Nanex ~ 26-Jan-2014 ~ Locking the Market

Update: 17-Mar-2014

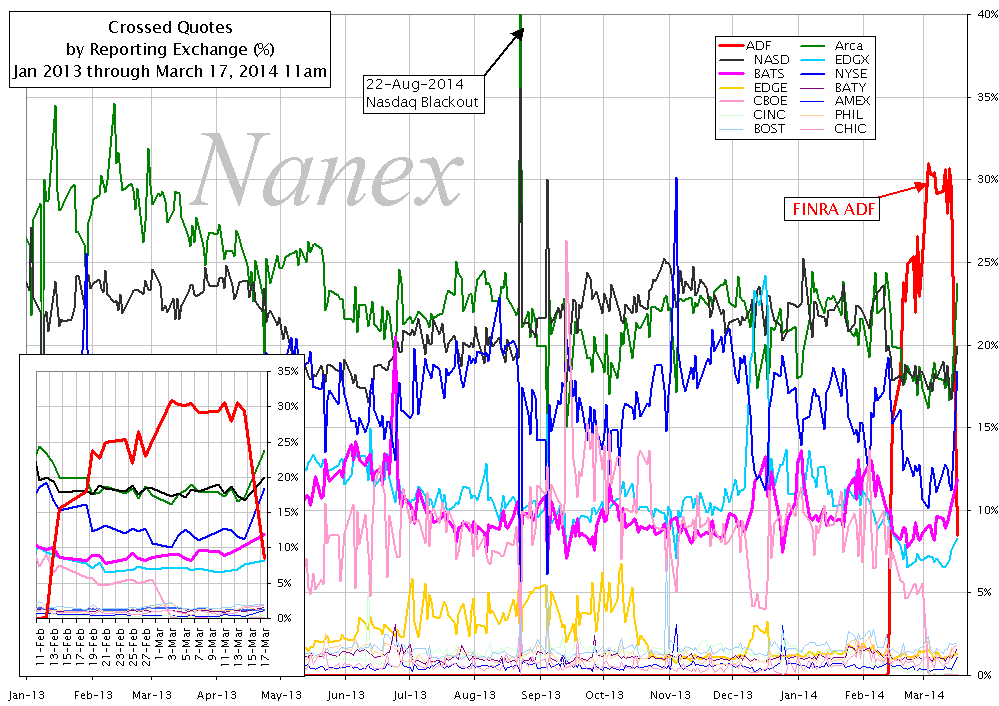

A noticeable drop in crossed/locked quotes from FINRA's ADF started March 17, 2014 -- see 1st chart below.Update: 06-Mar-2014

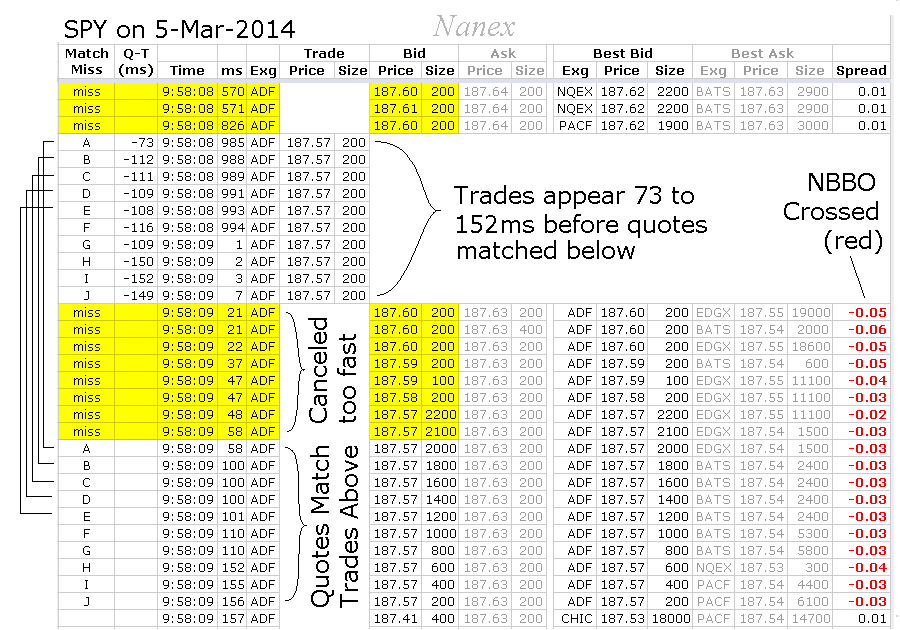

Added example (see below) showing crossed quotes in SPY.Quotes from the FINRA ADF started on February 11, 2014, have been responsible for locking and crossing the NBBO (National Best Bid Offer) over 30% of the time (thick red line below). Quotes that are crossed (bid is greater than ask) or locked (bid equals ask) are not supposed to happen according to regulations. There are many undesirable side-effects when quote cross - for example, retail trading is temporarily halted. Why is FINRA, a regulator no less, in the quote publishing business? And why are they so bad at it? Can a regulator fine itself?

It's not like they don't have rules prohibiting locked/crossed quotes:

Note the drop on March 17, 2014.