Nanex Research

Nanex ~ 10-Jul-2013 ~ $11.3 Billion in 1 Second

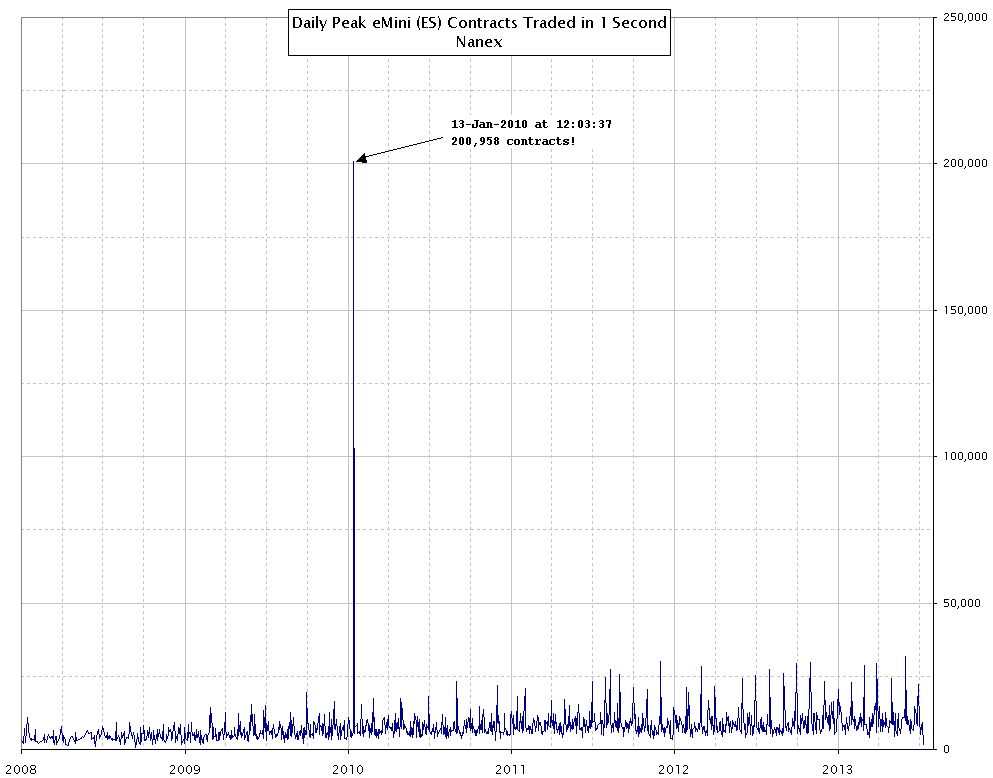

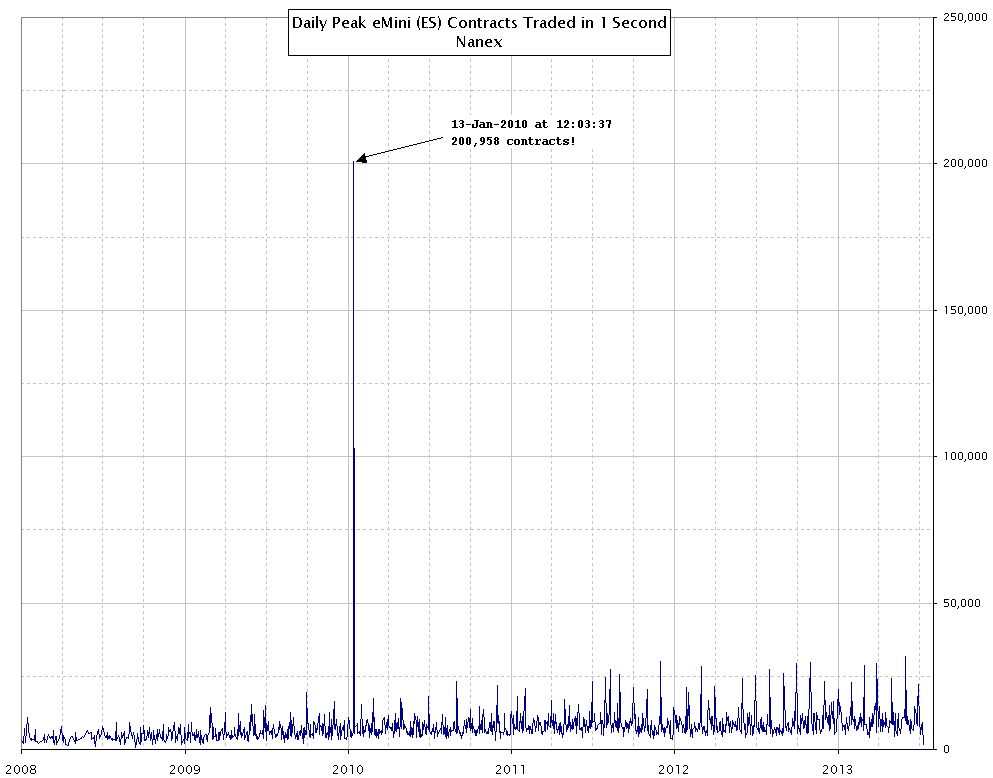

We were curious to what the highest number of eMini futures contracts (ES - S&P 500

futures) was ever traded in 1 second of time. When plotting the results, we were shocked

to find there was an instance of 200,000 contracts ($11.3 Billion notional value) that traded

in 1 second! That is about 6 times more contracts traded in 1 second, than Waddell and

Reed traded over a

720 seconds, and got them (incorrectly)

blamed for causing the flash crash.

Details

On January 13, 2010 during one second of time at 12:03:37, there were 200,958 contracts

from 1,571 trades: an average of 128 contracts a trade. To give you an idea of how large

an average of 128 contracts per tade is: Waddell and Reed averaged just 11 contracts

per trade (75,000 contracts in 6,438 trades over the entire 20 minutes). We suspect

this may have been a case of self-dealing, and could have involved a transfer of money

between accounts (money laundering), as the price barely moved.

It is curious that there has been no mention of this record shattering event. Until

now.

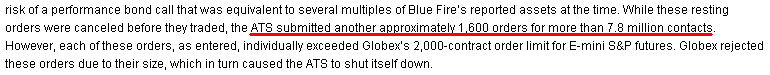

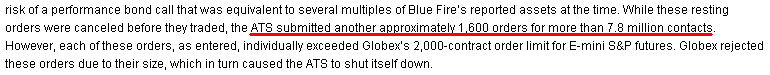

Update: A reader

sent us a link to regulatory action based on this event. Turns out, it was an

poorly written algo that traded against itself. But you have to read the narrative -

it is shocking. Because there was a very real possiblity that a major market event could

have unfolded. The algo tried to trade another 1,600 orders for more than 7.8 million

contracts! If the orders had been for 2,000 or fewer contracts each, they would have

passed the Globex 2,000 contract upper limit, and gone into the system, causing who

knows how much damage. Here is the relevant snippet:

1. Chart showing the peak number of ES futures traded in 1 second for each day

between January 2008 and July 10, 2013.