Our method for detecting data-feed delays is simple, straightforward, and will put Midas to good use. A good programmer with a few years experience should have no trouble coding the necessary logic in one or two days.

| Now that Midas gives

the SEC the

same ability Nanex had in 2010, we strongly urge them to use it to perform the same

time-stamp analysis on recent trading days (these 10 select days of 2013). This is an urgent matter as there is ample evidence that public quote delays continue

to exist from several exchanges.

These delays not only violate regulations, but they significantly disadvantage the

2.5 million subscribers who collectively pay almost $500 million annually for "real-time" public quotes. Our method for detecting data-feed delays is simple, straightforward, and will put Midas to good use. A good programmer with a few years experience should have no trouble coding the necessary logic in one or two days. |

|

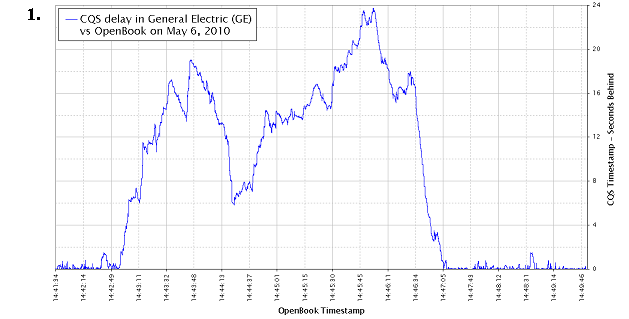

| After we pointed out the severe delay

in the NYSE public quote, the exchange immediately denied there was a problem: in spite

of probing phone calls from major news media such as The Wall Street Journal (Tom Lauricella and Scott Patterson), The New York Times (Graham Bowley), Reuters (Herb

Lash) , Bloomberg (Kambiz Foroohar), and Risk Magazine (Duncan Wood). To satisfy a curiosity of whether the NYSE public quote delay was unique to May 6, 2010, we ran another quote-by-quote comparison of time-stamps from the public quote and Open Book for a 30 minute trading period in General Electric stock (GE) on July 21, 2010 (see chart 2). We chose this period because there was a noticeable lag in the public quote from the NYSE versus quotes from other exchanges, which rules out the consolidation process as a source of the delay. |

|

|

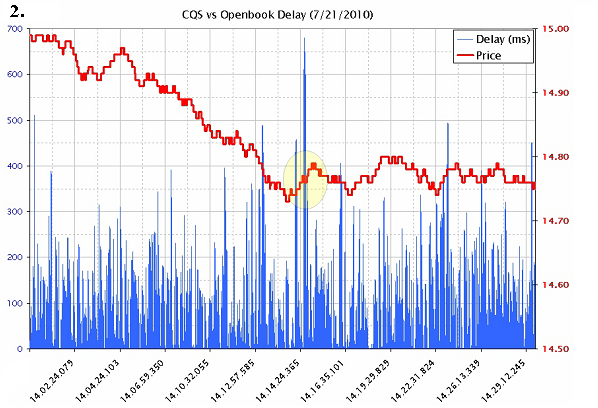

Our first attempt at finding a cause for the delay involved comparing the trading activity in GE stock with the magnitude of the delay. Chart 2 shows the price of GE stock in red, along with the public quote delay in blue. There shouldn't be any blue vertical lines! The left price scale shows the delay in milliseconds (thousandths of a second). We couldn't find a correlation between the price and magnitude of the delay, and one does not present itself on the chart. Next, we looked for a correlation between the number of quotes per second in GE stock and the delay, and again, found none. We noticed that NYSE's quote was involved in crossed NBBOs (National Best Bid/Offer where bid price is greater than ask price, which is caused by a delayed quote from one exchange), in a large number of stocks. That led us to see if the number of quotes from the NYSE for all stocks in CQS (the public data-feed that transmits GE), was correlated with the delay It was! More on that in a moment. |

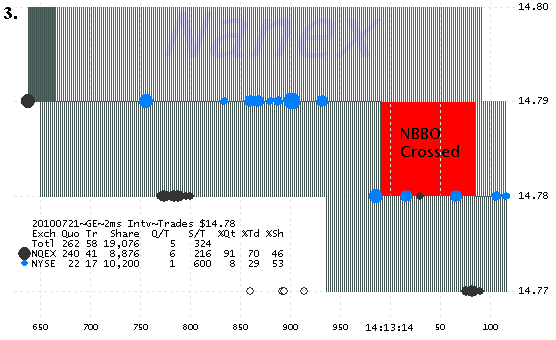

| The chart on the right is one

such example. It shows the quote spread and trades from 2 exchanges in GE. The NYSE

quote spread is shown in light blue, and the Nasdaq quote spread in gray. When the two

quote spreads overlap, the color is dark blue.

The red area is where the NBBO was crossed - a condition caused by the NYSE quote lagging far behind Nasdaq's, which resulted in NYSE's bid price remaining higher than Nasdaq's ask price. Note where the light gray shade shifts to 14.78 x 14.79 on the left side of the chart (14:13:13.650). The blue shade shifts to this same price almost 450 milliseconds later - which corresponds with the time-stamp difference between Open Book and the public quote. Note the NYSE trades (blue circles) appearing before the NYSE quote - another indication of a quote delay from the NYSE and not the consolidation process. We coined this phenomenon fantaseconds and published many examples over the years. |

|