The loss of original time-stamps makes it difficult to reconstruct accurate audit trails or make comparisons to quote data. It also renders any computations based on trade data (e.g. charts, technical analysis) inaccurate.

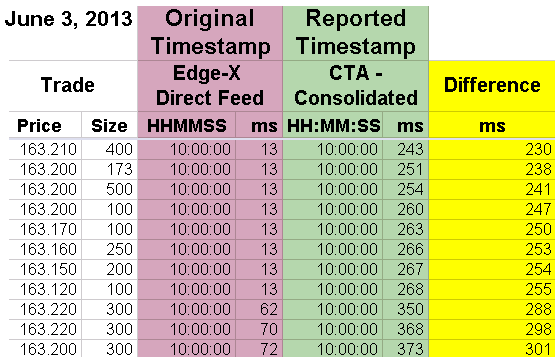

We matched a few seconds of SPY trades on June 3, 2013 from a direct feed (Edge-X) to the same trades from the consolidated feed. In the selection shown in the image on the right, the first trade (163.21 and 400 shares) has a time-stamp of 10:00:00.013 in the direct feed and a time-stamp of 10:00:00.243 in the consolidated feed, a difference of 230 milliseconds!

Download the complete list (pdf).

See this paper for more charts and data on this event.