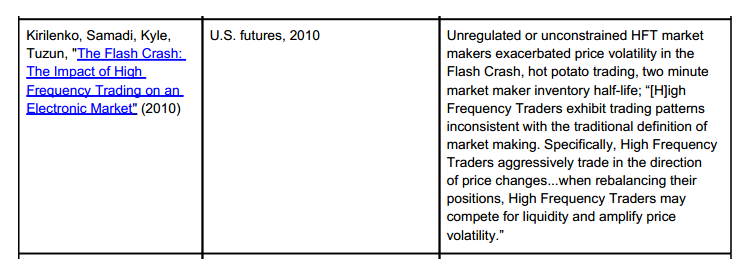

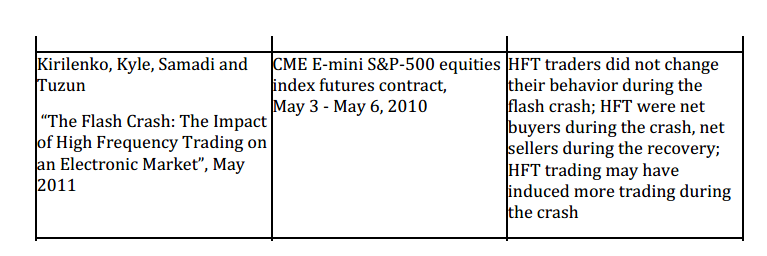

The second summary review (of same paper!) is from FIA PTG, November 2012. The FIA PTG is a lobbying and known pro-HFT group:

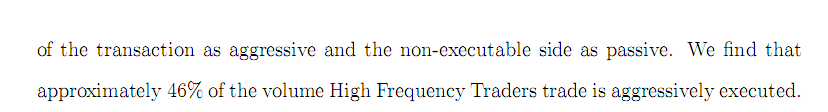

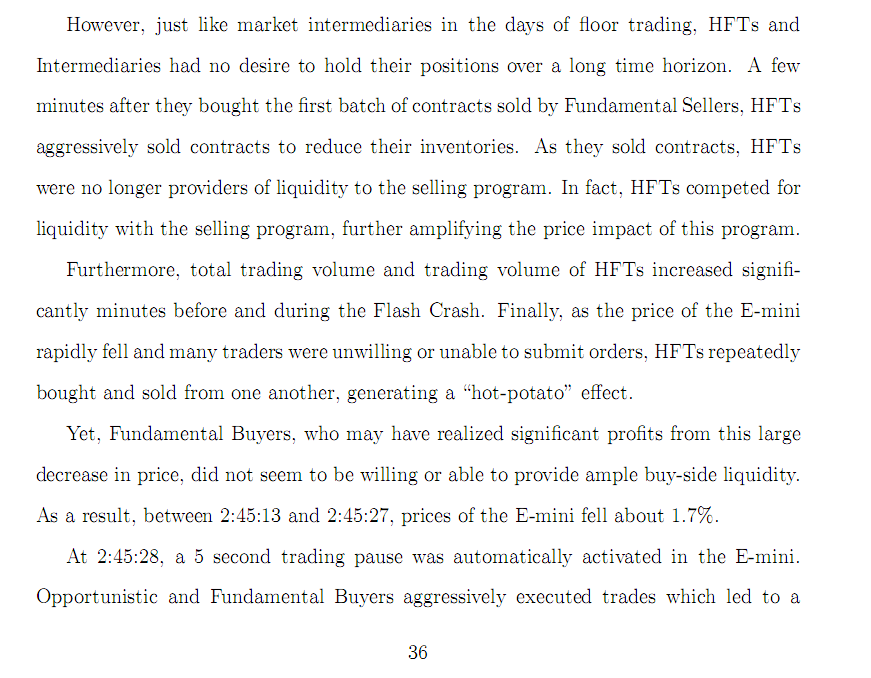

To call the second review dishonest would be kind. But don't take our word for it, let's look at the actual paper and find out. Kirilenko's paper tells us that HFT were aggressive 46% of the time during the flash crash. Aggressive trading is not market making. Aggressive trading removes liquidity. HFT may have been net buyers during the crash, but they weren't buying to make a market.

Furthermore, HFT competed for liquidity - took liquidity away from the market!

There are many more examples of wildly different summary rewiews of the same paper from these two sources. We'll leave that as an exercise for journalists.