Nanex Research

Nanex ~ 04-Sep-2013 ~ Another Black Eye

It appears another event of information asymmetry: that's where exchanges send quotes

to High Frequency Traders, but not the SIP (everyone else). Nasdaq listed symbols LL

through Z appear to have lost quotes for approximately 10 minutes (11:38 to 11:46:30).

One example is shown below, QQQ is an actively traded ETF.

See also our coverage of the

August 22, 2013 blackout.

Click for more charts on this event.

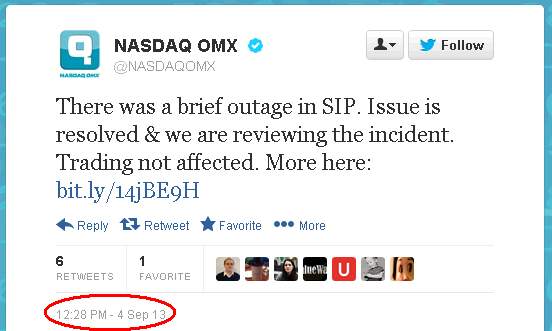

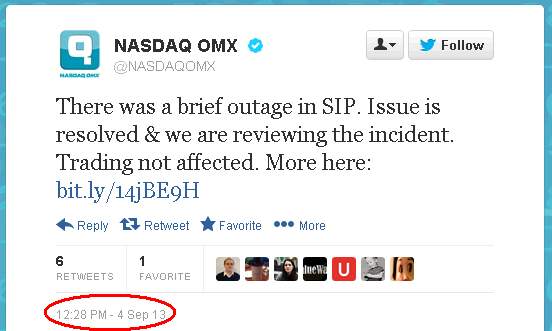

Nasdaq, operator of the SIP, posted their first alert at 12:05:53, a full 19 minutes

after the issue was resolved:

12:05:53 ET: Post - Trade

Today between 11:35 and 11:41 the Securities Information Processor (SIP)

experienced a brief outage in one of the quote dissemination channels, specifically

in symbols through PC through SPZ. The issue has been resolved and UTP SIP is reviewing

the incident. All quotes are currently disseminating normally. Trading has not been

affected.

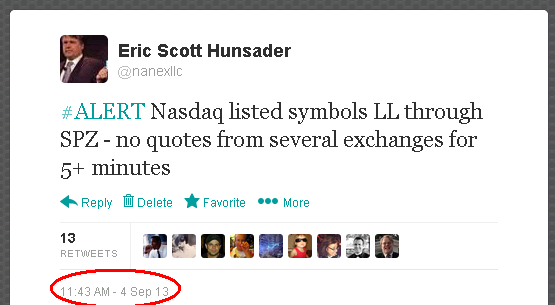

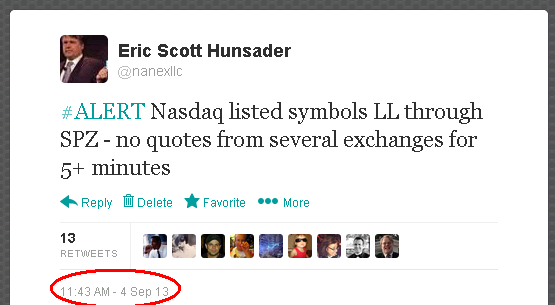

We think 19 minutes is an absurd amount of time in today's microsecond world. Plus,

we noticed and sent a tweet about the event at 11:43 ET. Well before the event was over.

Nasdaq's tweet came out at 12:28 ET. Also the symbol range affected was A through Z

(all of them), not just PC through SPZ. The most affected symbols were between M and

Z (download that list).

Trading wasn't affected? What do they mean, trading wasn't affected! There were no quotes

for the millions of people who pay $500 million annually for SIP quote data. Take

a look at the chart of SNDK below. The majority of trades executed outside (below) the

last published NBBO shown in dark gray (National Best Bid/Offer), violating a key provision

in Reg NMS: Trade through price protection.

1. SNDK - Trades color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

2. Count of Stocks with Crossed or Locked quotes each second.

The red line should be flat when all systems are normal. The blue line would only be

flat if exchanges were using the SIP NBBO to route orders.

3. QQQ - Trades color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

4. QQQ - Best bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

5. QQQ - All bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

6. SNDK - Trades color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

7. SNDK - Best bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

8. SNDK - All bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

9. NDAQ - Trades color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

10. NDAQ - Best bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

11. NDAQ - All bids and asks color coded by reporting exchange and NBBO (shaded red if crossed, yellow if locked, dark gray if normal).

12. NDAQ - Bids and asks from Nasdaq (gray) and ARCA (red).

Note how quotes stop from ARCA, but not Nasdaq.

13. NDAQ - Trades and quote spread from Nasdaq (gray) and ARCA (red).

Yet trades plow on for High Frequency Traders who use direct feeds. This is clearly

against Reg NMS.

Nanex Research

Inquiries: pr@nanex.net volatility