Nanex Research

Nanex ~ 30-Jul-2013 ~ Jumping the Gun at 9:59:59

On May 28, 2013 just before the release of the Consumer Confidence number, the market

exploded with activity. Close inspection showed that the news was released early to the

elite High Frequency Trading firms that pay for news in a machine readable format. Using

data we published on that event (click

for detailed charts and analysis), Eamon Javers at CNBC broke the story.

Three weeks later, Dow Jones

confessed and blamed a clock synchronization bug for the early

release:

"A malfunction in a timing device and its fail-safe system caused some economic-indicator

data to be prematurely released by a fraction of a second to some Dow Jones [news feed]

customers," the statement said, adding that the company has "taken corrective measures."

A bug in vendor software that auto-corrects the time led to the early release of data

between May 2 and June 17, according to a person familiar with the matter.

So we know the cause of the May 28, 2013 event and perhaps other events in the May 2

- June 17, 2013 time frame. But there is more than one news service that releases the

Consumer Confidence number, and these other news services must have had clock synchronization

bugs too, because a simple cursory search turned up more than 20 other instances of the Consumer Confidence number being released early, going all the way back to 2009.

With a little effort, it is almost certain we could find

dozens more.

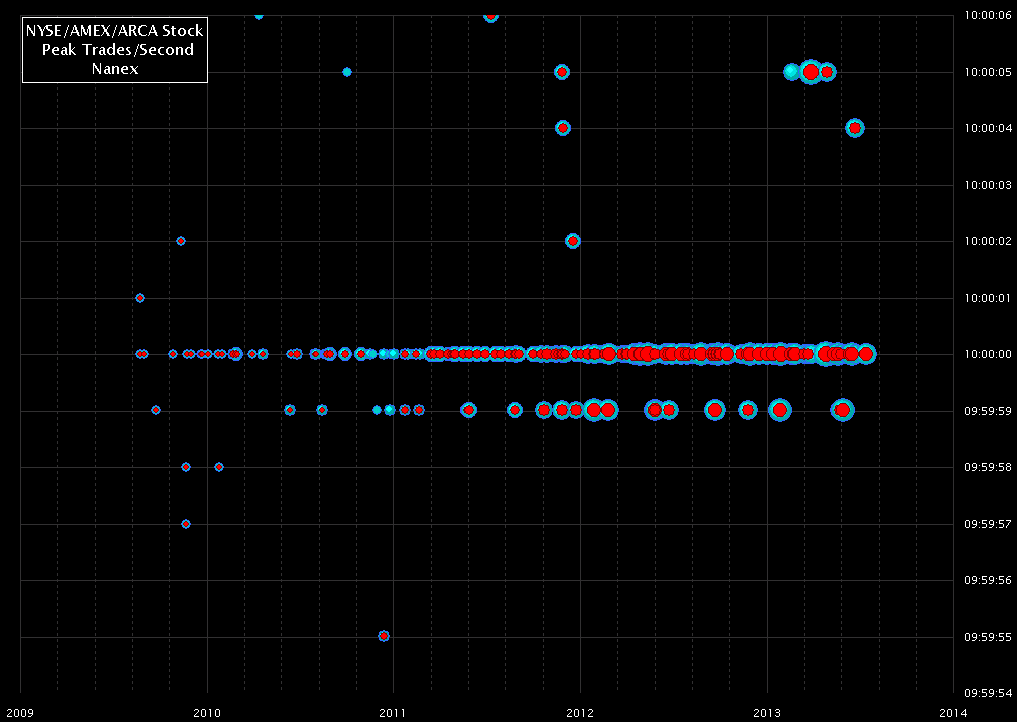

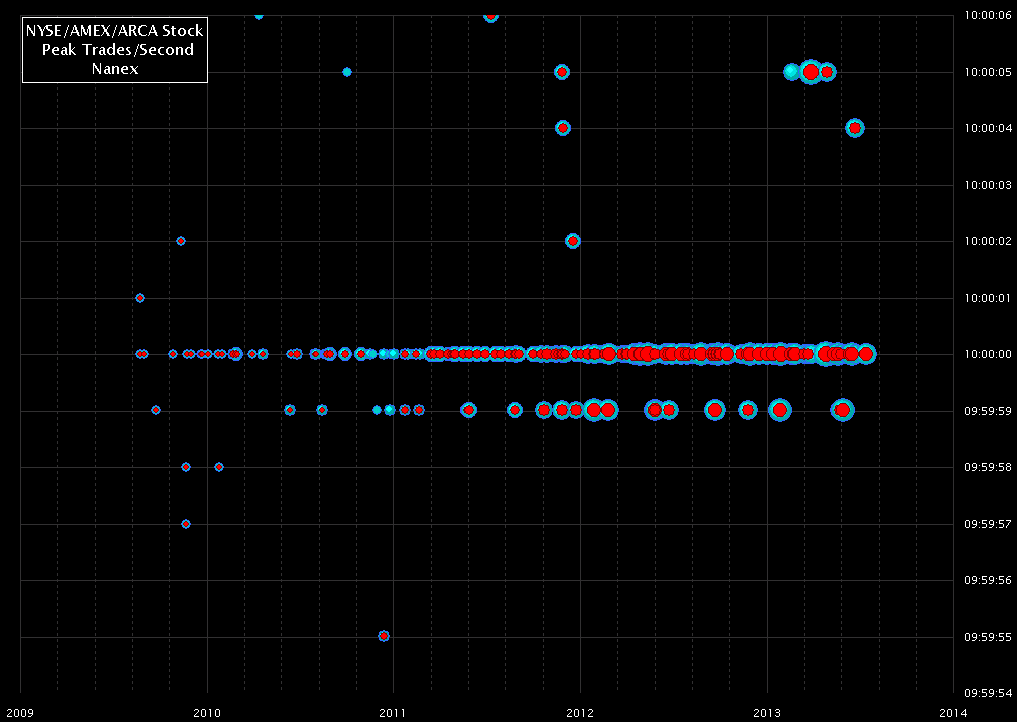

1. Showing Extreme Trading Activity 6 seconds before and after 10:00:00 ET between

January 2009 and July 26, 2013.

Note the dots that show up at 9:59:59 - this only happens when someone gets news

a fraction of a second before others.

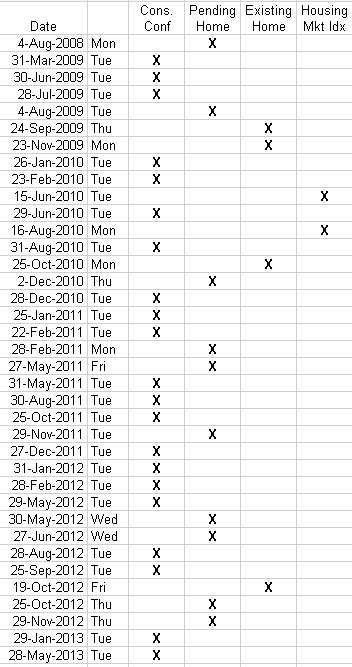

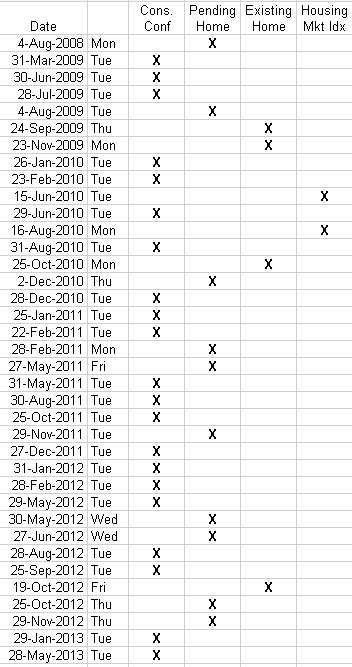

2. List of dates with high activity at 9:59:59 and known economic news releases.

Most of the early news releases discovered so far are from Consumer Confidence, Pending Home Sales,

Existing Home Sales and the Housing Market Index. Both Pending and Existing Home Sales are from the National

Association of Realtors.

3. Six examples showing trading in SPY on one of the dates from the table above.

Nanex Research

Inquiries: pr@nanex.net