Nanex Research

Nanex ~ 26-Feb-2013 ~ Marked Market Shift

On February 25, 2013, starting around 10:35, the number of quotes relative to the number

of trades began surging and rocketed to levels not seen for several months. Although

the levels have not come anywhere near the preposterous heights set back in August 2011

(when HFT reigned with impunity), the surge is enough to warrant extra attention. Charts

below plot the ratio of quotes to trade value (similar to Quotes/Trades but in way to

better compare the shifting lower transaction size since 2006). Each line shows the

one-minute average value for all NMS stocks (about 8,000) for each minute of one trading

day (9:30 to 16:00 ET), color coded by age: older dates towards the violet end of the

spectrum, while recent days are colored towards the red end. The thick red line is Feb

25, 2013: note the surge doesn't start until about 10:35.

A total of 764,962,237,673 quotes and 43,688,052,096 trades were processed to

create Chart 2.

1. Quotes per $10K of stock traded. One-minute average from Jan 2013 through Feb 25, 2013 for every minute of the trading day. Red line is Feb 25, 2013.

Things are normal until about 10:35am, when quote spamming surging.

2. Same as chart above, but showing from Jan 2007 through Feb 25, 2013

Excessive quote traffic has been on the decline. Though the surge on Feb 25th stood

out in stark contrast to recent trading, it is still way below the crazy days of August

2011, when HFT reigned with impunity.

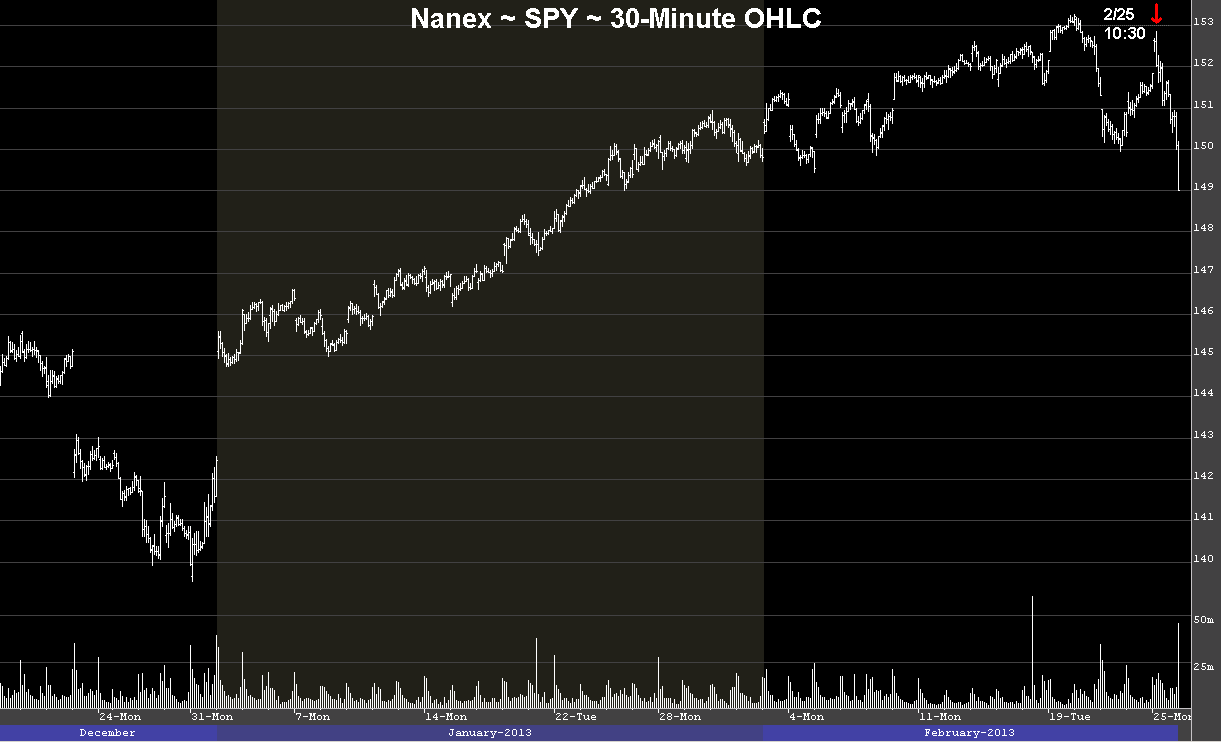

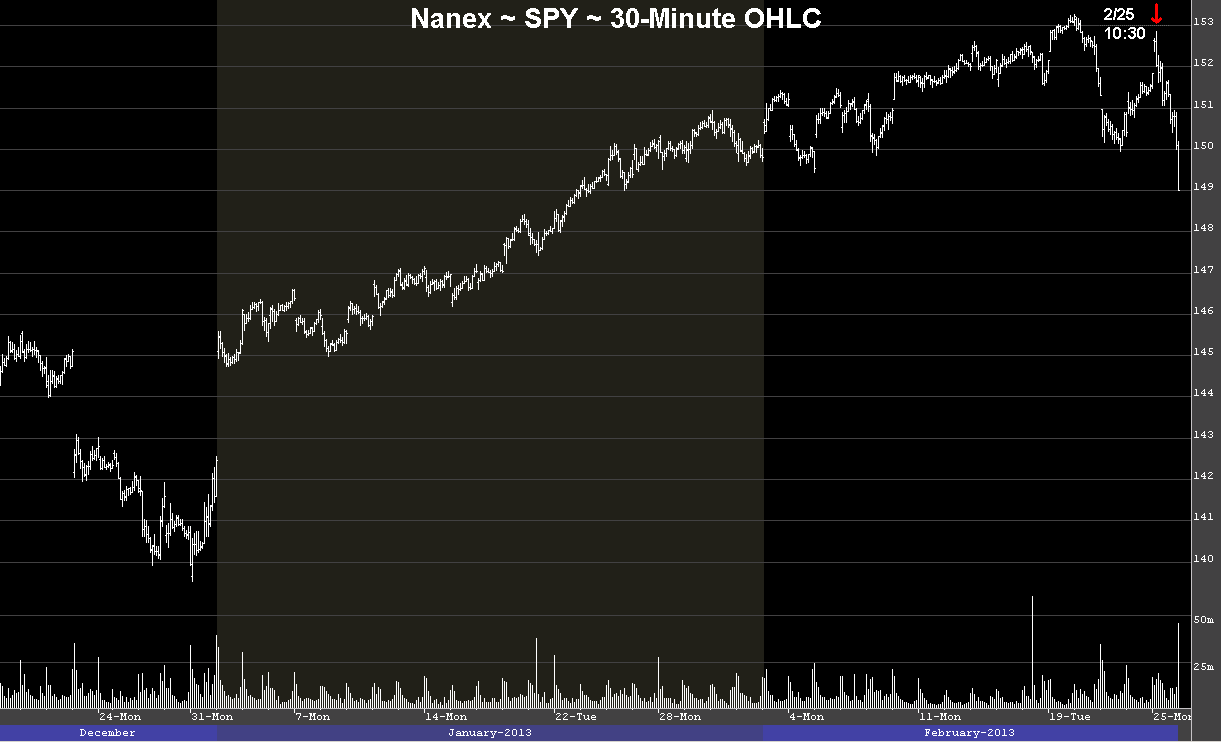

3. SPY 30-Minute OHLC bar chart. Red Arrow indicates when the surge in quotes

began.

Nanex Research

Inquiries: pr@nanex.net