This paper isn't going to discuss the fleeting nature of HFT liquidity, but rather the actual definition of liquidity, and what it means to provide liquidity to the market. If this concept is foreign to you, I suggest reading this excellent, short description from Interactive Brokers. Basically, liquidity is a measure of how many buy or sell orders a market can absorb without a price impact. If an investor wants to buy a million shares of a stock, and there aren't a million shares offered for sale at the current offer price, the price is going to rise. If a market maker has a million shares for sale at the offer price, then the investor's million share buy order can be absorbed without impacting the price. We can say the market maker provided liquidity to the market.

More simply, the act of passively adding limit orders to an exchange order book adds liquidity, while aggressively executing against orders in the order book removes liquidity. This is a concept that every paper about market liquidity assumes the reader already knows.

Imagine my surprise, when a well known advocate for HFT claimed that "providing liquidity" means something entirely different, and may have the opposite meaning depending on who is adding or removing orders! Make no mistake, this wasn't a misunderstanding of words, or the result of things said in the heat of a debate. Read the exchange for yourself below.

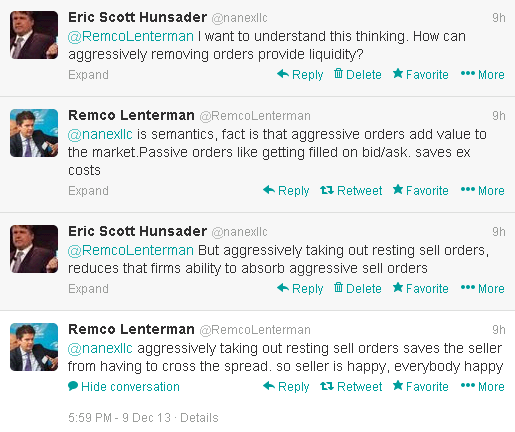

On December 9, 2013, I had a discussion on twitter with Remco Lenterman that started off about Quote Stuffing and Credit Suisse's paper, and ended on the topic of liquidity. Specifically, what it means when HFT says it provides liquidity. I asked him:

His response took me by surprise, as I was pretty sure everyone in the industry knew what the terms adding (providing) and taking (removing) liquidity mean. It's especially shocking when you take into account that this is from the Chairman of the FIA European Principal Traders Association.

The terms adding/removing liquidity are not soft terms - they have clear definitions. One does not have to argue whether executing against orders resting in the book is adding or removing liquidity: this action by definition, always removes liquidity.

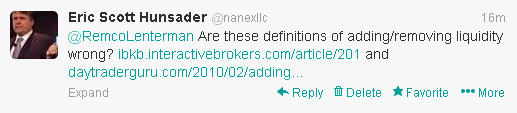

It's important to have a firm grasp of the basics - so that when the claim "HFT provides liquidity" is made, everyone understands what that (providing liquidity) means. I had to be sure Lenterman understood the question:

Lenterman clearly understands the question, and is sticking to his original, wrong notion of what providing liquidity means.

A quick google search brings up many hits that define, explain and detail what the terms adding and removing liquidity mean. I sent him the top 2, one from Interactive Brokers and one from DayTraderGuru, and asked his opinion:

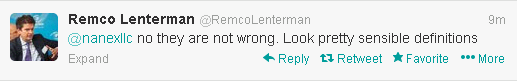

His answer: another surprise..

.. because now there is a conflict between his original notion and the industry definition of what providing liquidity means. I asked for clarification:

And that was the end of the conversation.

Would you believe I had a similar discussion when talking to an academic who advised the regulator on what happened in the flash crash? You'll just have to read the email correspondence for yourself.