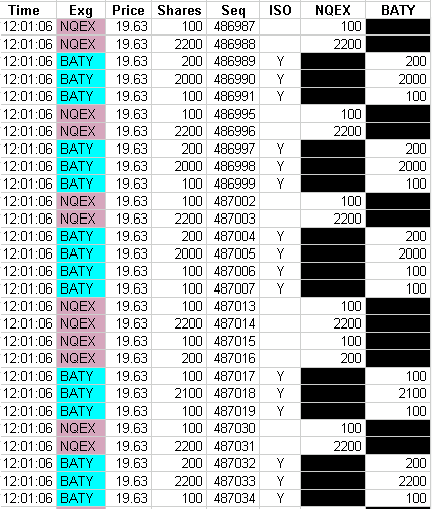

If your sell order on Nasdaq gets executed you collect a rebate from Nasdaq. If at the same time, BAT-Y has a sell order at the same price, then you could execute against it and collect a rebate from BAT-Y. You sold on Nasdaq and bought on BAT-Y leaving you with no position, but rebates in your pocket.

The only problem is ensuring you can execute against the BAT-Y order before another scoundrel (liquidity provider?) gets to it. Maybe blasting the market with lots of bogus orders would blind everyone else while you collect the prize? A rate of 20,000 orders placed/canceled per second should do the trick.

Which appears to be exactly what went on here.