Nanex ~ 08-Jan-2013 ~ Locked and Crossed NBBO

Market Stability

In August 2012, we made a fascinating discovery: whenever the NBBO crosses in a stock, several dark pools will stop reporting trades and wholesalers (internalizers) will stop matching customer orders (you can read that paper here). Because the SEC looked at flash crash data with mostly 1 minute snap-shot data, they concluded and wrote in the final flash crash report that internalizers stop matching retail customer orders when stocks have large price moves. But this is untrue. Internalizers only stop matching customer orders when the NBBO crosses in a stock. Which makes the integrity of the consolidated quote extremely important in maintaining market stability.NYSE Outage

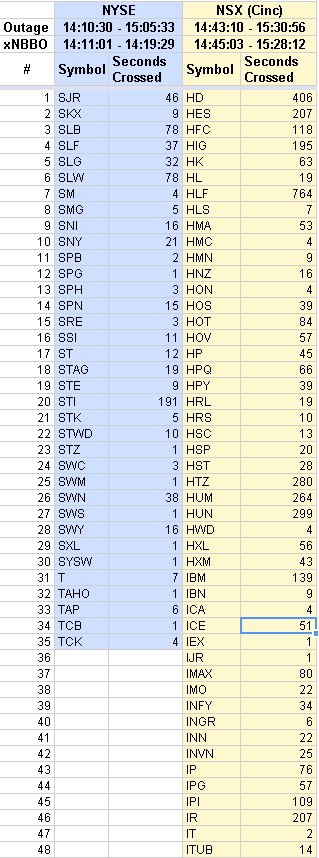

The first event began at 14:10:30, when NYSE's quote stopped updating in symbols within the alphabetic range SJ through TCZ. Within 31 seconds (14:11:01) the NBBOs of 35 of these stocks began to lock and cross as prices moved away from NYSE's stale bid or offer. NYSE finally cleared their quote at 14:19:29 which removed their last posted bid and offer from consideration as the NBBO: this had the effect of unlocking/uncrossing NBBOs in those stocks, allowing the market to resume normal trading. NYSE began quoting and trading in these stocks at 15:05:33.NSX Outage

The second event began at 14:43:10, when NSX's (also known as the CINC exchange) quote stopped updating in symbols within the alphabetic range HD through ITUB. Within 2 minutes (14:45:03) the NBBOs of 48 of these stocks started to lock and cross. Off and on over the next 45 minutes, NSX sporadically updated quotes and trades and some symbols had a crossed NBBO from a stake NSX quote until 15:28:12.The examples below provide more evidence that crossed quotes have a definite impact on trading at Dark Pools and order matching at Wholesalers (who internalize orders from E*Trade, Ameritrade and other retail brokers).