Nanex Research

Nanex ~ 12-Jun-2013 ~ 10,000 Option Quotes Per Trade

The growth of option quotes over the last month has exploded, but option trading has

stalled. Recently, we witness the number of quotes in just one symbol, SPY,

exceeded 1.1 billion in a single day. If this alarming trend

continues, the cost of processing and storing option data will shut out all but a few

academics. We think the capabilities of the regulator have been exhausted for years

- which means, in effect, there is no regulator that can spot anomalies in option trading.

We processed 700 trillion bytes of market data to produce the charts below.

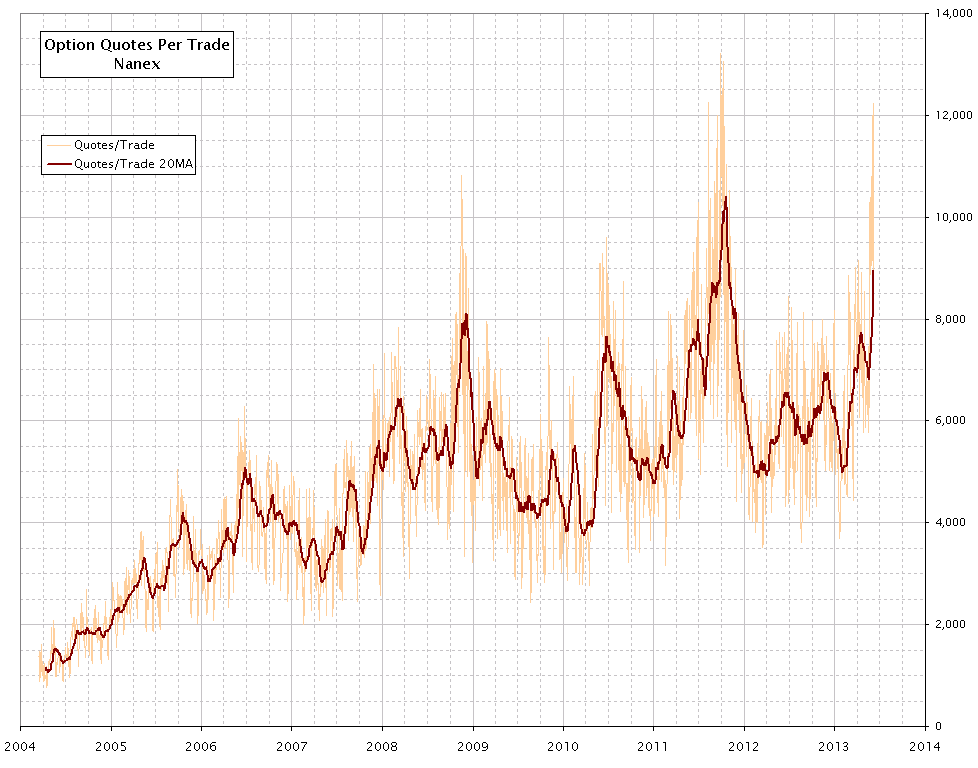

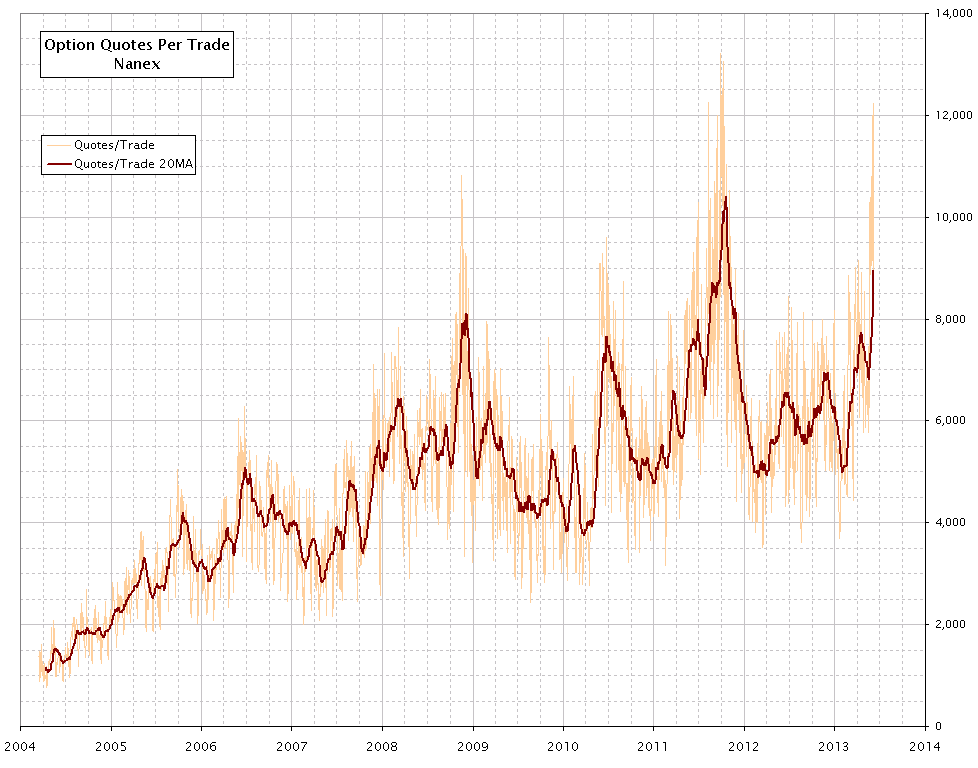

1. Equity and Index Option Quote/Trade ratio and 20 period moving average (20MA) for every trading day between April 2004 and June 2013.

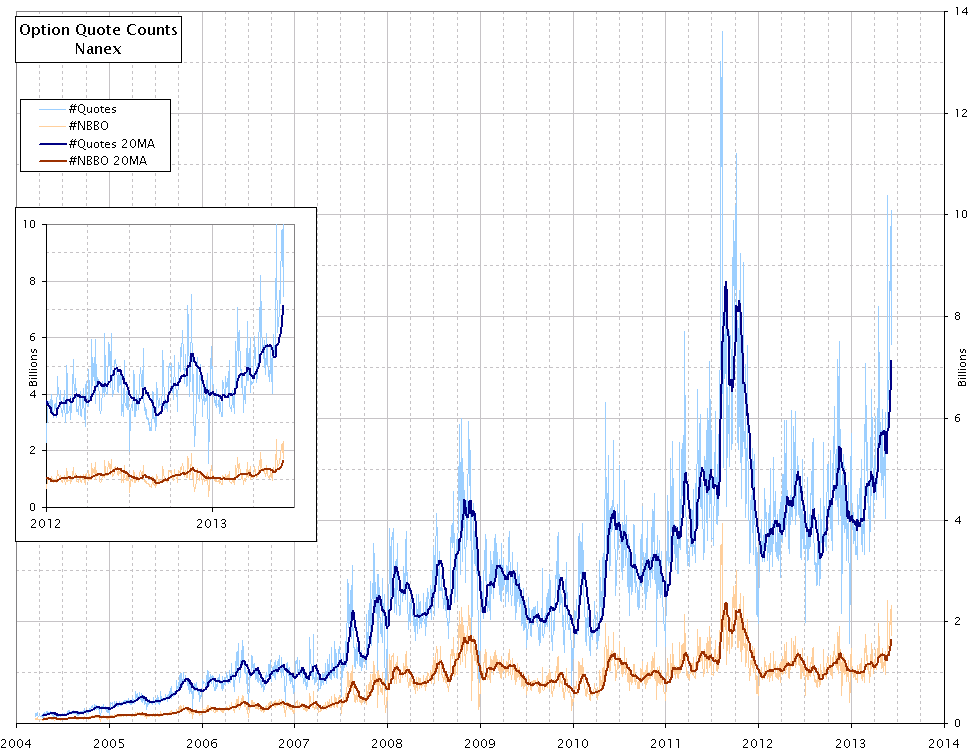

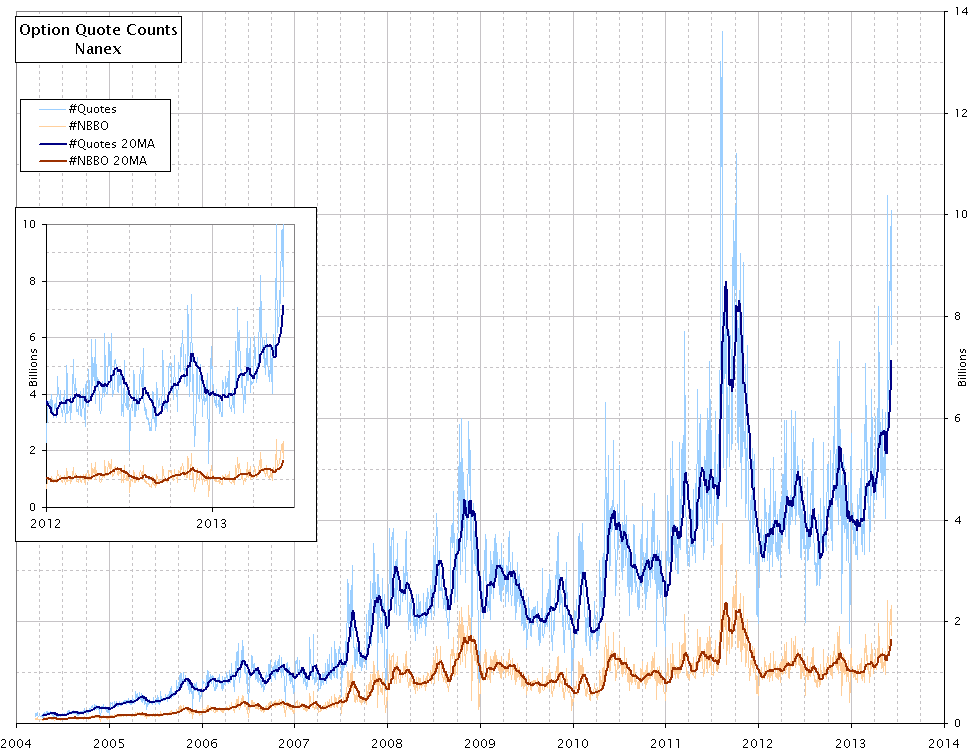

2. Equity and Index Option quote and NBBO counts for every trading day between April 2004 and June 2013. Inset shows from 2012.

Option quotes are growing rapidly.

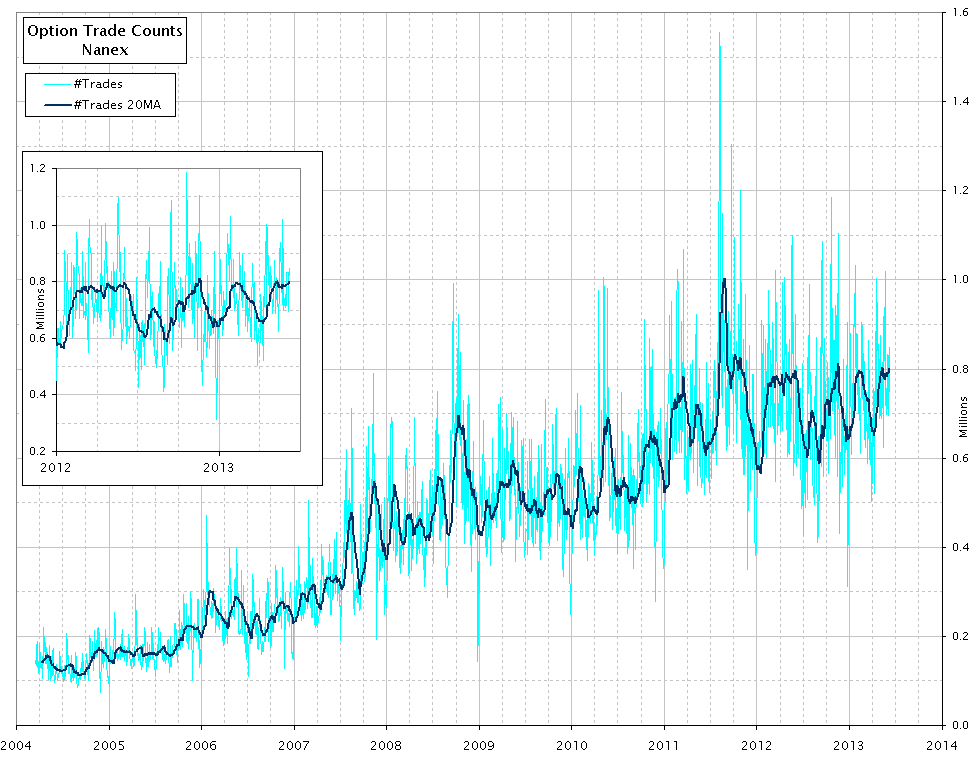

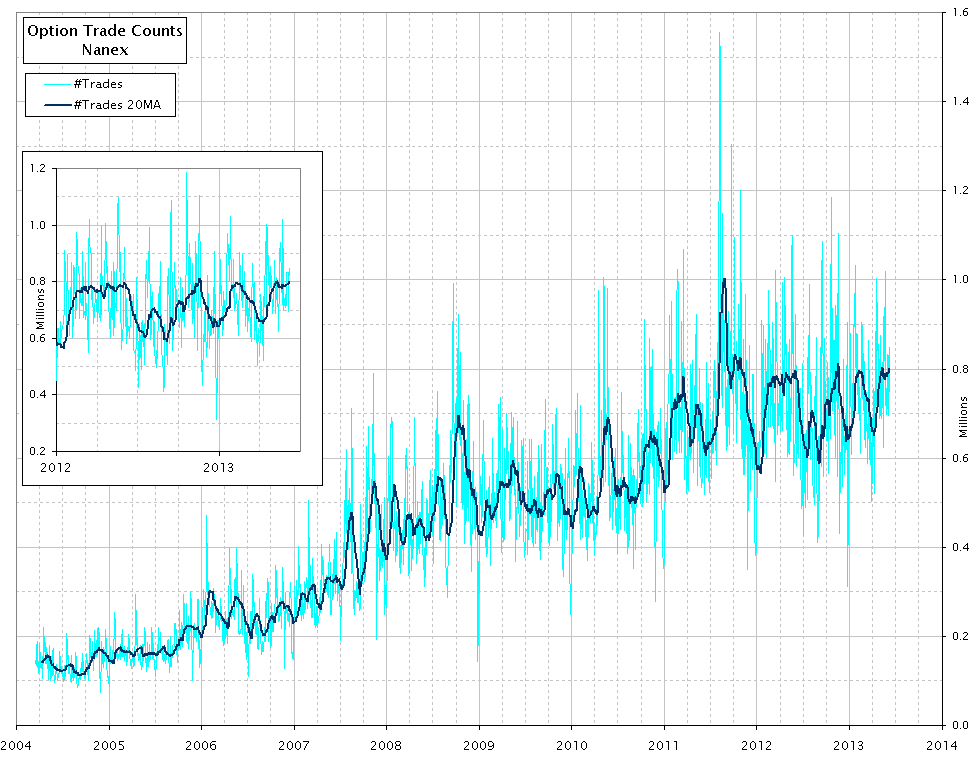

3. Equity and Index Option trade counts for every trading day between April 2004 and June 2013.

Inset shows from 2012.

But the number of option trades has stalled.

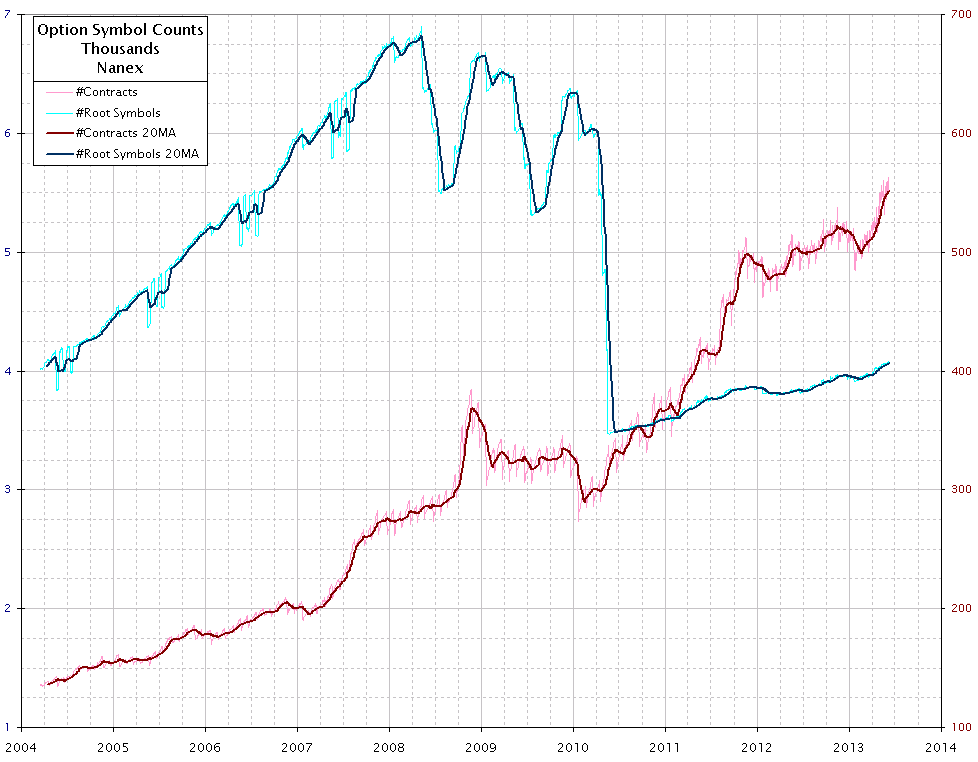

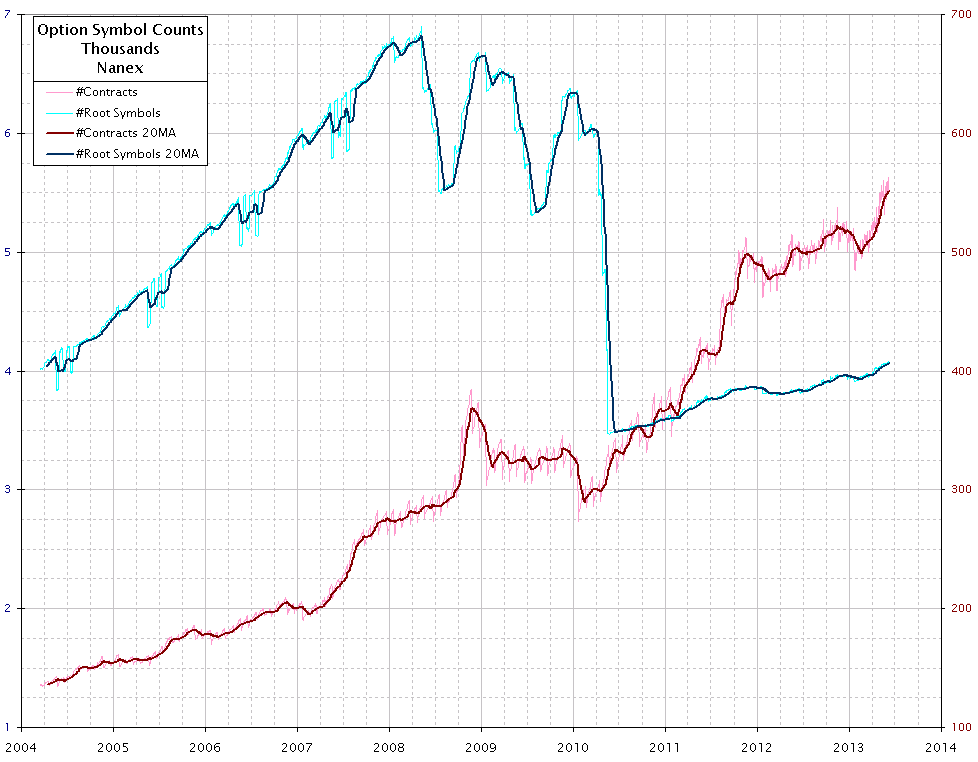

4. Equity and Index Option root and contract counts for every trading day between April 2004 and June 2013.

Note - the OSI initiative went into effect in February 2010, allowing the industry to

use more than 3 letters for option root symbols, and have more than 24 expiration dates

and more than 26 strikes per option root.

This resulted in an explosion of new option contracts: there are now over 500,000. Some

stocks, such as Apple, have about 4,000 different option contracts, each of which will

reprice when Apple stock changes price. Multiply that by 11 option exchanges, and

you can quickly see why option quote updates now exceed 8 million per second at peak.

Nanex Research

Inquiries: pr@nanex.net