Nanex Research

Nanex ~ 10-Jan-2014 ~ Treasuries Halted During Employment Release

On January 10, 2013, about 8/10ths of a second before the Labor Department released

the widely anticipated

Employment Situation Report, trading activity exploded in Treasury futures,

sending prices much higher in less than 1/10th of a second. The speed and magnitude

of buying activity during a period of low liquidity, quickly

overwhelmed the 5-Year T-Note market causing a stop logic circuit breaker to trip and

shut down trading for 5 seconds. During the halt in 5-Year T-Note futures, the employment news

was officially released in Washington, D.C. - meaning that anyone wanting to trade on

that information

would have to wait until the halt was lifted almost 4 seconds later (4,000,000

microseconds in high frequency trading lingo).

This isn't the first time Treasury futures have been halted like this: see also

08-Nov-2013 and 07-Jun-2013.

Before June 2013, a halt before and through a news release was an extremely rare event.

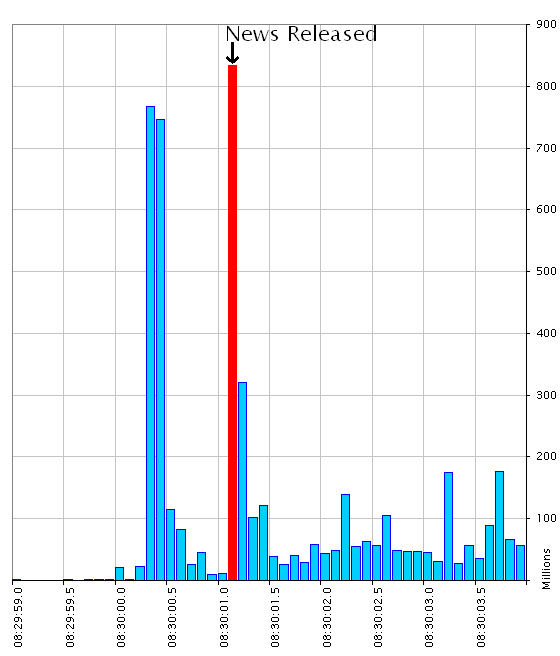

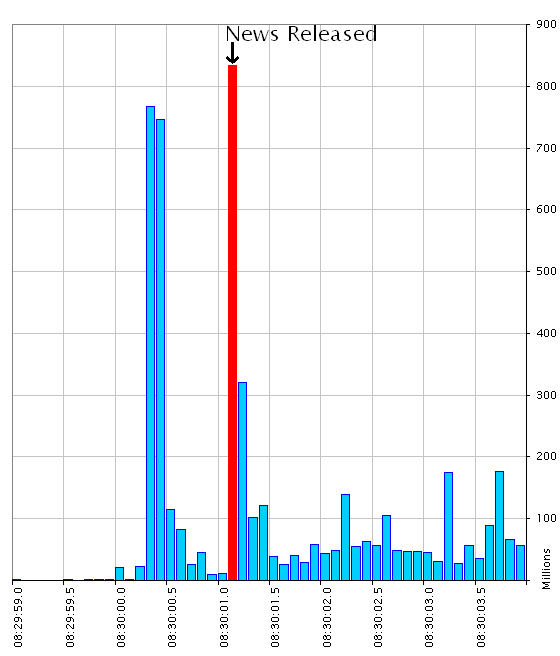

1. Value of Futures Traded per 1/10th second interval.

Chart shows just how much was traded before the official news release.

2. March 2014 5-Year T-Note (ZF) Futures.

3. All Futures Trades - showing that trading activity before news release was

higher than after news release!

4. March 2014 5-Year T-Note (ZF) Futures.

Zoom of Chart 2.

5. March 2014 T-Bond (ZB) Futures.

6. March 2014 10-Year T-Notes (ZN) Futures.

7. March 2014 2-Year T-Note (ZT) Futures.

8. March 2014 2-Year Minus 5-Year T-Note (TUF) Futures.

This contract also halted for 5 seconds (due to the halt in the 5-Year leg).

9. March 2014 Ultra T-Bond (UB) Futures.

Nanex Research

Inquiries: pr@nanex.net