Nanex Research

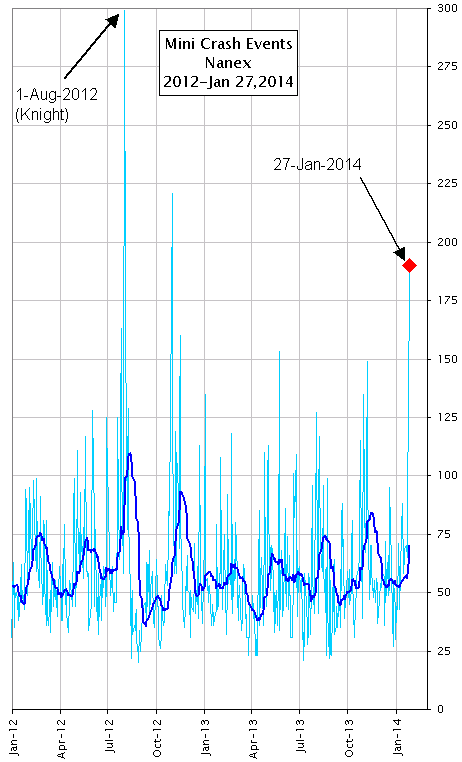

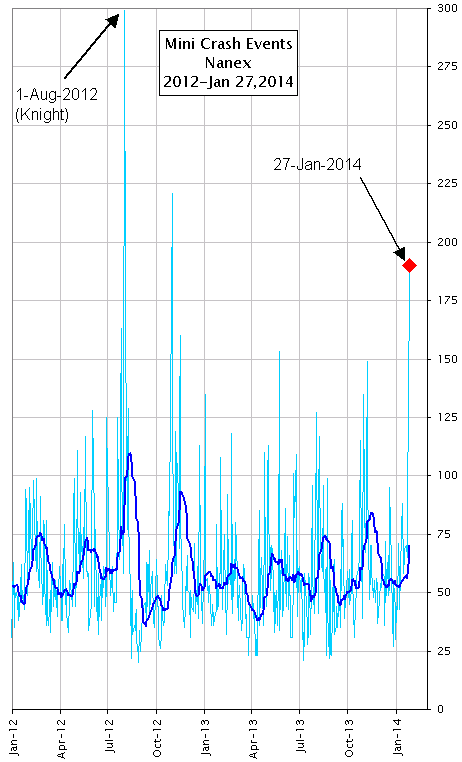

Nanex ~ 28-Jan-2014 ~ Mini Flash Crashes On The Rise

January 27, 2014 had the highest number of mini flash crash events (our term for a quick

unusual rise or fall in a stock's price) in at least a year. See

Un-Clearly Erroneous for a detailed look at a few of

these stocks. Also, an

incorrectly set clock may have caused the surge on January 27, 2014 (read

more).

If you think Wall Street's new, SEC approved, circuit breaker (Limit up, limit down,

or LULD) is going to help, think again. The law of unintended consequences has struck:

what LULD really does, is normalize deviant behavior. A

recent example.

See also:

list of mini flash crash events 2006-2011, which led to a paper published in

Nature:

Abrupt

rise of new machine ecology beyond human response time.

1. Number of Mini Crash Events between January 2012 and January 27, 2014.

The large number on August 1, 2012 was from the

Knight Capital Event.

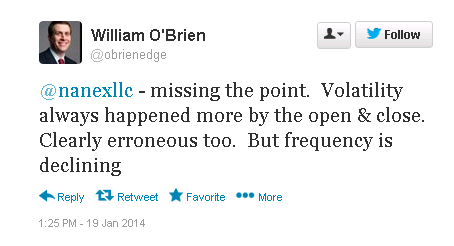

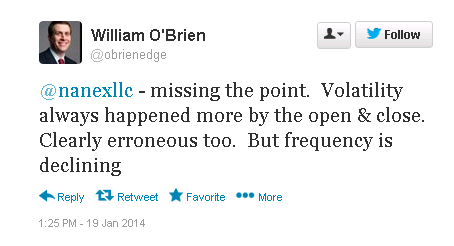

Now, let's compare reality (above) with fantasy (below).

2. Tweet from Direct Edge CEO on the frequency of mini flash crash events sent

January 19, 2014 (8 days before yearly record high):

Nanex Research

Inquiries: pr@nanex.net