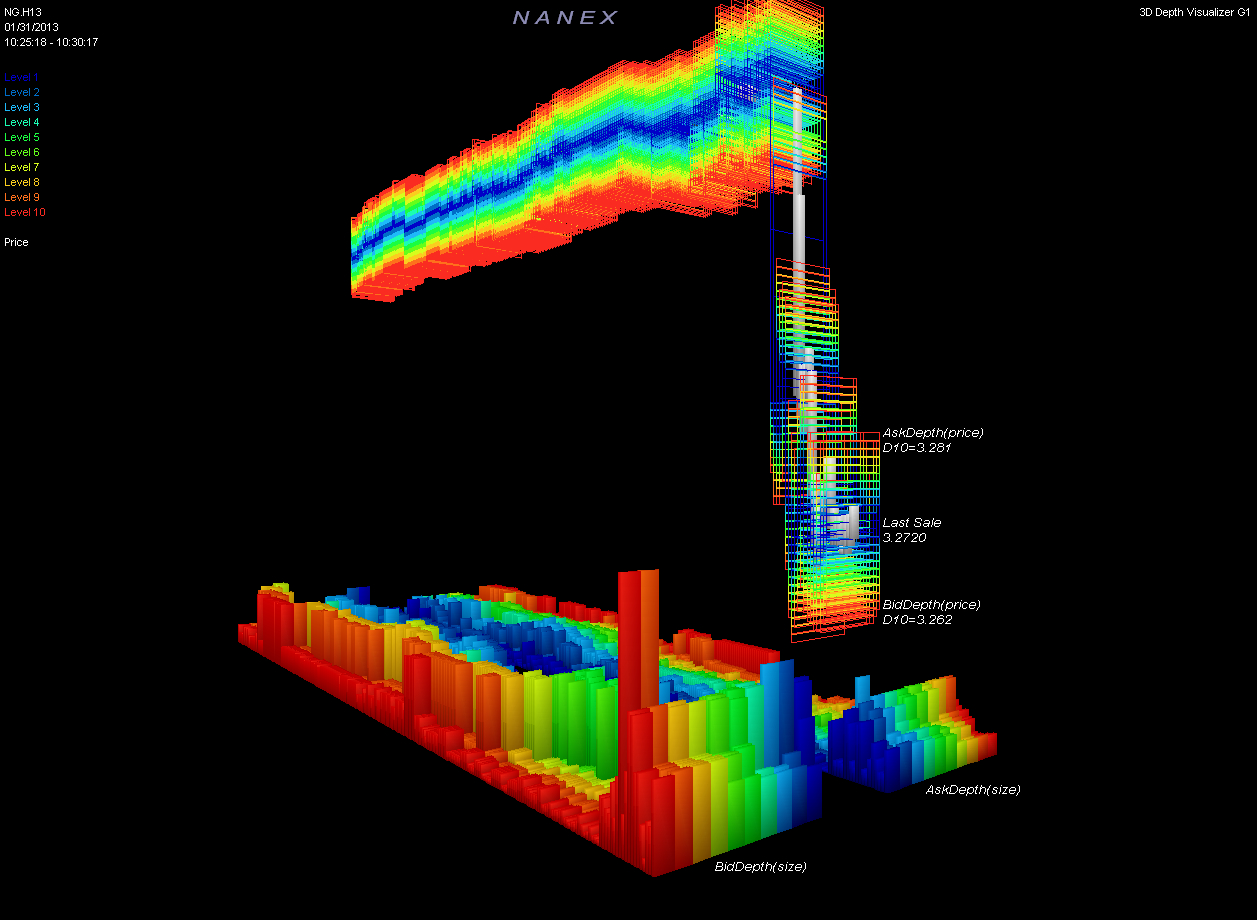

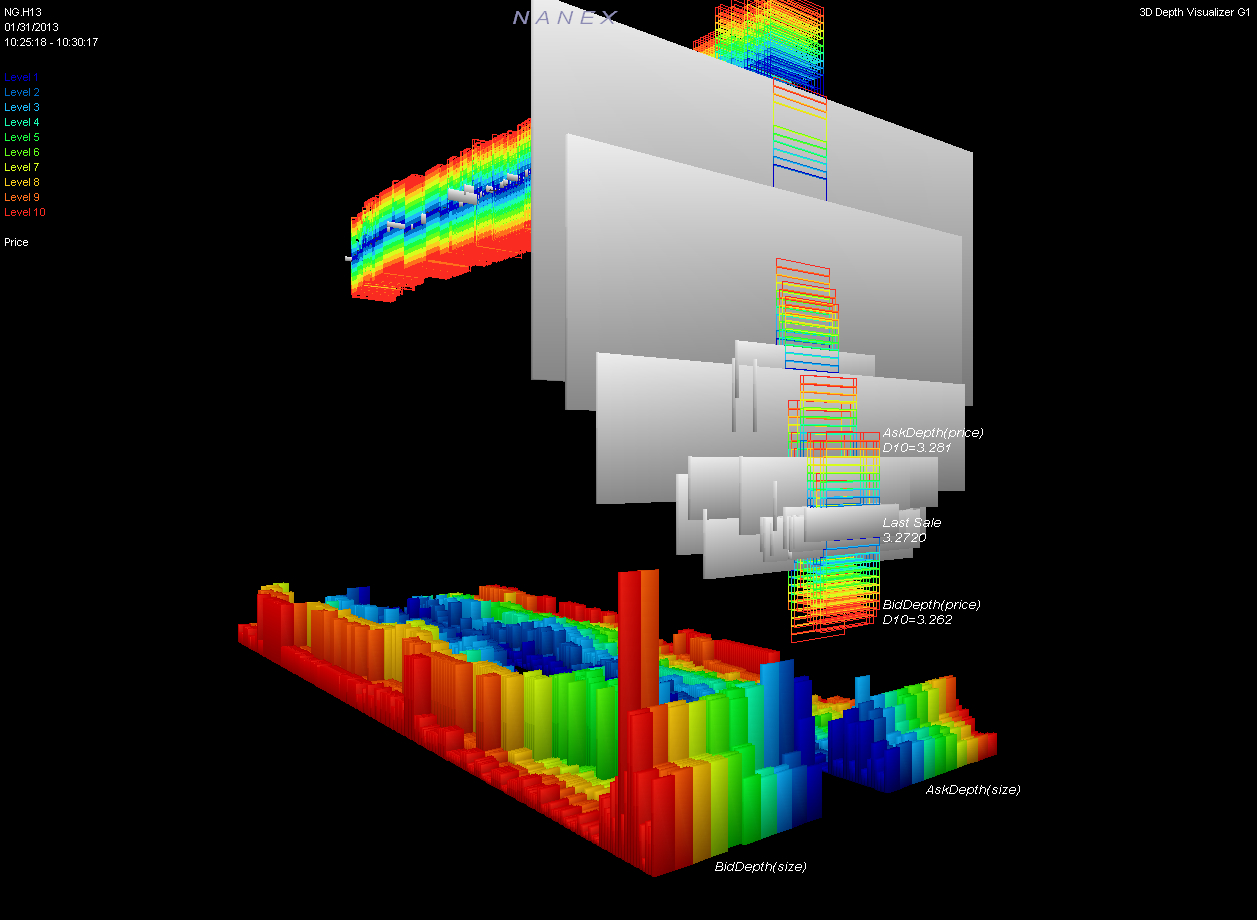

After witnessing dozens of these events (see example below) and discussing them with many experts over the years, we've developed a theory on what causes these sudden early moves.

There are more than 40 news services that try to predict the official number that comes out at 10:30 (ET) each Thursday. Some of these services are very good and often will have hot streaks, where they have many correct predictions in a row. These services release predictions earlier the same day. A subscriber could take a position when they first get the predicted number, but they would incur unnecessary market risk in the form of unexpected news that could occur before the 10:30 release. The closer to 10:30 a subscriber waits, the less market risk they incur.

As the official 10:30 release time approaches, other traders naturally begin withdrawing from the market, not wanting to be caught on the wrong side of the announcement. But the news subscriber needs someone to trade against to establish their initial position (or add to it). Having news early is worthless without a counter party, so the subscriber's algo closely monitors the number of contracts available to trade against as time approaches 10:30. Also, the subscriber knows that other subscribers are trying to do the same thing - waiting as long as possible (to reduce market risk), but not too long that there are no counter parties left to trade with.

About 10-15 seconds before the official 10:30 news release, liquidity (orders to trade against) dwindles rapidly, reaching a point that triggers the algo from the subscriber with the highest threshold, which removes some of the remaining liquidity, triggering algos with lower thresholds, which removes more liquidity, triggering algos with even lower thresholds and so on. This all happens in a matter of milliseconds (thousandths of a second).

Basically, it comes down to a balance between market risk (wait as long as possible) and available liquidity (don't wait too long). Once the first subscriber's algo trades, it ignites a race for the remaining liquidity.

It is highly likely that some participants understood this mechanism long ago and evolved their algos to take advantage of this knowledge (for example, adding fake liquidity to hold off the other algos just a bit longer).