Nanex Research

Nanex ~ 03-Jun-2013 ~ Great Timing

On June 3, 1013, trading in SPY exploded at 09:59:59.985, which is 15 milliseconds before the

ISM's Manufacturing number released at 10:00:00. Activity in

the eMini (traded

in Chicago), exploded at 09:59:59.992, which is 8 milliseconds before the news release,

but 7 milliseconds after SPY.

Note how SPY and the eMini traded within a millisecond for the

Consumer Confidence release last week, but the eMini lagged

SPY by about 7 milliseconds for the ISM Manufacturing release. The simultaneous trading

on Consumer Confidence is because that number is released at the same time in both NYC

and Chicago.

The ISM Manufacturing number is probably released on a low latency feed in NYC, and

then takes 5-7 milliseconds, due to the speed of light, to reach Chicago. Either the

clock used to release the ISM number was 15 milliseconds fast, or someone (correctly)

jumped the gun.

Update: 05-Jun-2013

CNBC reported on this story. The clock used to release the ISM was indeed, 15 milliseconds fast. This could

be from using the default setting of many NTP clients, which allows the clock to

drift up to about 16 milliseconds before adjusting time. Late in 2011,

we found that the clock in the UQDF feed was allowed to drift by about 16 milliseconds

before it was corrected: you can see that report

here with charts (the issue appears to have been corrected).

1. SPY trades color coded by exchange and NBBO. Chart shows 150 milliseconds

of time.

Note that trades shown as blue diamonds appear to lag behind trades from other exchanges.

Something we have reported on

several times

in the past.

2. ES June 2013 Futures (eMini) trades and quote spread. Chart shows 150 milliseconds

of time.

3. SPY trades color coded by exchange and NBBO. Zoom-out of Chart 1. Chart shows

1 second of time.

4. ES June 2013 Futures (eMini) trades and quote spread. Zoom-out of Chart 2.

Chart shows 1 second of time.

5. SPY trades color coded by exchange and NBBO. Zoom-out of Chart 3.

6. ES June 2013 Futures (eMini) trades and quote spread. Zoom-out of Chart 4.

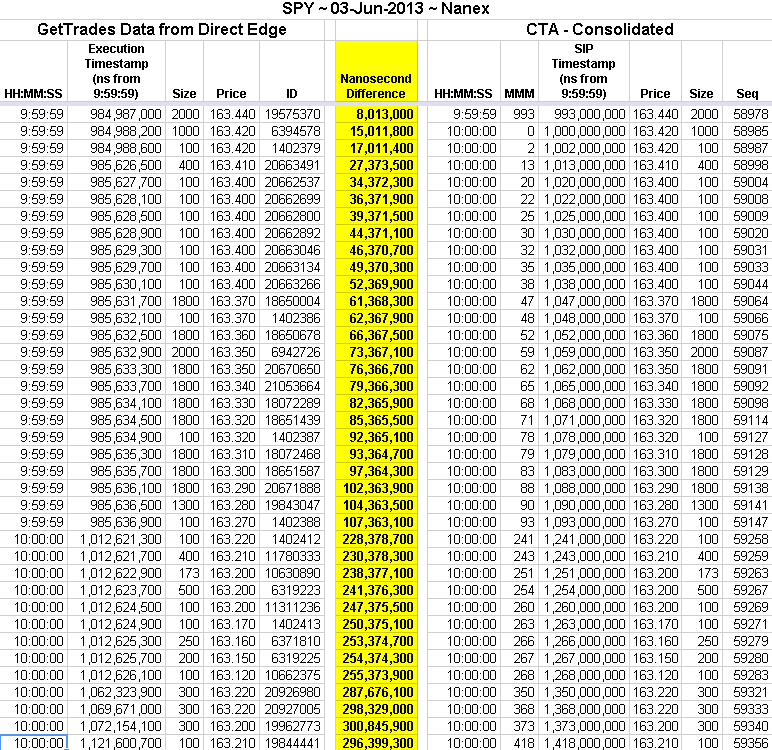

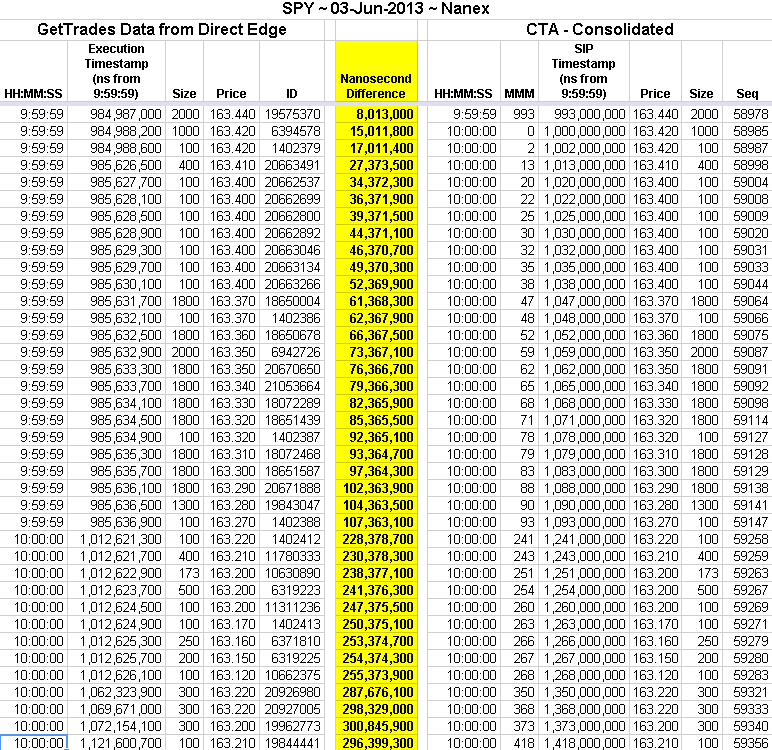

We found another issue during this event. It appears that trades reported from EDGX

may have been sent to the consolidated feed as much as 300 milliseconds after orders.

We compared SPY trade execution timestamps from their GetTrades product with the timestamp found on matching trade reports from the Consolidated (CTA). The table showing these trades and timestamp difference appears below (download

the pdf). Note that EDGX trades appear as blue

diamonds in Chart 1.

Note: Direct Edge called us and strongly denied this is happening, though

the data indicates otherwise.

7. Comparing EDGX Trades from Consolidated (blue) and GetTrades (red, direct

feed).

Note how the blue dots/lines are simply offset to the right of the red dots - this indicates

the magnitude of the delay to the consolidated. Several points have been measured and

labelled.

8. EDGX Trades from GetTrades (D) and Consolidated (C), plus bids from Consolidated

(triangles).

9. Zoom of Chart 8.

Note how some of the trades from GetTrades are timestamped earlier than bids from the

consolidated!

Nanex Research

Inquiries: pr@nanex.net