Nanex Research

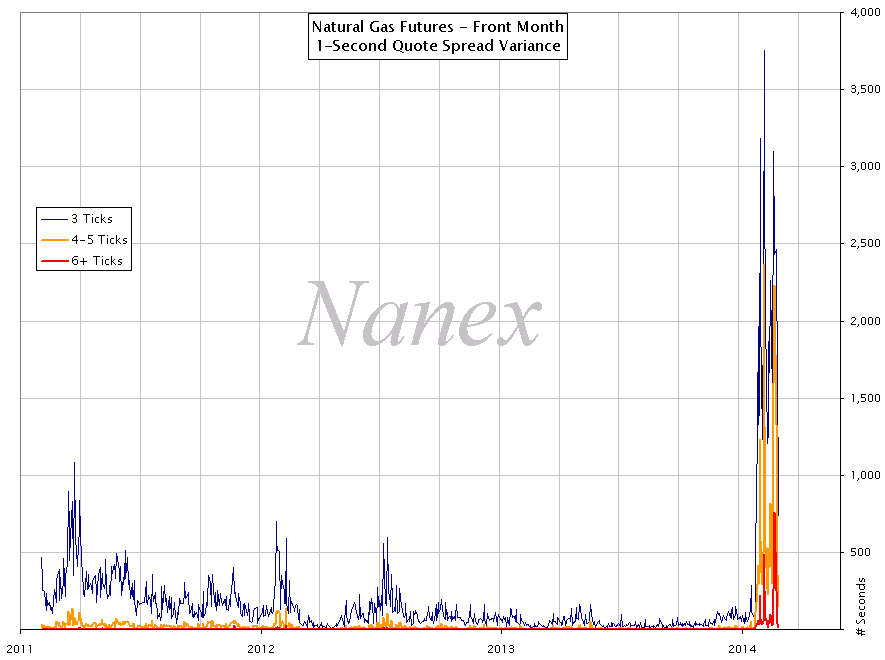

Nanex ~ 27-Jan-2014 ~ Natural Gas Quote Spreads

Beginning on January 23, 2014, Quote Spread Variance in Natural Gas Futures on a 1-second

basis has exploded. The chart below puts this activity in perspective. For each second,

we find the minimum and maximum quote spread (ask-bid price) in the Natural Gas (NG)

front month futures contract: the difference becomes the variance for that second. We

count and plot the number of seconds in 3 different bins: those with a variance of 3,

4 or 5, and 6 or more ticks.

We only sample 1-second periods from 9:15 to 10:20 and 10:45 to 14:15. This avoids the

first and last 15 minutes, and also excludes market reaction to the weekly EIA Storage

report that comes out at 10:30.

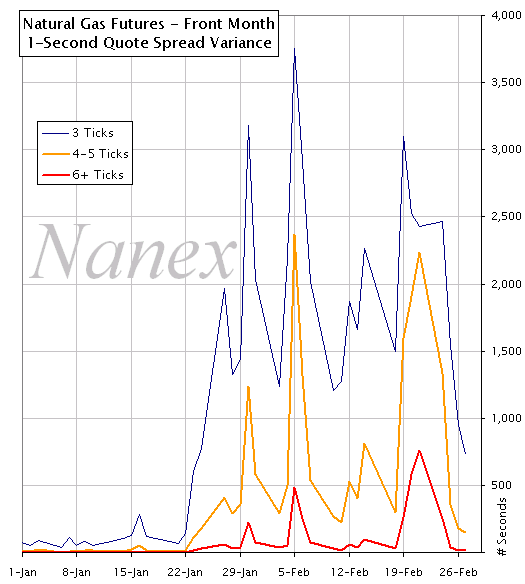

Zooming into 2014

Nanex Research

Inquiries: pr@nanex.net