Nanex Research

Nanex ~ 10-Jan-2013 ~ Evaporating Liquidity

On January 10, 2013 at 9:30:20, the stock of 1st Constitution Bancorp (symbol FCCY)

dropped from $8.39 to $1.65 in about 2 seconds. Watch the bids evaporate ahead of the

trade. This is what traders mean when they say liquidity just evaporates after placing

a trade.

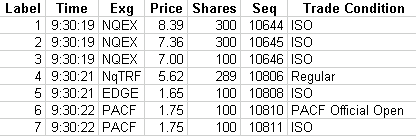

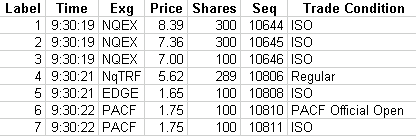

Later in the day, the exchange canceled trades below $5 (labelled 5, 6 and 7 in first

chart).

In charts below, circles are trades, triangles are bids and asks: color coded by exchange.

The gray shading shows the NBBO spread (National Best Bid/Offer). On the first chart,

there are 7 trade reports labeled 1 through 7. Data for these trades appears in table

below:

Note how many bids appear between $7 and below $2 in the 2 second period between trade

number 3 and 5. A market order should have executed at one of those much higher prices.

Every one of those bids (the triangles between trade number 3 and 5) represents at least

one order that was placed, and almost immediately canceled.

ISO trades (Intermarket Sweep Order) are mostly from High Frequency Traders: you have

to be a broker-dealer or sponsored by one to be able to use ISO orders.

We saved the best for last. Trade #6 has the condition "Market Center Official Open".

That's right, NYSE-ARCA is calling the trade at $1.75 it's Official Open. So it must

be official.

The following 8 charts show different views of the same time period.

Nanex Research

Inquiries: pr@nanex.net