Nanex Research

Nanex ~ 21-Oct-2013 ~ It's Getting Darker

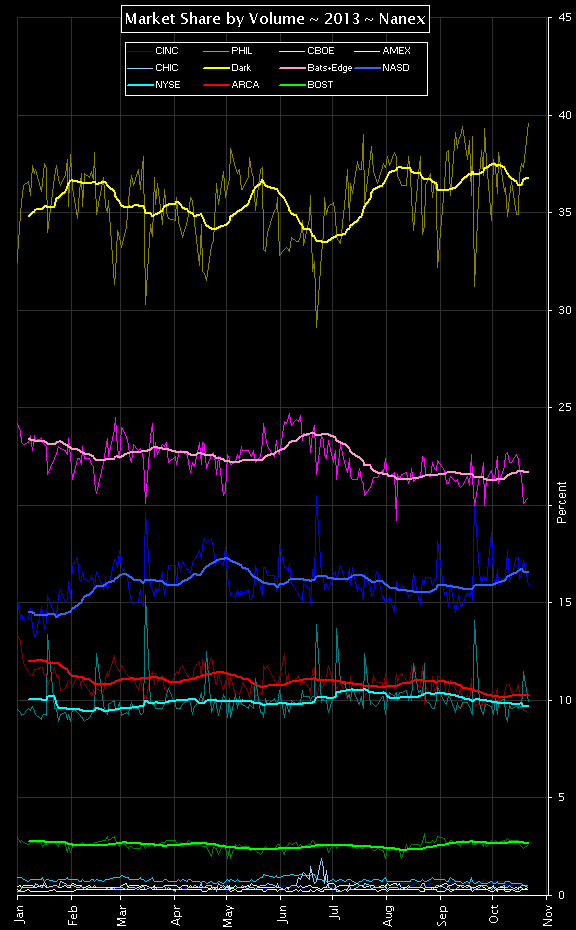

The percentage of shares executed on Dark Pools and Internalizers (trades reported

to the consolidated tape from

trade reporting facilities) is at a new high for the year. Probably a symptom that lit

markets aren't working except for those who are co-located.

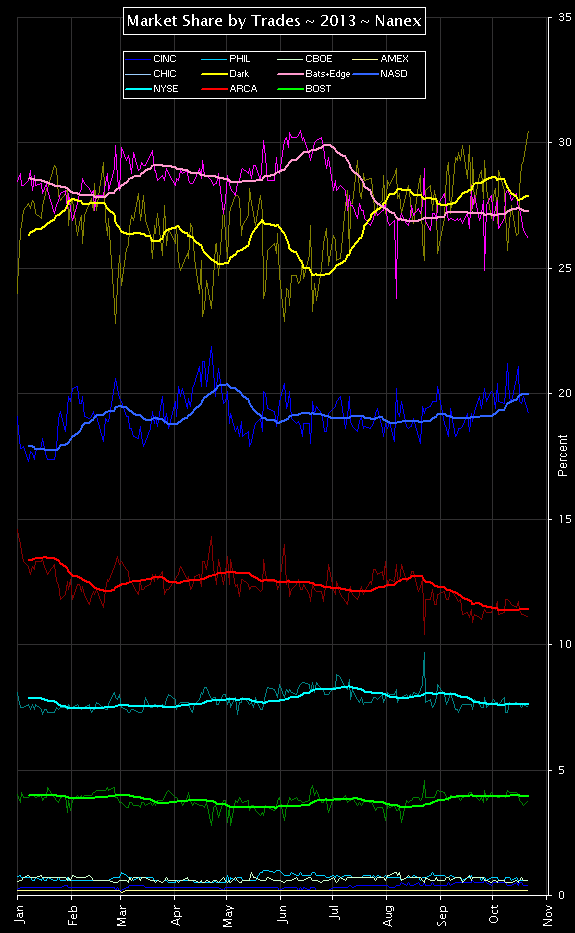

The growth is genuine, as chart 2 shows below, the percentage by number of trades is also at a new high.

1. Percent of Regular Session Trading Volume and 20 period average by Reporting Exchange (from Consolidated).

The yellow lines show combined volume from the 2 trade reporting facilities, which are

used by Dark Pools and Internalizers (retail trades).

The 2 BATS and 2 Direct Edge exchanges are combined into one (they are merging and it reduces

clutter).

2. Same as above, but using the number of trades instead of share volume.

Trade executions leap to new highs in dark pools (yellow line).

The average trade size of Dark Pools is dropping. The growth in Dark Pool trading isn't from a few large trades, it's genuine growth.

Nanex Research

Inquiries: pr@nanex.net