Nanex Research

Nanex ~ 05-Nov-2013 ~ I'd Like to Sell $685 Million of Natural Gas

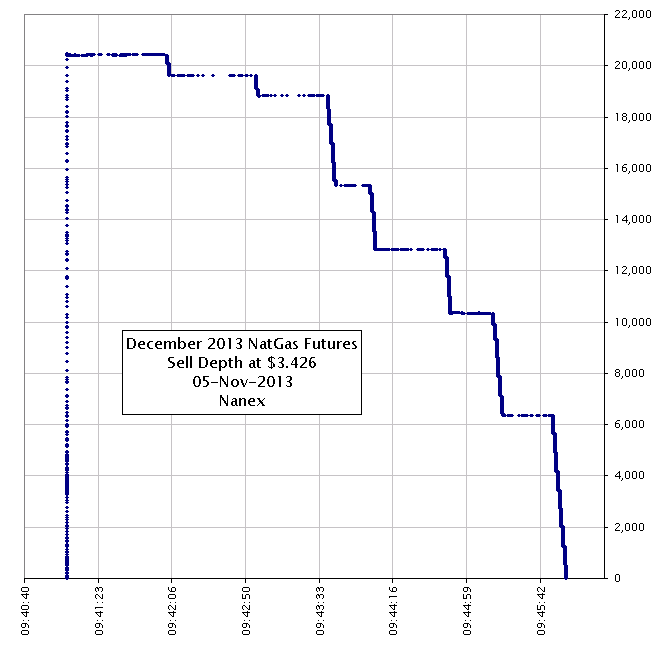

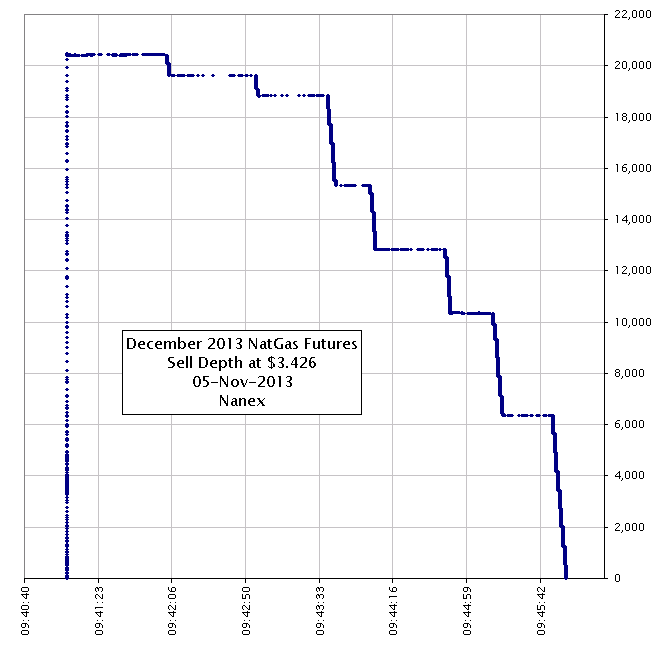

On November 5, 2013 at 9:41:05 ET, a monster 20,000 contracts to sell Natural Gas (NYMEX:

NG3Z) futures contracts at one price level ($3.426) suddenly appeared, causing an immediate

drop in price. This large sell order gradually disappeared over the next 5 minutes.

Only 322 contracts traded at $3.426 during that time.

Normally there are less than 100 contracts to buy or sell the active Natural Gas futures

contract at one price level.

One NYMEX Natural Gas futures contract is for delivery of 10,000 mmBtu (10,000 million

Btu) of energy, which is approximately 10 million cubic feet (280,000 cubic meters)

of gas. At a price of $3.426, one futures contract is worth $34,260 which makes this

sell order of 20,000 contracts worth $685 million in natural gas.

The sudden appearance of a large number of futures contracts to buy or sell at one price

level is a tell-tale sign of one type of manipulative algo found and fined by the CFTC. Note the similar pattern we recently found

in Crude Oil futures. This large sell order could very well be part of a manipulation

strategy designed to fool other

algos and traders into thinking there was a real, sudden

imbalance in the supply and demand of Natural Gas futures. This would cause a drop in

the price of the Natural Gas contract, which is exactly what

happened.

Looking closer at how the depth of book increased and decreased, it appears that this

large 20,000 contract sell order was actually comprised of about 2,500 individual orders,

each order for 8 contracts. All at limit price of $3.426. The first chart below shows

how the number of contracts to sell at $3.426 changed over the period of time of this

event. Note the rapid appearance (less than a third of a second). Almost every addition

of sell orders at $3.426 was a multiple of 8 contracts: 8, 16, 24, 32, 40, 48, 56,

64, 72, 80, 96, 104, 112, 120, 128 and so on up to 344. Since order book depth changes

are a series of snap-shots, multiple order adds/delete in rapid succession can appear

as one update: meaning that the additions could very well have been 8 contracts at a

time, but show up as multiples of 8.

The cancellation of these 20,000 contracts came in several bursts. There were 2,543

decreases of sell orders of exactly 8 contracts.

Only 322 of the 20,000 contracts for sale traded at $3.426.

1. Total size (in contracts) of sell orders at $3.426 in December 2013 Natural

Gas (NG) futures depth of book.

The increase from 0 to 20,000 took about 1/3 of a second. Most of the increases were

multiples of 8.

The drop from 20,000 to zero took about 5 minutes and was made up (mostly) of 2,543

changes of 8 contracts each.

2. December 2013 Natural Gas (NG) Futures Depth of Book (how

to read).

A monster 20,000 contract sell order appears, then slowly fades away over a period of

4 minutes.

3. Zooming in on Chart 2 when the huge order appears.

It was not one order, but was made up of over 2,500 orders of 8 lots each. Very few

were executed.

4. Zooming in on Chart 2 when huge order disappears.

Very few contracts executed from these extremely large (20,000 contract) sell order.

5. December 2013 eMini (ES) Futures Depth of Book (how

to read).

Probably unrelated to the Natural Gas event, but this occurred less than 30 minutes

later.

Note the red speckles - large orders suddenly appear and disappear. See

this page with more examples and a detailed explanation.

Nanex Research

Inquiries: pr@nanex.net