Charts alternate between showing NBBO and Trades. The first 2 show all reporting exchanges, followed by a pair of charts for each reporting exchange. Note that some exchanges (e.g. EDGE and BATY) rarely set the NBBO, but have a significant number of trades. The last 2 charts show trades from TRF's (Trade reporting facilities, which is how Dark Pools report trades). Dark Pools do not post quotes, so there are no corresponding NBBO charts for those.

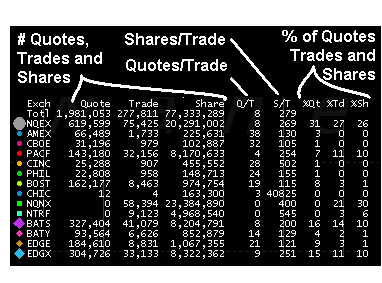

The legend (right) gives useful information on Quote, Trade and Share counts and ratios of these, such as Shares/Trade which gives the average trade size for all exchanges (Totl column) as well as individually for each reporting exchange.