Nanex Research

Nanex 09-Apr-2014 ~ Economically Insignificant Price Improvement

Unwanted Touching?

Did you know that most retail stock orders never execute on an exchange? Most retail

orders are "internalized" by a "wholesaler" or more aptly, an "internalizer", many of

which claim they match retail buyers and sellers, and even give both buyers and sellers a little extra - something they call "price improvement". Which sounds great, until

you realize that buyers and sellers aren't actually getting matched to each other: even

when a buyer and seller send their orders at the same time - even within the same second.

Below is a real-world example of this: the chart shows several retail buy and sell orders

executing over a 10 second period of time in Facebook stock. You can just barely make

out the "price improvement" - the squares, representing trades, are l/100th of a cent

inside National Best Bid/Offer, represented by the light gray shading.

Examples like these are suprisingly common - a typical day in Facebook stock alone has

about 10,000 sub-penny trades with the minimum $0.0001 price improvement per share and

at least 10% (1,000) of these trades involve buyers and sellers executing within seconds

of each other.

See also this page showing the same thing happening in Apple.

1. Facebook Retail Trades on April 9, 2014 ($0.0001/share "Price Improvement")

Note how retail buyers and sellers never actually meet, even when their orders arrive

in the same second. An intermediary is always present. Worse, those who posted liquidity

to an exchange (were willing to buy at 59.62 or sell at 59.63) will see their orders

unfilled and wonder how they too could offer 1/100th of a cent more or sell for 1/100th

of a cent less than the NBBO. This is called getting sub-pennied. You can read more

about it in the links below.

We've published a number of in depth

analysis on sub-penny trades:

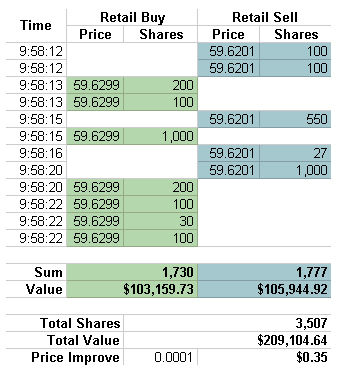

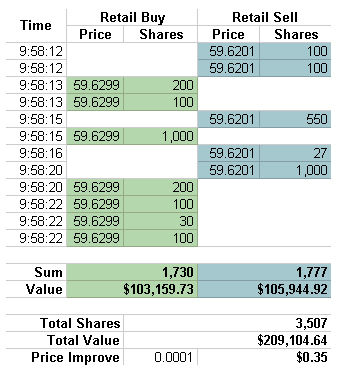

The table below lists Facebook trades shown in the chart above. Most retail trades can

identified by trade prices with 4 decimals of precision: for buy orders, the last 2

digits will be between 90 and 99 and for sell orders, between 01 and 10. In this example

all buy orders had a trade price of $59.6299 and sell orders had a price $59.6201. The sum of shares from Retail Buyers is 1730, while the

sum of shares from Retail Sellers is 1777. This example presents practically zero risk

to the internalizer.

Note that Retail Buyers and Retail Sellers don't directly exchange stock - even though

many times a buyer and seller arrive in the same second. Also, rather than being matched

at the midpoint, a wholesaler or internalizer comes between (intermediates) every buyer

and seller. The internalizer magnificently gives the buyer or seller an extra $0.0001

per share. That works out to 35 cents of price improvement on $209,105 worth of stock.

Some will argue that 35 cents is better than nothing, but those making that argument

conveniently leave out the third party involved in practically every one of these transactions.

That third party is someone (often an investor) who posted liquidity to the market,

yet as a group, ends up losing about a billion dollars a year (read

more) to this price improvement scheme.

Nanex Research

Inquiries: pr@nanex.net