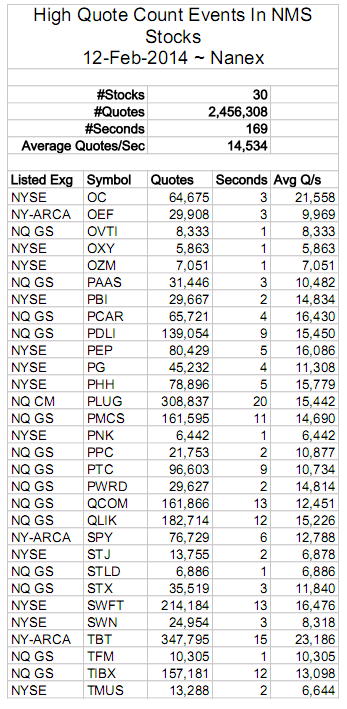

anyone farther than about 4 miles away, was essentially processing 20,000 bogus "real-time" quotes per second in 1 stock.There were 30 symbols affected: all beginning with the letter 'O', 'P', 'Q', 'S' or 'T'. Not all stocks were listed on the same exchange, but as far as we can tell, these blasts of extreme quotes all had Nasdaq as the reporting exchange, which is interesting in light of the recent statement Nasdaq issued about the cause of the August 2013 blackout (more than 26,000 quotes per stock per second).

In one 15 second period of time, there were 275 thousand bogus orders placed and canceled in 1 stock: PLUG. In the nearly 8,000 other NMS symbols, there just 255 thousand quotes combined. Which means for 15 seconds, one high frequency trader accounted for more than half of all stock market quotes: all from orders they placed and canceled in one stock.We documented a similar HFT quote spamming algo that rocked the market on November 2, 2012.

Here is a PDF of the individual events. Note how many occur in the last 3 minutes of trading.