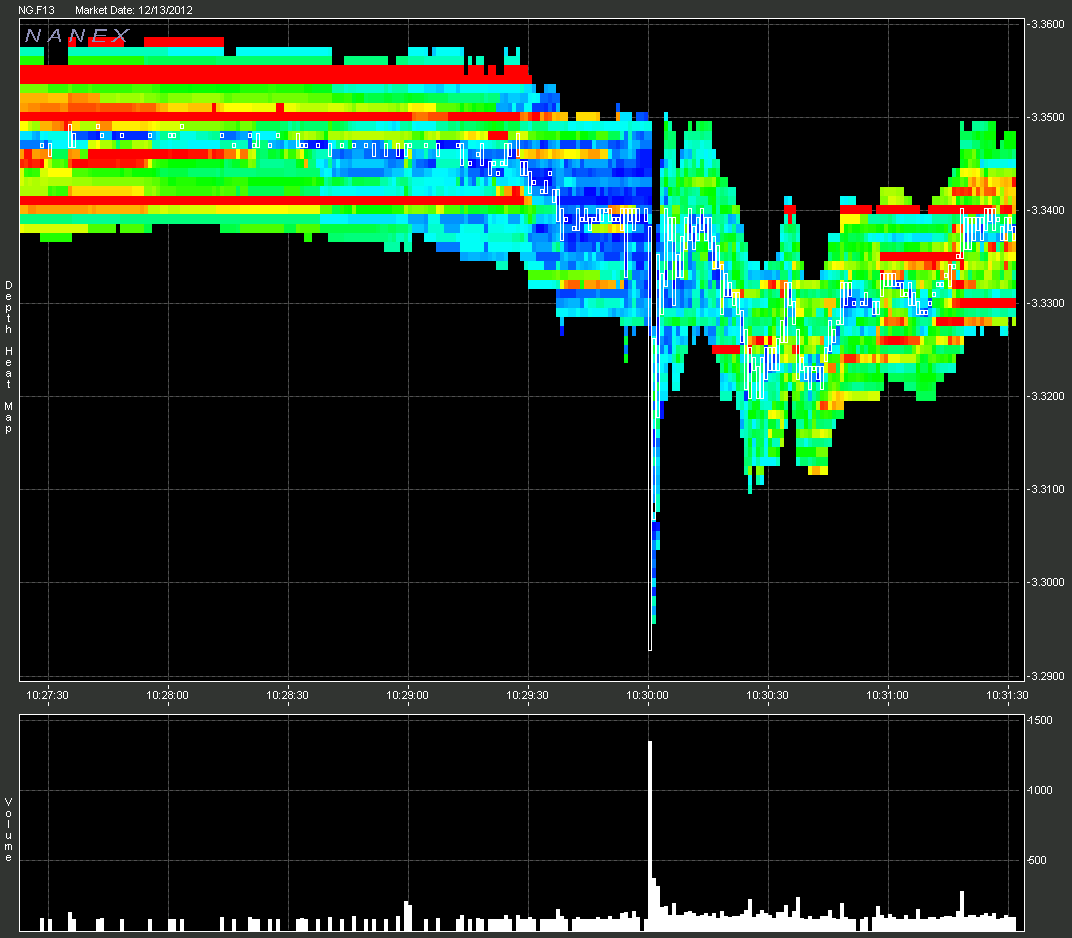

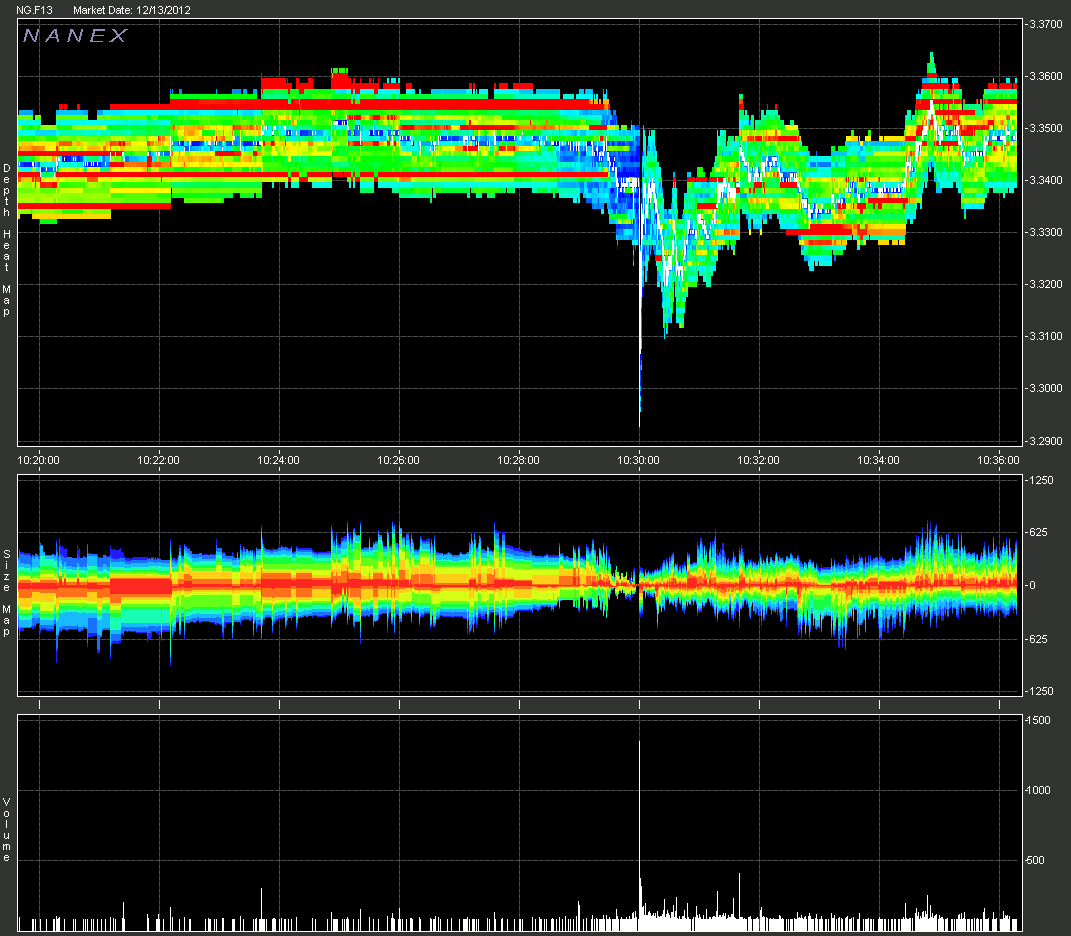

4. January 2013 Natural Gas futures showing last sale and depth of book.

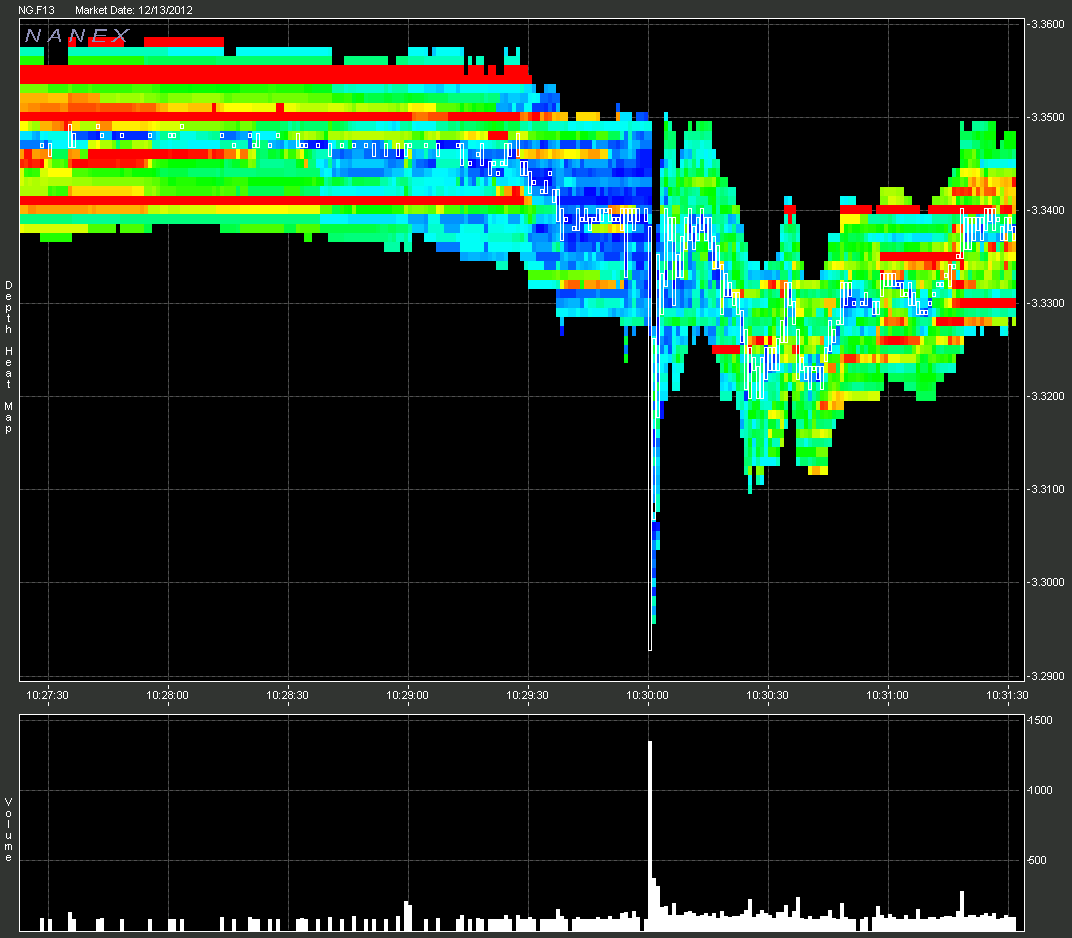

5. Zoom of chart 4 (above)

Nanex Research

Inquiries: pr@nanex.net