Nanex Research

Nanex ~ 13-Mar-2013 ~ Disorder in Options

During the first 30 minutes of March 5, 2013, there were 6.7 million quotes (canceled

orders) in a single option contract. Over 99% of these quotes came from just one exchange

(out of 11). The option contract was GNW Jan 2014 $5 Puts. GNW is an inactive stock

and it traded above $9 on that date - meaning this put option was way out of the money,

which means it should be extremely inactive.

There are over 500,000 option contracts and 11 exchanges. Just one quote per contract

per exchange per second results in 5.5 Million quotes/sec - which is within 90% of the

maximum capacity of the networks that carry vital option pricing data. Yet one option

contract had 4.5 thousand quotes per second from one exchange.

How can a regulator or exchange claim to have any handle on trading networks if non-sense

like this example go unnoticed? This is just one of thousands of events caused by out-of-control

High Frequency Trading (HFT) algorithms.

1. GNW Jan 2014 $5 Puts - showing bids and asks color coded by exchange and

NBBO (gray shading). Chart shows about 30 minutes of time.

The almost solid blue wall of color in the bottom panel reflects the enormous number

of quotes from MIAX. Orders were placed and canceled at MIAX at a rate of about 4.5

thousand per second.

1. GNW Jan 2014 $5 Puts - showing bids and asks from MIAX and NBBO (gray shading).

Chart shows about 30 minutes of time.

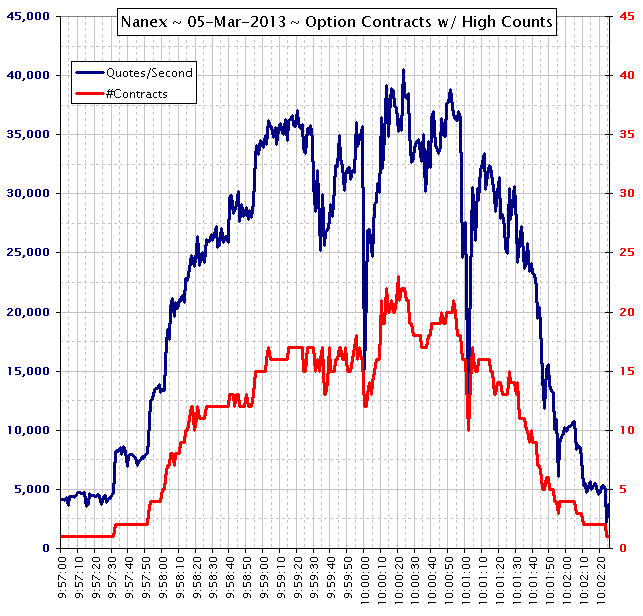

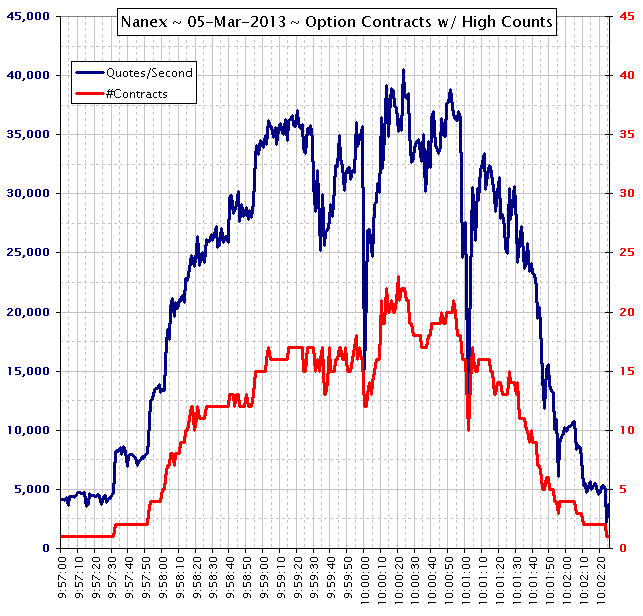

On the same day, between 9:57:30 and 10:02, the same Quote spamming algo in GNW appeared

to infect as many as 23 option contracts during the same second. The chart below plots

the number of contracts infected along with total quotes per second for those contracts.

The quote rate peaked at 40,000 per second for 23 option contracts.

Nanex Research

Inquiries: pr@nanex.net