Nanex Research

Nanex ~ 31-Mar-2014 ~ SEC Loves HFT

Maybe a little too much

Link to my interview on CNBC

where I discussed the first item below.

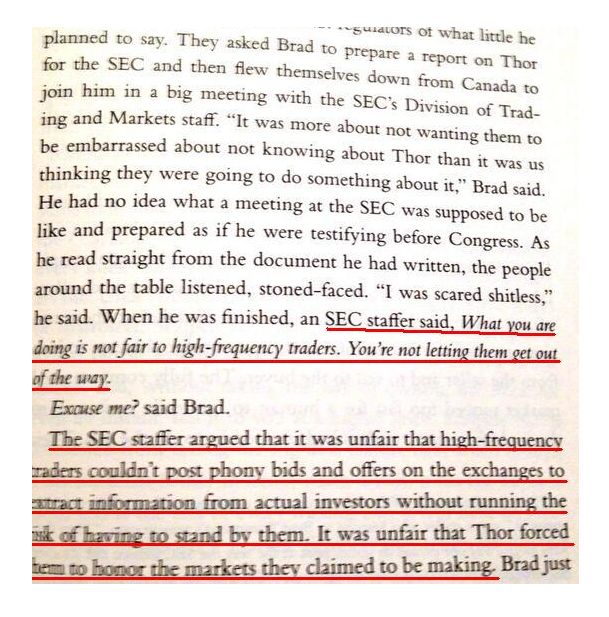

1. The SEC exists to protect High Frequency Trading?

Placing orders for which one has no intent to execute violates Section 9(a)(1)(A) of the Securities Exchange Act.

From Michael Lewis's Flash Boys:

2. A High Frequency Trading Firm Exonerates High Frequency Trading!

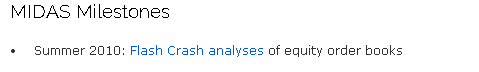

We finally know who helped the SEC write the

flash crash report: the infamous report that

incorrectly laid blame on a mutual fund company that traded futures through

Barclay's. This is the same report that exonerated High Frequency Trading (HFT) from

causing the flash crash.

From

the bottom of

this page under "milestones":

That's right!

A High Frequency Trading firm provided flash crash analysis that exonerated High Frequency

Trading. See if you can find this disclosed anywhere in the

SEC flash crash report

or related press conferences. Did the press

bother to ask? Will they now?