Nanex Research

Nanex ~ 01-Aug-2013 ~ Extreme Options

On August 5, 2013, a new Options Exchange called Gemini will go online. Let's hope the

new interaction between the other 11 exchanges will run without tripping a high frequency

trading algo to run amok and generate, say

1 billion quotes a day in 1 symbol. Or causes excessive quoting

above the already outrageous

current rate of 10,000 quotes per trade.

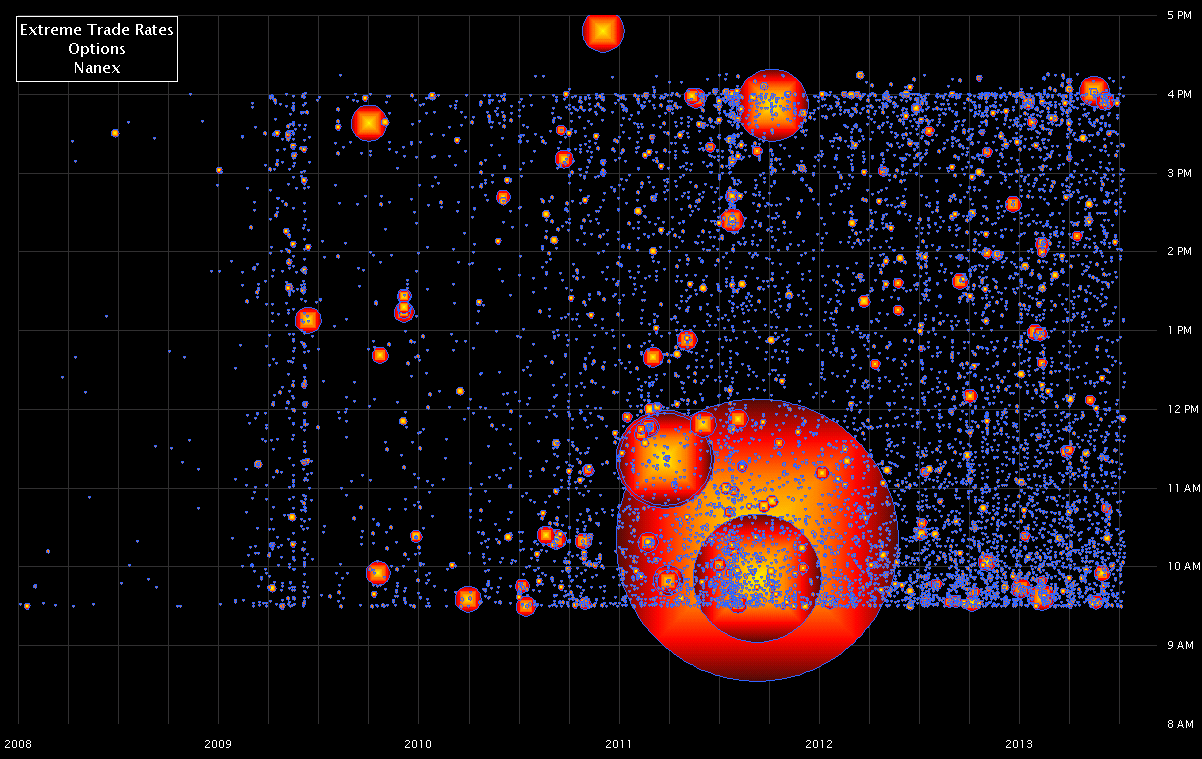

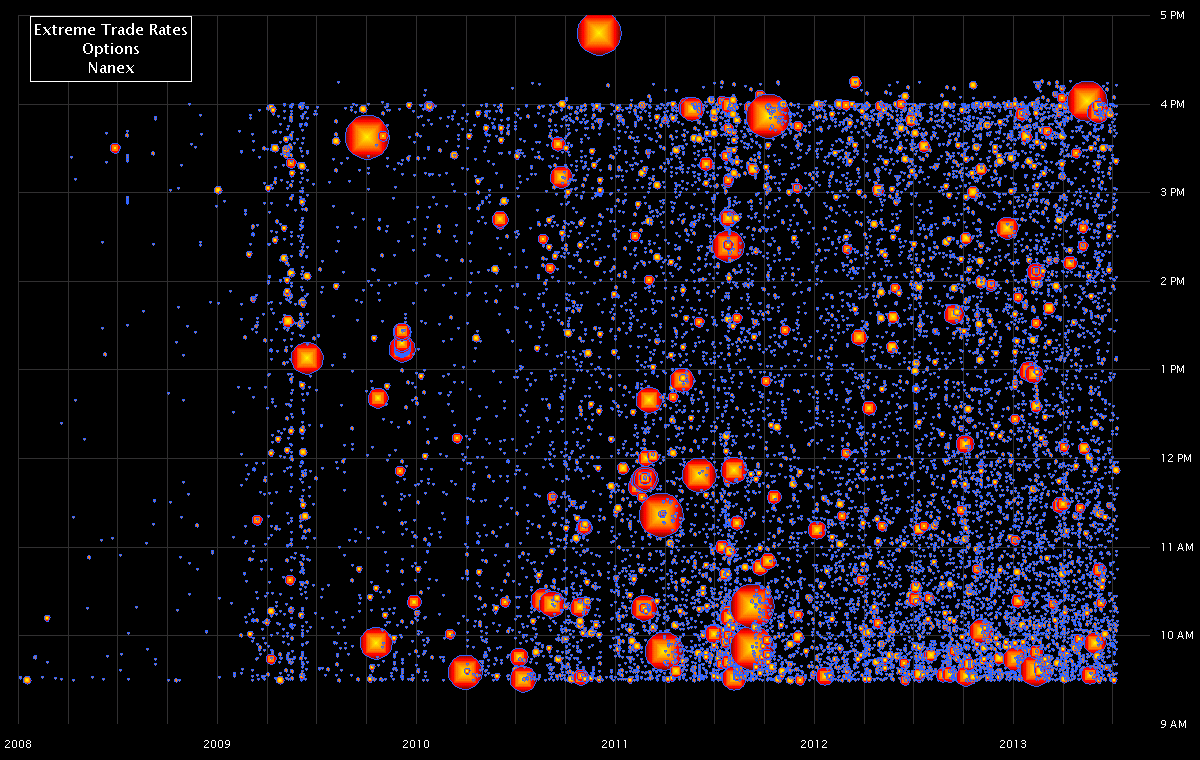

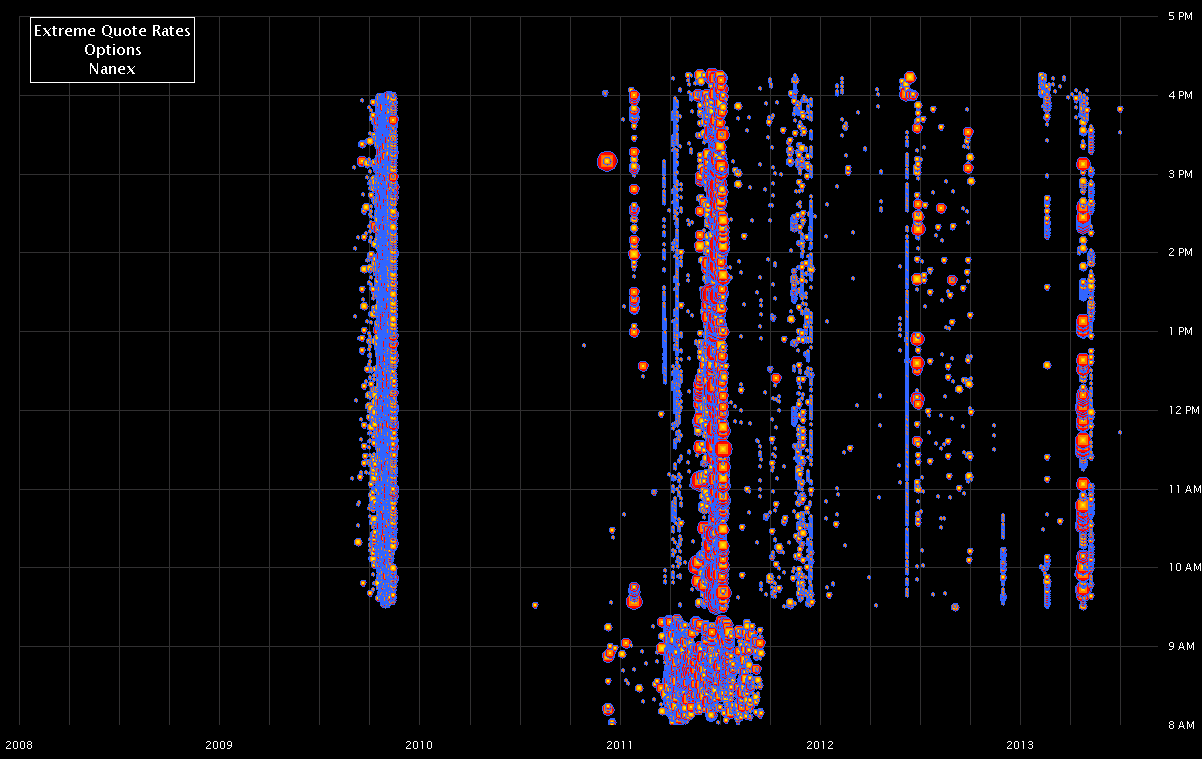

We created the charts below by sifting through 7 trillion option messages (trades and

quotes) between 2006 and July 23, 2013, looking for instances of extreme trading and

quoting. For extreme trading, we looked for 50 or more trades in a single option contract

in 1 second. For extreme quoting we looked for 3,000 or more quotes in a single option

contract in 1 second. Note, there are currently over 1/2 million active option contracts.

We then plotted each of these instances as circles and made the size of the circles

relative to how many trades or quotes appeared in each event. The larger the circle,

the more significant the event.

When we plotted the results, several things stood out. For extreme trades, there was

a monster event on one day in September 2011. This event lasted just 1 second, and included

options in many large cap stocks (AAPL, SPY, QQQ). The other interesting find is how

extreme option activity showed up in earnest in August 2011 - which was an extremely

volatile trading period.

1. Showing 16,340 Instances of Extreme Trading in U.S. options - One event stands

out, can you spot it?

That big ball is from one second of enormous trading activity in options for AAPL, SPY,

and a few other large cap stocks. Pretty sure something didn't go according to plan

(or did it?).

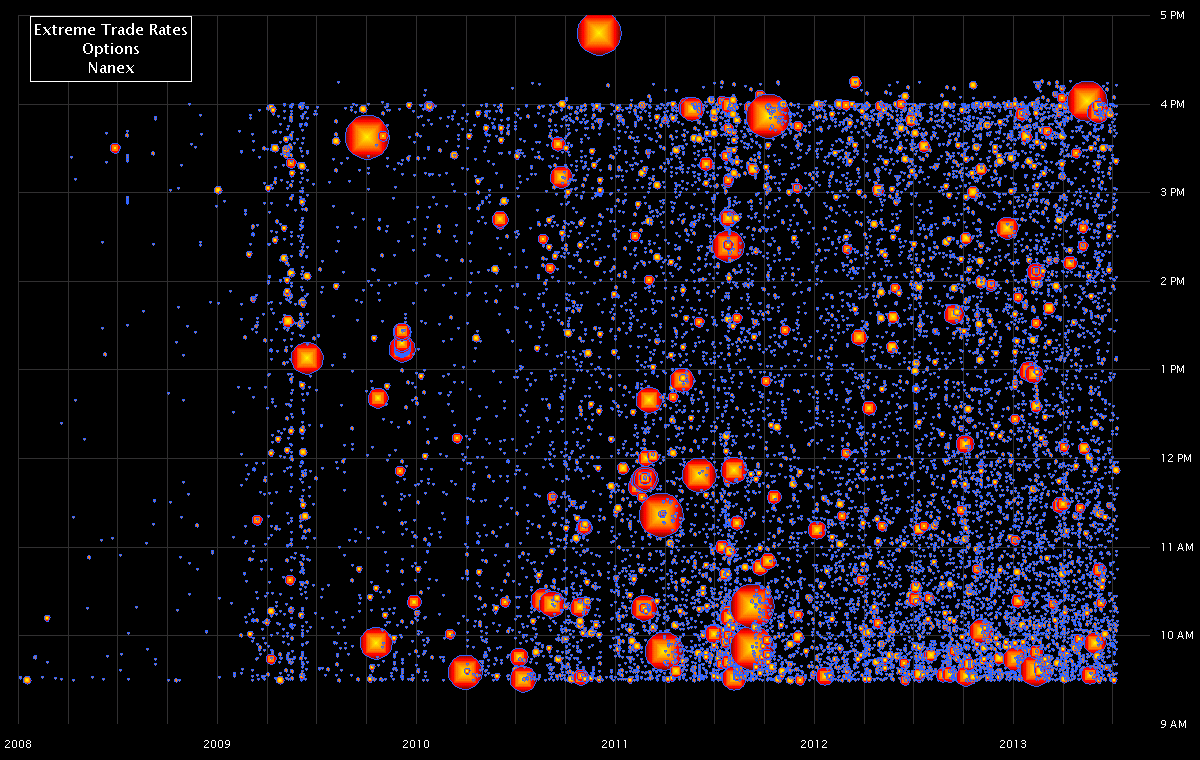

2. Same as chart 1 above, but scaled to see more detail (>50 trades/second in a single option

contract).

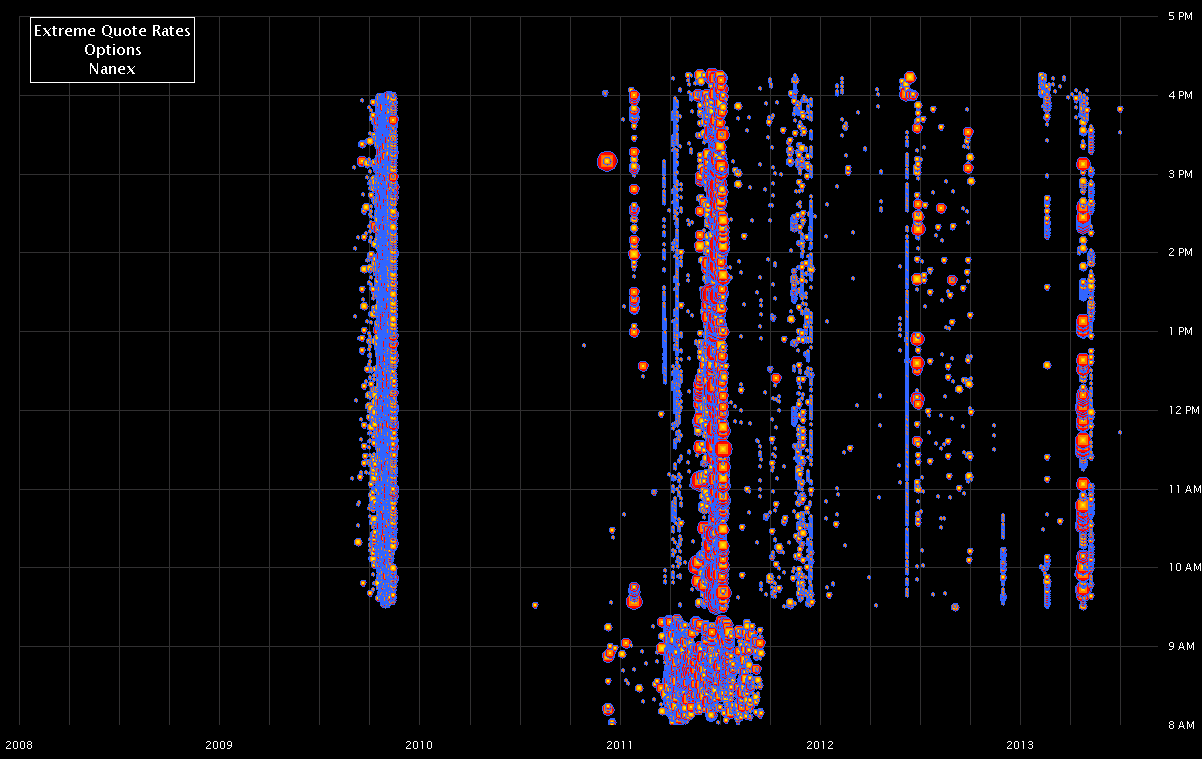

3. Showing 20,789 Instances of Extreme Quoting in U.S. Options (>3,000 quotes/second in a single option

contract).

Note:

- Extreme quoting has little to do with trading (compare to the chart above). It comes

from poorly written HFT algos, or in some cases, intentional manipulation strategies.

- The huge number of instances in mid-2011 occurred during the very volatile month

of August that year. We believe much of that volatility was induced by new HFT strategies.

Nanex Research

Inquiries: pr@nanex.net volatility